Market watcher Spot On Chain has observed that two dormant Ethereum whales moved $399 million in ETH to Bitfinex just hours before the market crash.

Ethereum experienced a significant downturn in the market, posting a 15% decline in the last 24 hours and a 17% drop over the past seven days. While the price of ETH now stands at $2,584, it initially tanked to $2,100 earlier today.

Notably, crypto market liquidations climbed to $2.4 billion today. Amid this shakeout, on-chain data indicates substantial whale activity around Ethereum just before the market sell-off.

Ethereum Whale Activity Precedes Market Crash

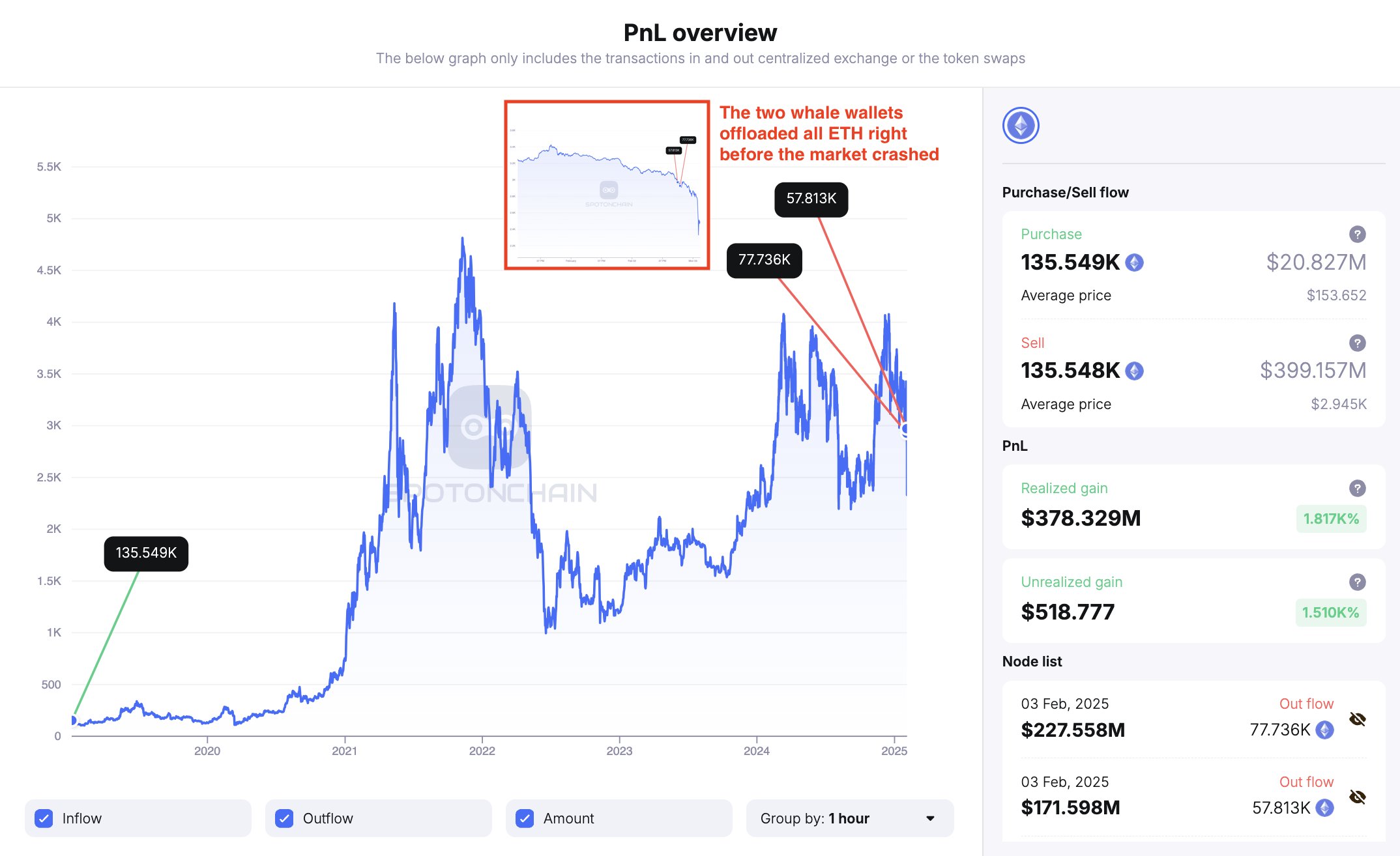

Data from Spot On Chain highlights the movement of two dormant Ethereum whale wallets that reactivated after six years. These wallets deposited 135,548 ETH, valued at approximately $399 million, to the Bitfinex exchange eight hours before the market downturn.

Notably, these wallets initially accumulated ETH at $153.65 per token on January 5, 2019, when their holdings were worth $20.8 million.

If the owners of these wallets sold their ETH at current market prices, they would have realized a $378.3 million profit, marking a +1,817% return.

Their perfectly timed movements ahead of the broader market correction raised speculation over their potential impact on ETH’s decline.

Ethereum Distribution Amid Recent Perfomance

A breakdown of Ethereum’s ownership distribution confirms changes in investor behavior for the week ending January 27, which aligned with the market crash. Long-term holders had increased by only +0.40%.

Meanwhile, mid-term holders surged by +4.69%, suggesting that more traders had shifted towards holding rather than short-term speculation.

Conversely, short-term traders had declined by -2.83%, reflecting a reduction in speculative trading activity.

Bearish Sentiment in The Derivative Market

Amid the holder activity, the ETH derivatives market has seen a notable decline in open interest, dropping by 26.42% to $23.21 billion. This reduction reflects significant liquidations and bearish sentiment, with traders shifting their positions accordingly.

The long-to-short ratio now stands at 0.9084, suggesting an increase in short positions relative to longs.

Meanwhile, the OI-Weighted Funding Rate for ETH has declined to 0.0221, signaling reduced bullish support and growing selling pressure. This shift in sentiment underscores the heightened volatility and uncertainty surrounding Ethereum’s short-term price movement.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/02/03/how-legendary-ethereum-whales-secured-profit-before-eth-price-dumped-hard/?utm_source=rss&utm_medium=rss&utm_campaign=how-legendary-ethereum-whales-secured-profit-before-eth-price-dumped-hard