- Aptos has faced steady selling pressure over the past two months

- Steady token unlocks and panicked market sentiment is likely to send APT lower

Aptos [APT] continued to trend south at press time. The daily RSI revealed that bearish momentum has been persistent since December, with the bearish market structure highlighting caution for the bulls.

The price approached a key support level and the psychological round number level at $5. We would likely see a price bounce soon, but can this morph into a trend reversal?

Aptos bulls have their backs against the wall

Source: APT/USDT on TradingView

When Aptos lost the bullish order block just above $11 (red box) in mid-December 2024, its market structure flipped bearishly. Since then, any attempts by the buyers to force a recovery have been met with failure.

The OBV outlined one good reason for this. Its downtrend since December revealed that selling pressure has consistently outpaced the buying pressure. The attempted recoveries in the last two months were more liquidity grabs to the upside, before a continuation of the downtrend.

The $5-level started the strong rally last August. While Bitcoin [BTC] is up by 78% since then despite the recent volatility, APT is merely 11.87% better off. This lack of relative strength compared to BTC has sapped the conviction of bulls and would make a subsequent recovery that much harder.

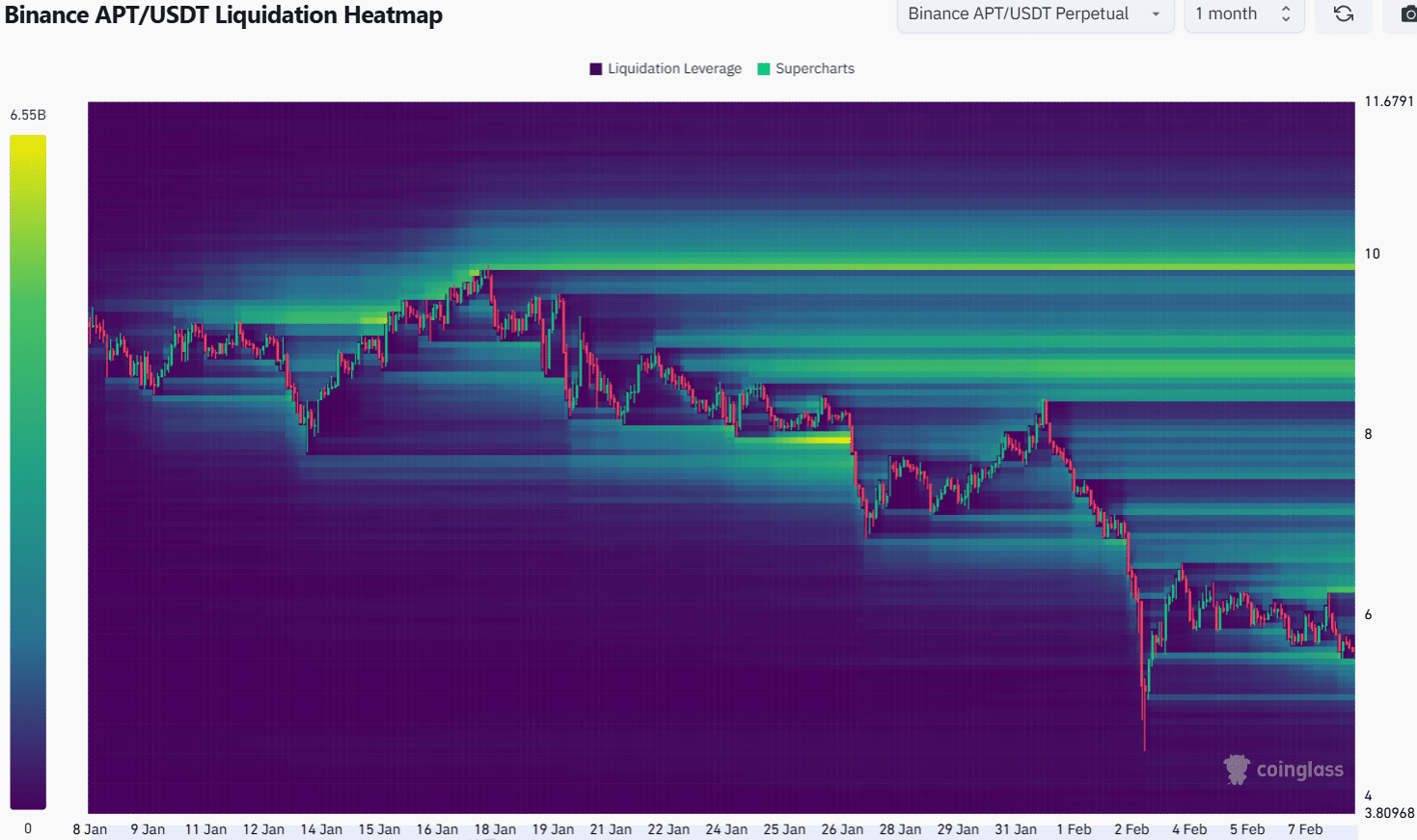

Source: Coinglass

The 1-month liquidation data showed that the $5.47 and $6.27 levels were the closest magnetic zones of importance. The $5.47 one was closer and hence, APT may be more likely to be drawn toward it.

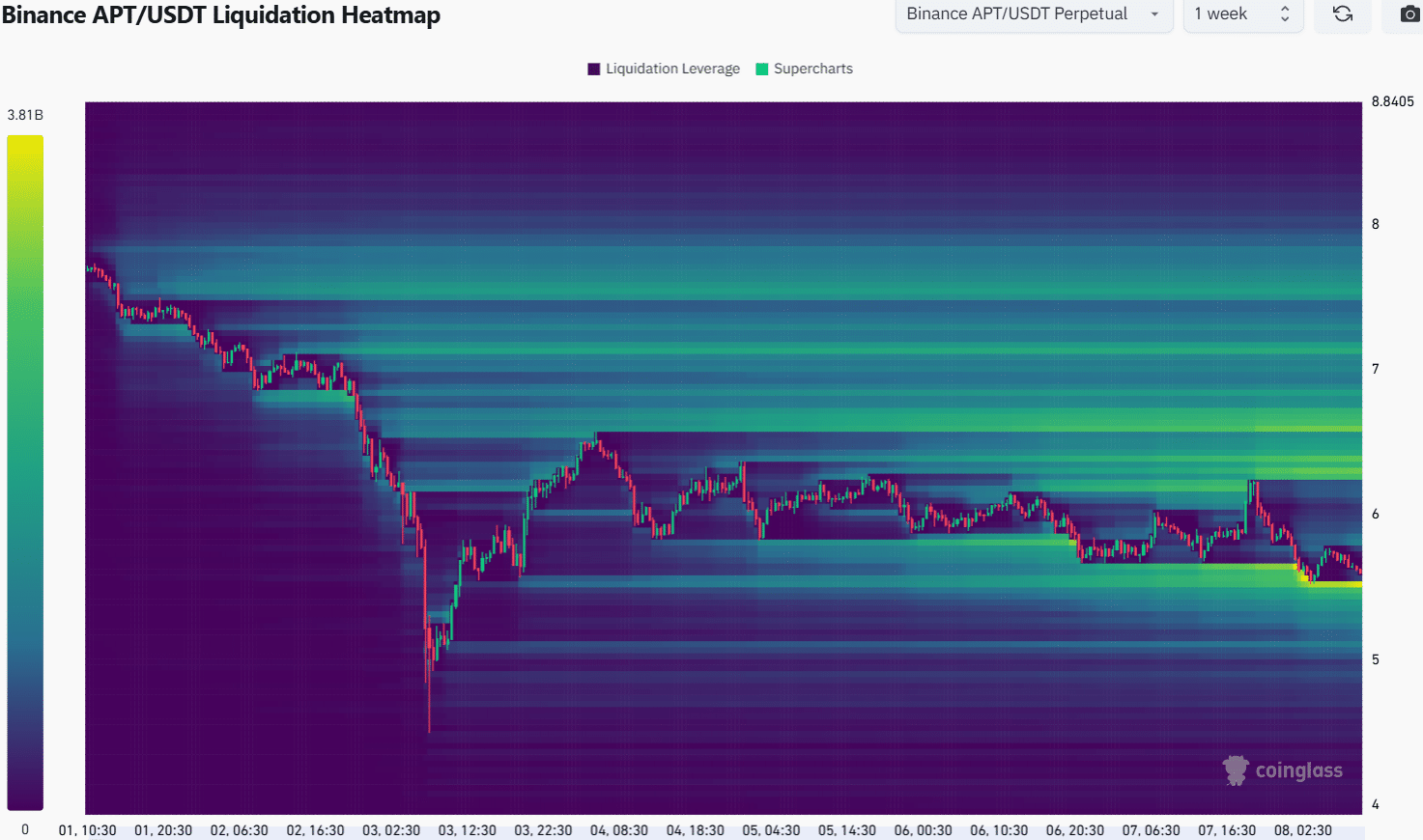

Source: Coinglass

The 1-week heatmap threw the $5.5 liquidity cluster into sharper relief. The $5.34-$5.5 area was a likely candidate for a short-term bullish reversal. Swing traders could buy a test of this area and target a bounce to $6.3 to take profits.

Read Aptos’ [APT] Price Prediction 2025-26

It would be prudent to take profits more aggressively, given the altcoin-averse market sentiment recently. As for investors, beware. CoinMarketCap data showed that 50% of APT’s total supply is still locked. Unlocks will inflict greater pain for holders unless demand goes up multifold or an altseason ensues.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Source: https://ambcrypto.com/aptos-holders-beware-heres-why-unlocks-could-bring-more-pain-to-market/