- Trump has signed an executive order to develop a U.S sovereign wealth fund.

- Congressional hearings will investigate alleged regulatory pressure on crypto firms under Biden

President Donald Trump has taken a bold step towards reshaping the U.S financial landscape by signing an executive order to develop a sovereign wealth fund.

Trump’s sovereign wealth fund plan

Announced on Monday, the initiative aims to establish a government-controlled investment vehicle that could play a strategic role in economic policymaking. Notably, Trump hinted that the fund might involve a potential deal with TikTok, the Chinese-owned social media giant currently facing regulatory scrutiny.

He said,

“I think in a short period of time, we’d have one of the biggest funds.”

During the signing ceremony, Trump emphasized the potential of a U.S sovereign wealth fund, noting that nations like Saudi Arabia have already built massive investment reserves.

Challenges ahead

He pointed to Saudi Arabia’s Public Investment Fund, currently valued at approximately $925 billion, as a benchmark. While acknowledging that the U.S lags behind in this regard, Trump expressed confidence that the country could eventually establish a competitive fund, leveraging its economic strength to drive long-term financial growth and global influence.

However, Mark Crosby, Director of Monash University’s Bachelor of International Business Program, believes that successful funds are usually established by countries with minimal or no debt—An area where the United States faces a challenge.

With the U.S debt soaring to approximately $36 trillion, the feasibility of launching such a fund raises critical questions about financial sustainability and long-term economic strategy.

“For a country that has a lot of debt, like the United States, it doesn’t make that much sense.”

Biden vs Trump

The concept of a U.S. sovereign wealth fund has gained rare bipartisan backing, with both the Trump and Biden administrations exploring its viability. However, the newly inaugurated Trump administration has already demonstrated a stark contrast to its predecessor, particularly in its stance on cryptocurrencies.

While the Biden administration took a restrictive approach to the sector, Trump is being hailed as the “crypto president” for his more favorable policies.

Execs shows support for the Trump administration

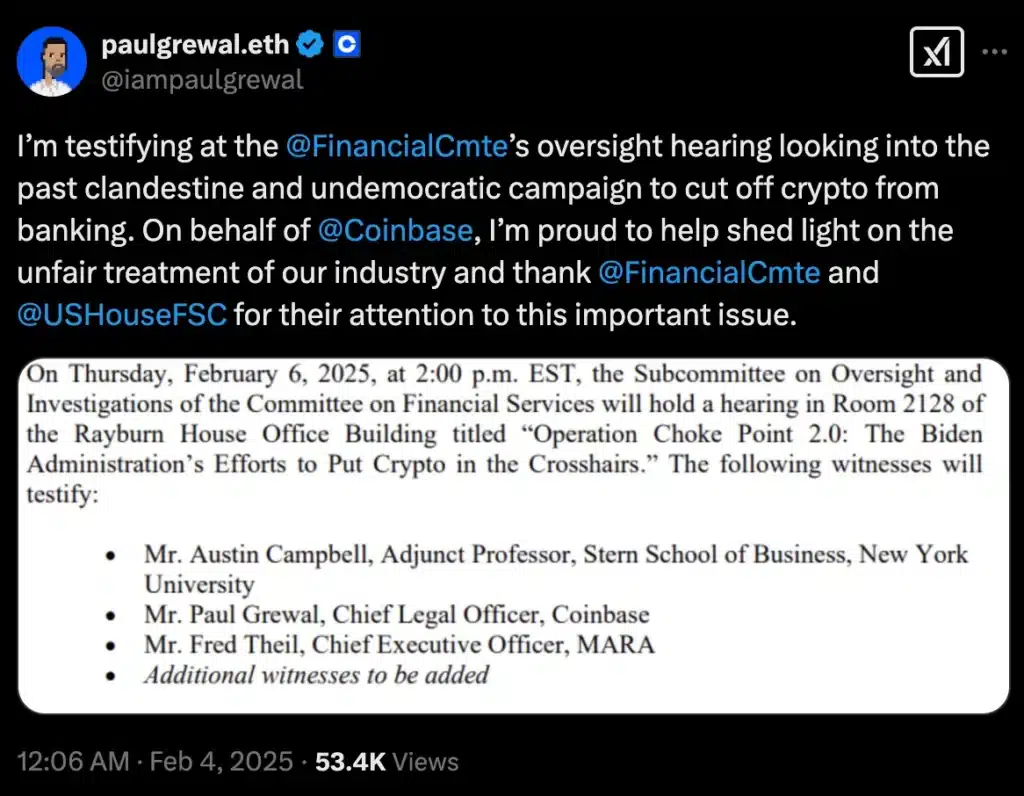

While a sovereign wealth fund could drive innovation, the Trump administration is also working to ease previous crypto restrictions. Coinbase’s Chief Legal Officer, Paul Grewal, is set to testify before Congress as lawmakers probe claims that federal regulators deliberately pressured banks to sever ties with crypto firms.

Taking to X he said,

Source: Paul Grewal/X

The Congressional hearing – Operation Choke Point 2.0: The Biden Administration’s Efforts to Put Crypto in the Crosshairs – comes amid growing concerns that U.S regulators, including the FDIC, engaged in covert efforts to restrict crypto’s access to traditional banking services.

As the Trump administration takes a markedly different approach to digital assets, the outcome of these hearings could be pivotal in redefining cryptocurrency’s place within the U.S financial landscape.

Source: https://ambcrypto.com/how-trumps-executive-order-on-sovereign-wealth-fund-could-reshape-u-s-financial-strategy/