- Kiyosaki sees the latest bout of BTC weakening as a buying opportunity

- Trump’s tariffs could dent the Fed rate cut outlook and Bitcoin’s projections amid renewed inflation fears

Robert Kiyosaki, author of “Rich Dad, Poor Dad,” has termed the recent weakening of Bitcoin [BTC] following Trump’s tariffs a discounted “buying opportunity.”

President Donald Trump announced tariffs against imported goods from Canada, China, and Mexico, with the same set to be effective from February. Market pundits have been cautious about tariff wars triggering inflation and denting the Fed rate cuts’ outlook – Something that is bearish for risk assets like Bitcoin.

However, Kiyosaki also believes the U.S fiscal debt situation is a bigger problem that would always make BTC, gold, and silver more attractive. He said,

“Trump tariffs begins: Gold, silver, Bitcoin may crash. Good. Will buy more after prices crash. Real problem is DEBT…which will only get worse. Crashes mean assets are on sale. Time to get richer.”

In January, the author stuck to his $175K-$350K price target for BTC by end-2025. Hence, the question – Can the crypto still soar to these levels?

Will we see February gains again?

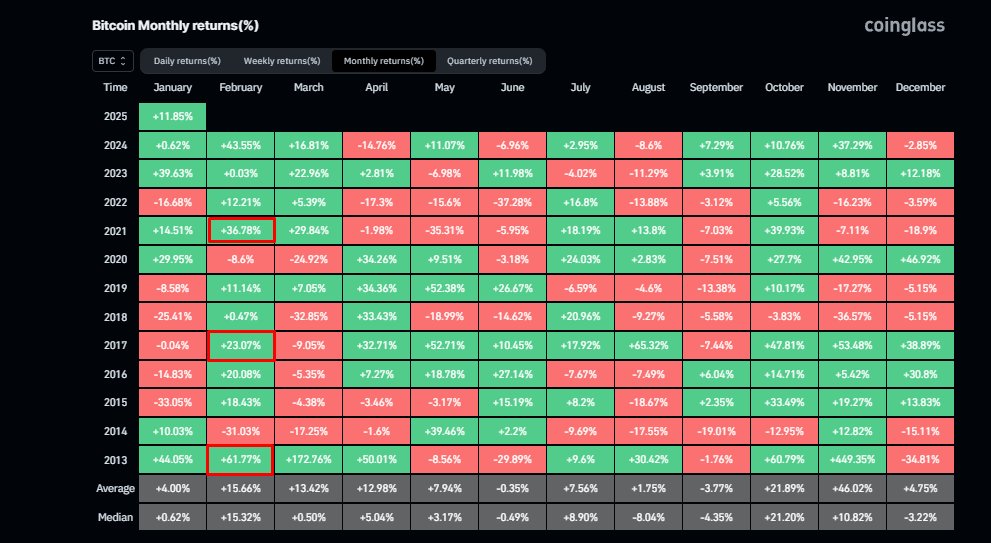

Source: Coinglass

Bitcoin closed January in the green, with gains of 9.29% on the charts. Interestingly, February has usually recorded massive historical gains, especially for the post-halving year. For instance – Since 2013, BTC has never closed February in the red, with an average of 15% gains. If the trend repeats itself this time, BTC could edge higher in February.

However, the tariff-induced inflation risk can’t be overlooked just yet.

Another bullish indicator for the king coin is the U.S money supply (M2) as USD liquidity is typically associated with BTC rallies. In fact, according to market analyst Joe Burnett, the indicator could surpass 2021 highs and push the crypto even higher.

“M2 is set to break all-time highs for the first time since 2021. Infinite liquidity chasing 21,000,000 bitcoin. You know what happens next.”

Source: X

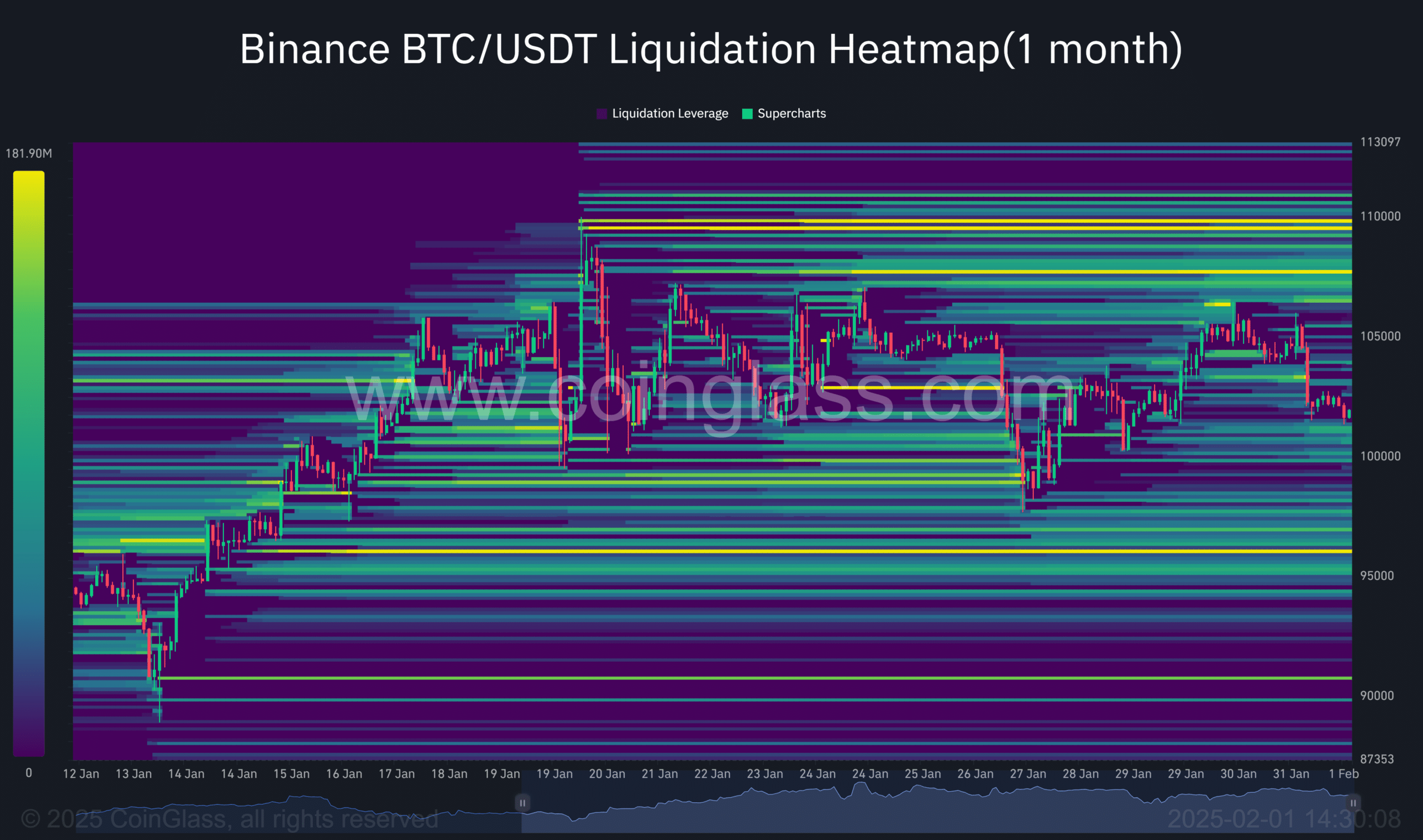

In the meantime, the monthly liquidation heatmap indicated marked key levels (bright yellow) at $96k, $107k, and below $110k.

At press time, however, the price action was nearly halfway from its key liquidity levels. And, it might be difficult to pinpoint which direction it could take. Perhaps, the U.S jobs report (Scheduled for 7 February) could offer more clarity when guessing BTC’s next direction.

Source: Coinglass

Source: https://ambcrypto.com/trumps-tariff-wars-heres-why-kiyosaki-is-encouraging-buying-bitcoin-right-now/