Bitcoin has been trading sideways since mid-January, moving within a tight range between its all-time high and the $97,750 support level. The market remains divided, with bulls expecting a breakout into price discovery and bears speculating that the cycle top is already in. Despite this uncertainty, Bitcoin continues to hold above critical levels, keeping investors on edge about the next major move.

Related Reading

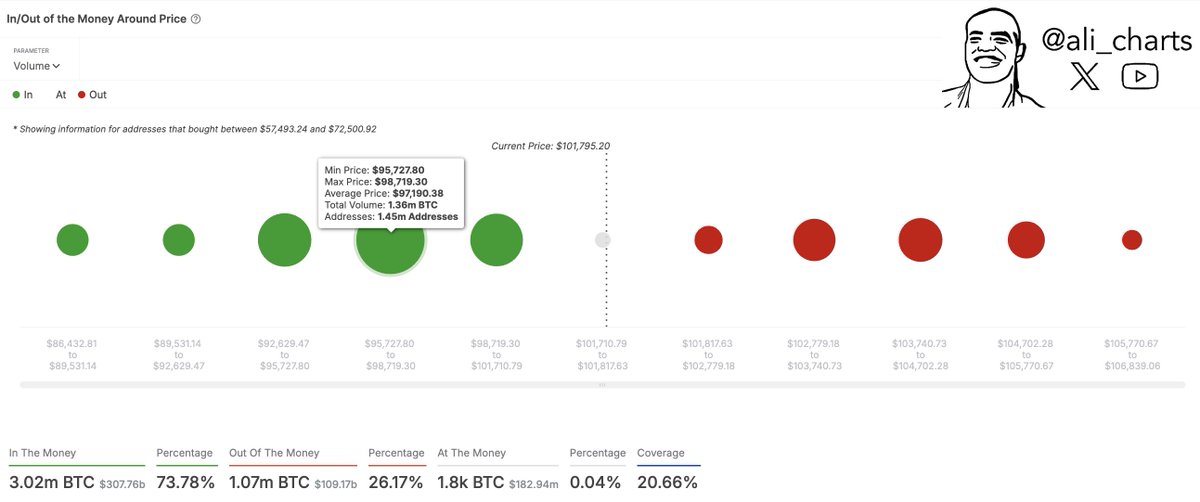

Top analyst Ali Martinez shared key insights on X, revealing that $97,190 is one of the most important support levels for Bitcoin at the moment. Martinez emphasizes that holding above this level is crucial to sustaining the bull market and determining BTC’s price direction for the coming weeks. If Bitcoin maintains strength above this zone, it could provide the foundation for another rally toward the $110K mark and beyond. However, losing this level could result in a deeper correction, shaking market confidence.

With macroeconomic conditions still playing a key role in market sentiment, traders closely watch how BTC reacts to this critical support. Whether Bitcoin can hold firm or break lower will likely define its short-term trajectory, shaping expectations for the rest of the bullish cycle.

Bitcoin Facing A Crucial Test

Bitcoin is at a crucial moment in its cycle, as the coming weeks will determine whether BTC can break above all-time highs and enter price discovery or if a longer consolidation—or even a correction—into lower demand levels is ahead. After weeks of sideways trading, Bitcoin remains at a crossroads, with bulls and bears battling for control of the next major move.

Key metrics shared by Martinez reveal that $97,190 is one of the most important support levels for Bitcoin at the moment. This level is a crucial structural point that has provided strong demand during recent corrections.

Holding above it is vital to sustaining the bull market, as it could serve as a launchpad for BTC’s next leg up. Martinez emphasizes that if the price maintains strength above this support in the coming weeks, a new bullish phase is almost inevitable—pushing BTC into new highs and likely sparking a broader market rally.

Related Reading

However, failure to hold above $97,190 could lead to a breakdown, triggering extended consolidation or a deeper retrace into lower demand zones. Investors and traders are closely watching how Bitcoin reacts to this level, as it could define the market’s trajectory for the next few months.

Consolidation Below ATH

Bitcoin (BTC) is trading at $101,200 after a volatile week, with price action consolidating between all-time highs (ATH) and the crucial $100K level. Despite recent swings, Bitcoin has held strong above key structural support, signaling resilience in the face of market uncertainty.

If BTC stays above $100K in the coming days, a push above ATH is almost certain, as demand remains strong at these levels. The market is watching closely for a breakout confirmation, which would require BTC to clear the $106,000 level with strength. A successful move above this resistance would likely trigger a massive rally, sending Bitcoin into uncharted territory.

However, losing the $100K support could change the short-term outlook, signaling a possible correction into lower demand zones. Such a move could lead to extended consolidation or a deeper retrace, allowing new liquidity to enter the market before another bullish push.

Related Reading

For now, BTC remains at a critical level, with investors and traders closely monitoring whether bulls can sustain momentum and drive prices higher—or if a temporary pullback is on the horizon.

Featured image from Dall-E, chart from TradingView

Source: https://www.newsbtc.com/bitcoin-news/bitcoin-price-must-hold-above-97k-to-sustain-momentum-metrics/