Recently the price of Bitcoin token dropped below $100,000 mark which developed a sense of fear within the market. Experts believe that this drop in the price of Bitcoin (BTC) is mainly because of the FOMC meeting that will be held today and tomorrow. FOMC meetings are scary for the market because there is always risk of potential rate hike that can be imposed after the meeting. While there is has been a significant amount of liquidations in the market, institutional buying from companies like BlackRock, Metaplanet and MicroStrategy has surged.

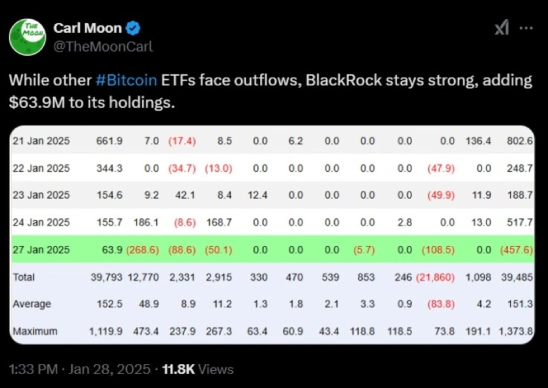

BlackRock Adds BTC Worth $63.9M To Its Holdings

It was recently observed that Bitcoin ETFs are experiencing heavy outflows, but BlackRock took a significant step and added Bitcoin worth $63.9 million to its holdings. This move indicates and highlights the importance of strategic consistency and also confidence in the token even though the market is currently is a very volatile state.

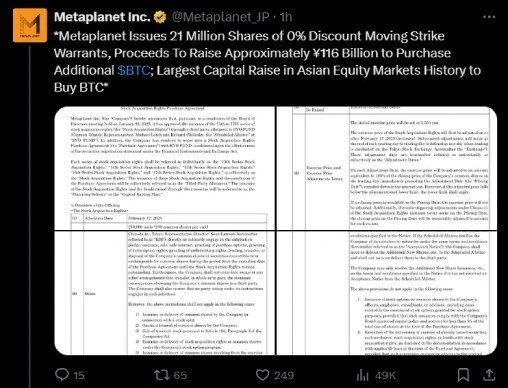

Metaplanet Announces Largest Capital Raise in Asia

BlackRock is not the only one who is taking advantage of the of the dip in Bitcoin prices. Metaplanet recently announced issuance of 21 million shares of 0% Discount Moving Strike Warrants where the asset can be bought at a discounted price with adjustable strike price. This move is believed to raise approximately 116 billion yen (which is approximately about 745 million U.S. dollars) for buying more Bitcoin in the coming future. This is supposedly will be the largest raise of capital in Asian equity market for BTC acquisition. This news again indicates the institution’s faith in the token.

MicroStrategy Files For Expansion

MicroStrategy is one of those institutions that buys BTC left and right and the company’s acquisitions affects the price of the BTC token. MicroStrategy filed for Form S-3 on January 27, 2025 with the United States Securities and Exchange Commission (SEC) which will allow the company to buy more Bitcoins through various securities offerings. Additionally, MicroStrategy also acquired 10,107 BTC for approximately $1.1 billion yesterday. This indicates the companies commitment to honor their strategic plan and their commitment to increase their BTC holdings as much as possible.

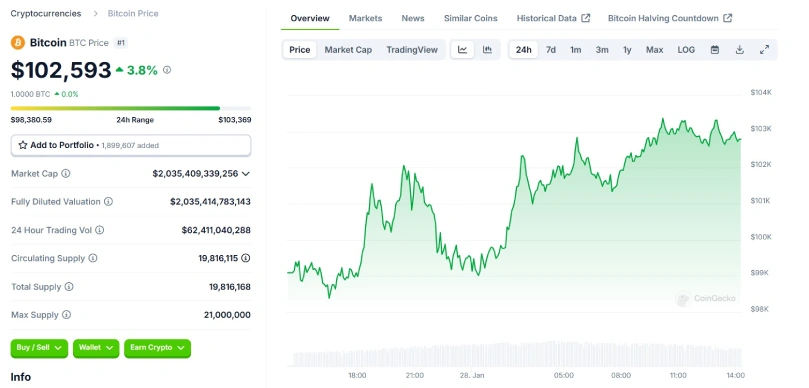

This influx of institutional investments has had a stabilizing effect on Bitcoin’s price. When big names like BlackRock, MicroStrategy and Metaplanet make a move or announce their next move, specially when the price of the token is dipping, it leads to an increased confidence amongst the investors. The news of such developments from such big companies causes a significant uptick in the price of the token.

At press time, the price of the token stands at $102,593 with an uptick of 3.8% in the last 24 hours.

Analysts believe that this increased institutional interest and activity could serve as the most important factor for a potential breakout in the near term.

Also Read: Donald Trump: The Rise of Deepseek Is a Wake-up Call for US Firms

Source: https://www.cryptonewsz.com/bitcoin-price-stabilize-amid-institutional-buy/