- Solana breached its symmetrical triangle after the market crashed.

- SOL has surged by 5.3% over the past 24 hours.

Over the past month, Solana [SOL] has struggled to maintain an uptrend. The lack of momentum escalated over the past day following the market crash. As the crypto market declined, Solana was the hardest hit among major crypto assets.

During this period, SOL dropped to a low of $220, marking a 12.06% decline. However, this decline paused with SOL recovering to a high of $243.95.

Solana breached below the symmetrical triangle

These drops left the crypto community concerned over Solana’s future trajectory. Inasmuch, popular crypto analyst Ali Martinez suggested a potential 20% move, citing its symmetrical triangle.

Source: X

In his analysis, Martinez observed that Solana was trading within a symmetrical triangle. This pattern forms when prices move between two trendlines, one representing higher lows and the other representing lower highs.

This pattern usually suggests market indecision, where neither sellers nor buyers have total market control. As prices trade inside this pattern, they gradually converge towards the midpoint.

Therefore, a break above the triangle could signal the start or continuation of an uptrend. Conversely, a drop below the triangle could result in a bearish outcome.

According to Martinez, Solana could see a 20% price breakout. For this to happen, SOL must close above $251-$262.

A failure to do so would mean a potential bearish trend. While the analyst predicted a breakout above the triangle, the market crash saw the altcoin breach below it, signaling SOL could see more losses.

Can SOL hold and see a trend reversal?

According to AMBCrypto’s analysis, Solana has signaled a strengthening upward momentum following the market crash.

As such, the altcoin could see a breakout to the upside.

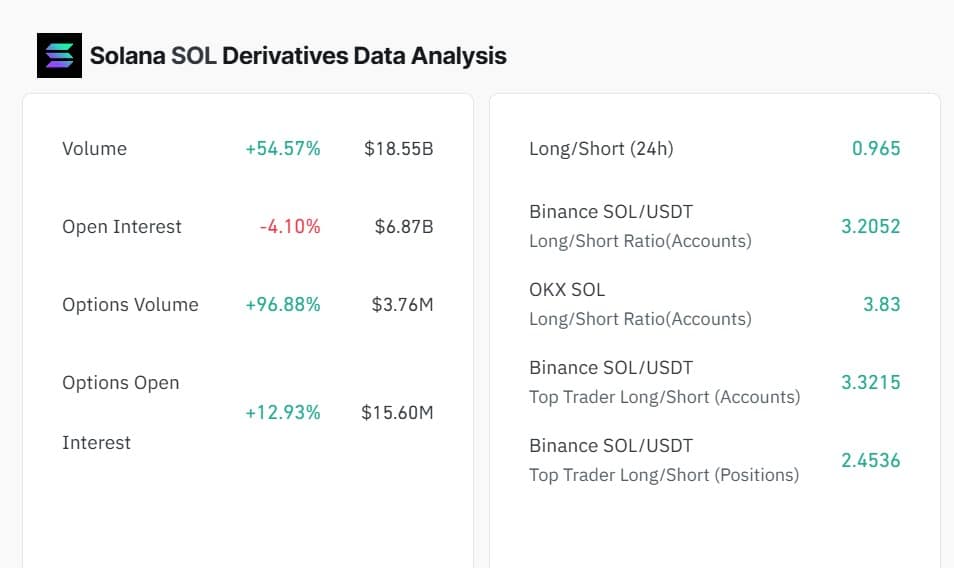

Source: Coinglass

For starters, Solana’s Options Volume(OV) and Options Open Interest(OI) have surged on daily charts. Accordingly, OV has spiked by 96.88% to $3.76 million while OI hiked by 12.93% to $15.60 million.

When OV surges, it implies increased trading activity, while OI implies more contracts are created, reflecting growing interest.

Source: Coinalyze

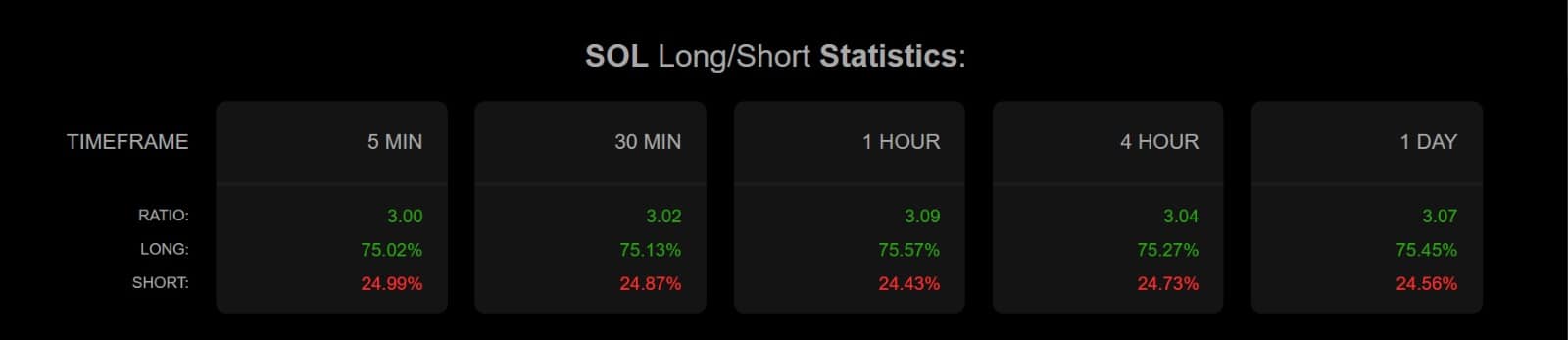

Additionally, most traders remain bullish, as evidenced by the Long-Short Ratio. As such, longs have continually dominated the market with 75.45% on daily charts.

When longs dominate, it implies that traders expect prices to rise.

Source: Santiment

The overall market sentiment remains bullish, with Weighted Sentiment staying positive over the past six days. When most investors turn positive, it suggests higher favorability for the altcoin and expects prices to recover.

Although Solana breached below the symmetrical triangle during the market crash, the altcoin has signaled recovery. It has recovered to $242, gaining 5.32% on daily charts.

Is your portfolio green? Check out the Solana Profit Calculator

If the positive sentiment over the past day holds, Solana could reclaim $260. If the altcoin reaches this level, we could see a breakout predicted by Martinez, with SOL reaching $314.4.

However, if the trend over the past day returns, a correction could see a drop to $228.

Source: https://ambcrypto.com/why-solana-could-surge-20-if-it-breaches-this-price-level/