- Bitcoin’s price corrected below $100K, declining nearly 8% from its recent all-time high.

- Analysts noted that long-term holders showed no signs of selling, signaling new market cycles ahead.

Bitcoin [BTC] is currently facing a notable correction, after its price fell from as high as above $109,000 last week to now trading once again below the $100,000 price mark as of today.

Particularly, at the time of writing, BTC has dropped by nearly 5% in the past week to its press time trading price of $99,986—bringing the price to 7.9% decrease any from its all—time high achieved last week.

Major market players show restraint

Amid the ongoing correction, a CryptoQuant analyst has highlighted an intriguing trend in long-term holder (LTH) behavior.

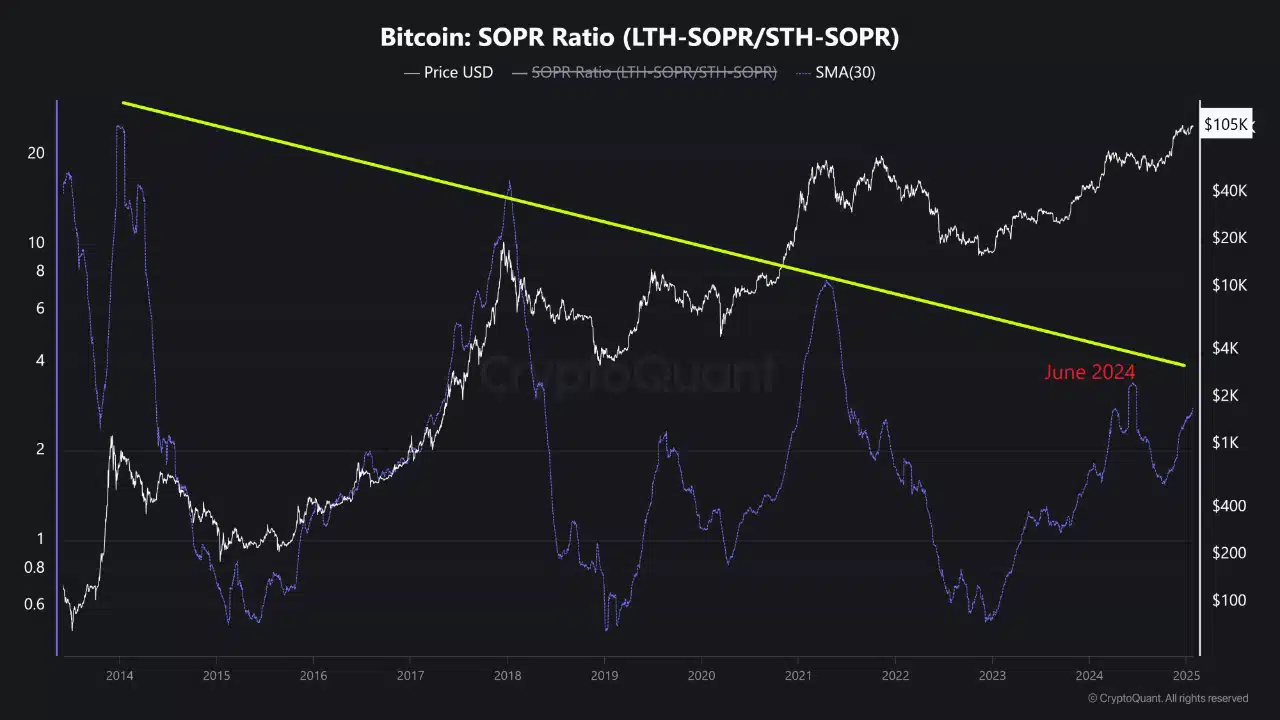

In a post on the CryptoQuant QuickTake platform titled “Major Market Players are Reluctant to Sell,” the analyst noted that the SOPR Ratio (LTH SOPR/STH SOPR), was showing slower growth in the current bull run compared to previous cycles.

Source: CryptoQuant

This ratio, which measures long-term holders’ realized profits relative to short-term holders, remains lower than levels seen during Bitcoin’s price run-up in mid-2024.

The analyst also suggested that as Bitcoin matures, long-term holders have increasingly adopted a more measured approach, distancing themselves from speculative activities.

Institutional participation also appears to have reshaped market dynamics.

With more investors viewing Bitcoin as a long-term store of value rather than a trading instrument, the capital flowing into exchanges has decreased.

As a result, many long-term holders are opting to keep their Bitcoin in portfolios rather than cashing out.

The implication is that, while the market may experience corrections, new cycles will likely emerge in which Bitcoin is held for extended periods, reducing speculative selling and potentially stabilizing the market.

On-chain data offers additional insights

In addition to examining long-term holder behavior, it’s important to consider other key metrics to get the complete picture of what is ongoing behind the scenes of BTC and where the asset is likely headed in the short-term.

Notably, data from CryptoQuant on BTC’s MVRV ratio revealed that this metric has so far been on an increase along with BTC’s recent price action.

This increase brought BTC’s MVRV ratio from 2.2 as of January 9 to as high as 2.52 on the 21st of January.

Although, as of the 26th of January, there has been a slight decrease to 2.4, the overall trend of this metric is still quite in an uptrend.

Source: CryptoQuant

It is worth noting that the continued increase in MVRV ratio points to a positive sentiment among holders and investors.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

A higher ratio typically indicates that the market is still willing to value Bitcoin at levels above its realized price, which could signal resilience and potential for recovery.

However, the slight pullback in MVRV could also be a cautionary sign, suggesting that the market might be approaching a period of consolidation.

Source: https://ambcrypto.com/is-bitcoins-latest-dip-just-a-minor-pullback-before-btcs-next-move/