- ETH whales accumulated over $1 billion worth of tokens, signaling confidence in Ethereum’s future.

- Ethereum Foundation’s leadership overhaul aimed to strengthen technical expertise and ecosystem ties.

Ethereum [ETH] has experienced a relatively mild performance this year compared to other major cryptocurrencies, but historical trends indicate that the best may still be ahead.

As the market continues to evolve, Ethereum’s potential for growth remains strong, especially with developments from within the Ethereum Foundation.

Vitalik Buterin, the co-founder of Ethereum, has proposed significant changes that could reshape the foundation and accelerate the network’s evolution.

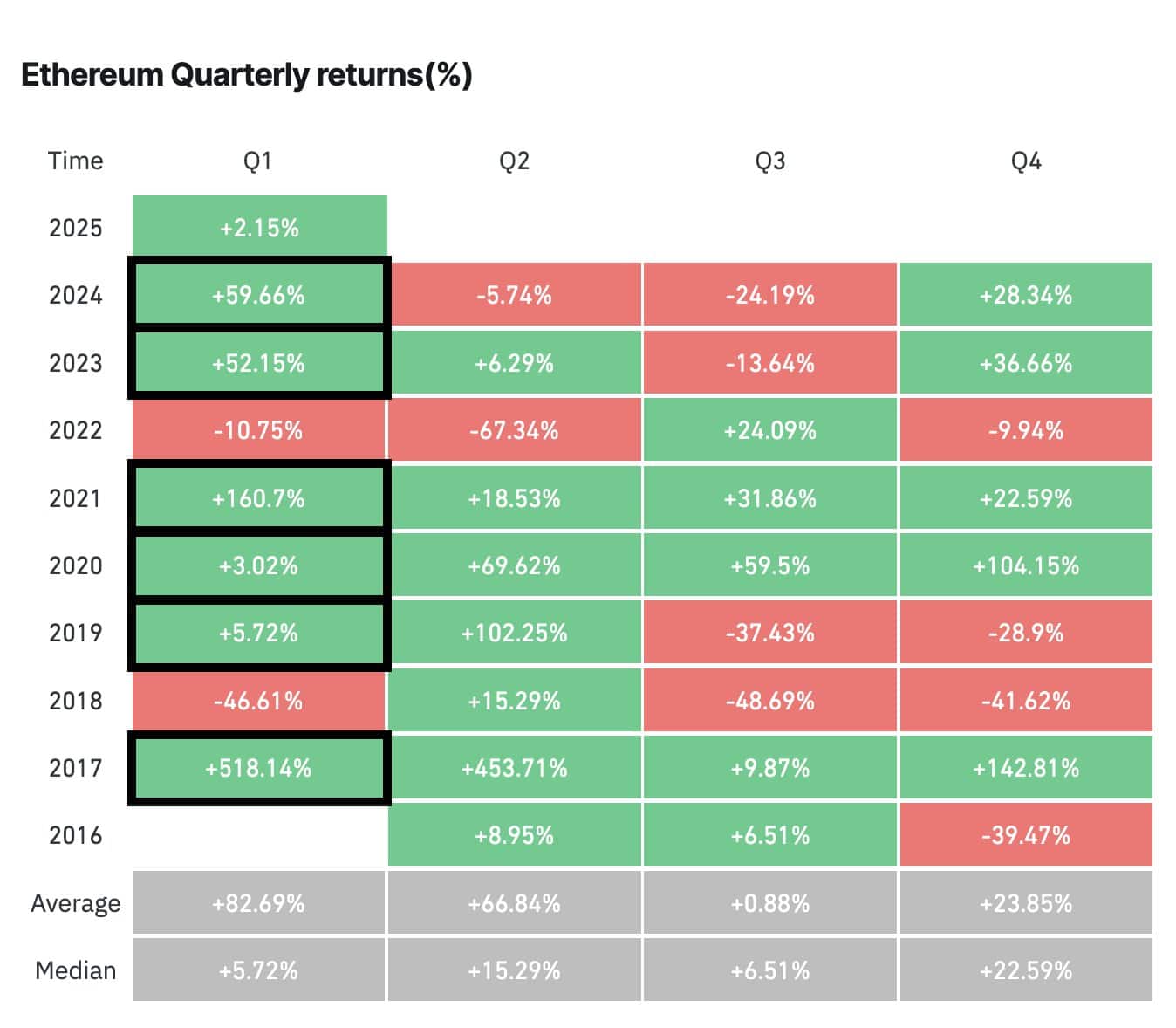

Ethereum’s historical post-halving strength

Source: X

Ethereum has a proven track record of exceptional performance during the first quarter of the year.

Historical data highlights that Q1 often serves as a springboard for Ethereum’s price growth, with notable rallies occurring in past cycles.

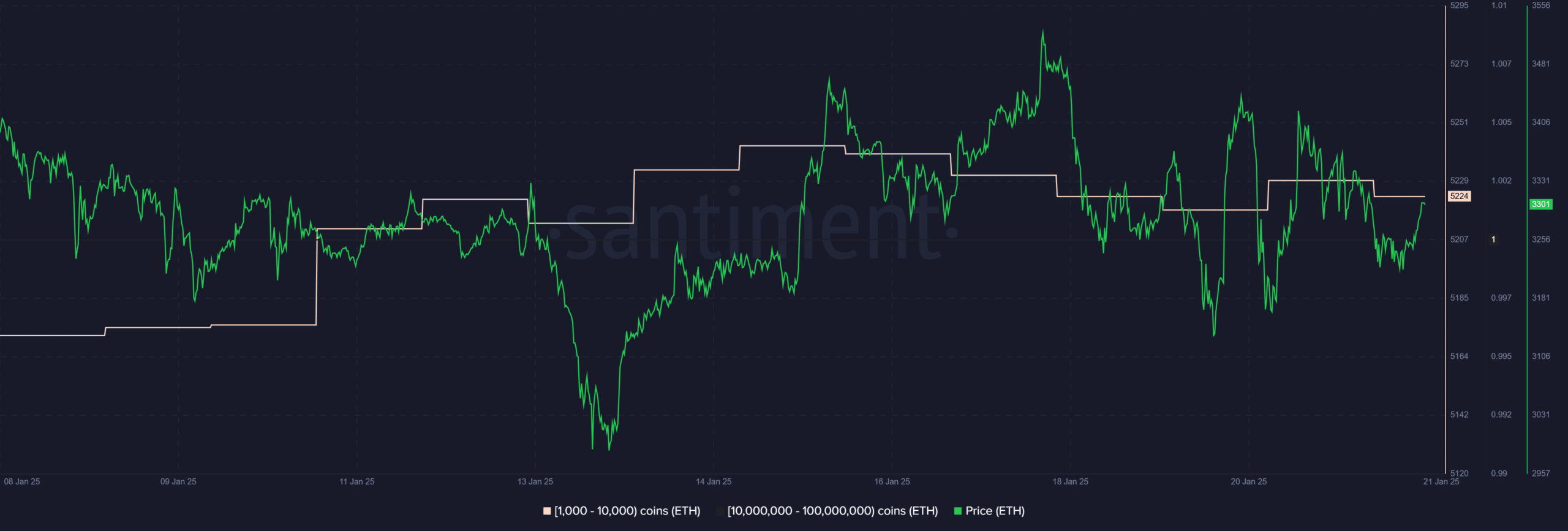

This seasonal trend seems to be catching the attention of major market players, as evidenced by recent whale activity.

Source: Santiment

Over $1 billion worth of ETH has been accumulated by whales in just the past week, signaling strong confidence in the asset’s potential.

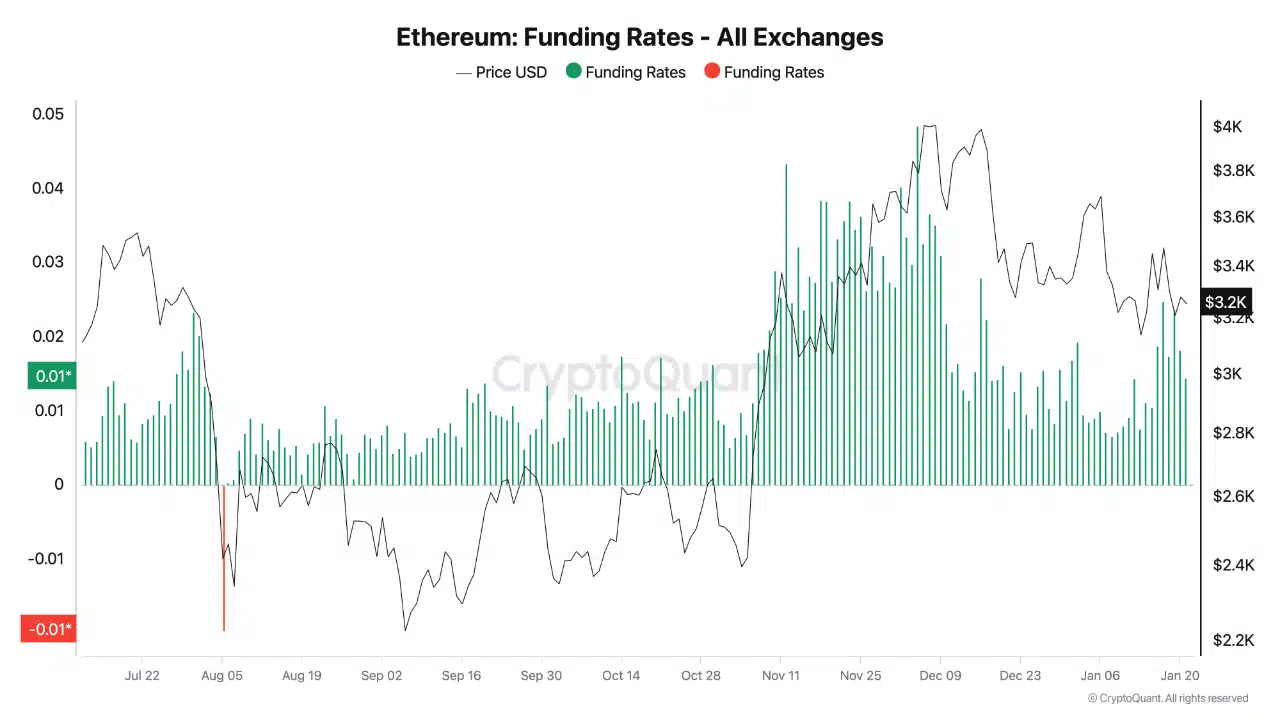

Source: Cryptoquant

Recent data shows rising Funding Rates, indicating traders are paying premiums for long positions — possibly in anticipation of a potential upside.

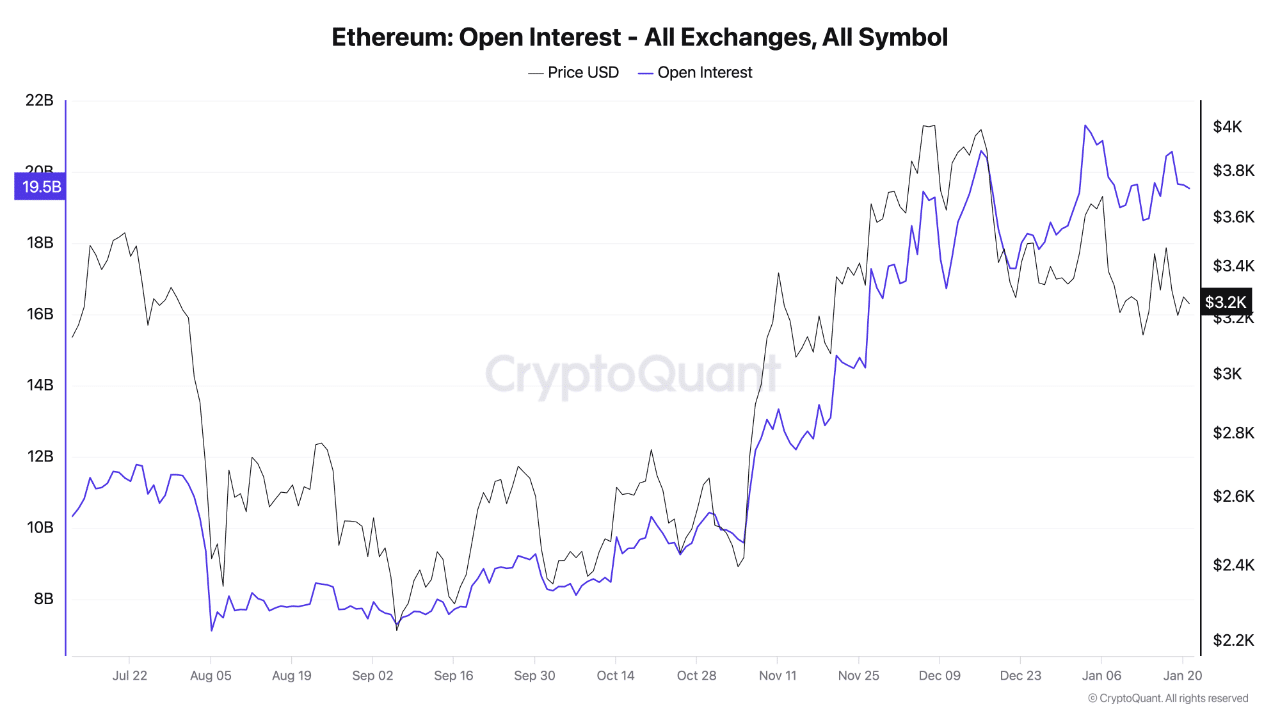

Source: Cryptoquant

ETH is also seeing growing Open Interest, suggesting more capital is entering leveraged positions. However, excessive leverage can lead to liquidations, causing short-term volatility.

If demand sustains and leverage remains controlled, ETH could experience an upside breakout, reinforcing the market’s confidence in further price appreciation.

Key breakout levels

Source: Tradingview

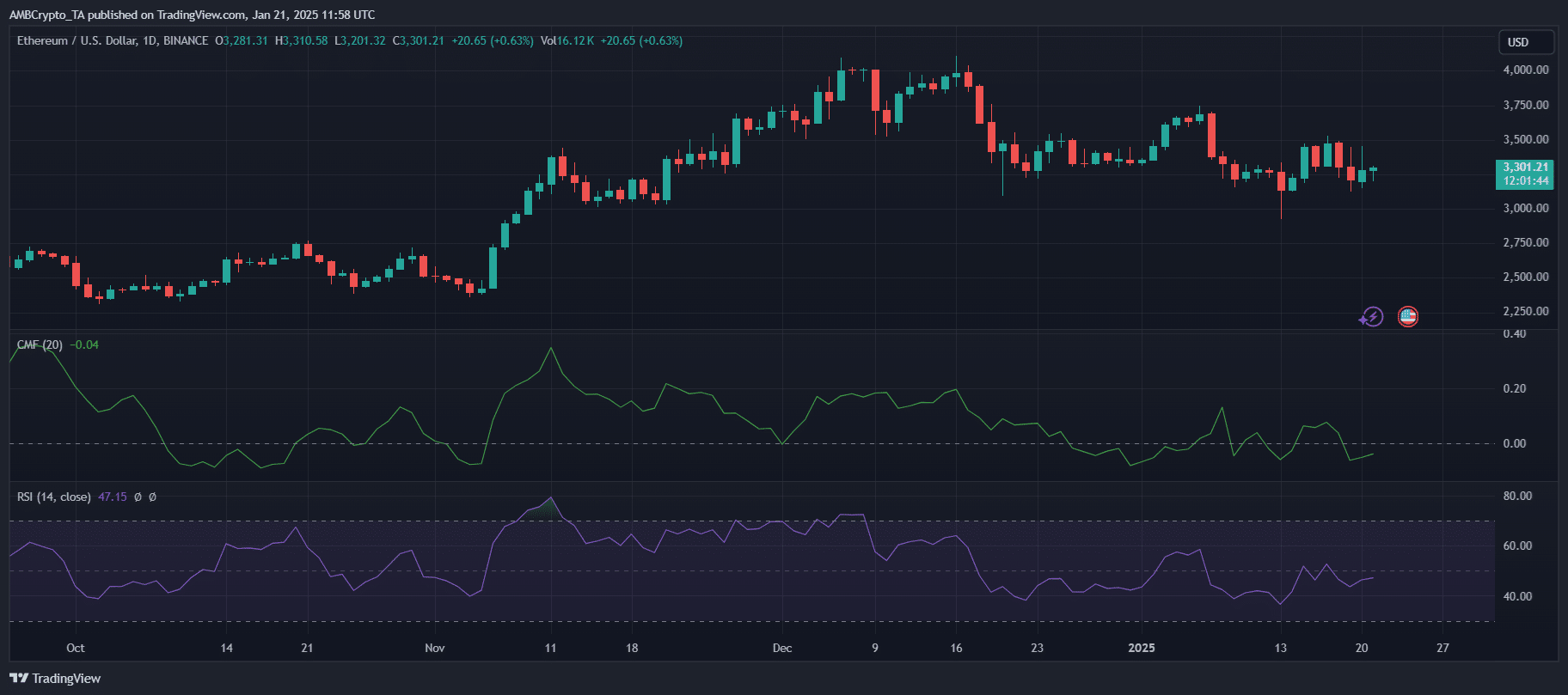

At the time of writing, Ethereum is trading at $3,301, with key indicators suggesting potential volatility ahead. The RSI signals neutral momentum, while the CMF suggests weak capital inflows.

A decisive breakout above $3,500 could trigger a strong upward push toward $3,750 and $4,000, marking critical resistance zones.

On the downside, support at $3,200 remains crucial, with a breakdown potentially exposing $3,000 and $2,750.

Bulls need stronger buying pressure to regain control, while bears may capitalize on a liquidity squeeze if ETH struggles to reclaim $3,500 in the coming sessions.

Read Ethereum’s [ETH] Price Prediction 2025–2026

Source: https://ambcrypto.com/ethereum-eyes-3500-can-q1-trends-fuel-a-rally/