Crypto market analyst Ali Martinez sets a two-digit XRP price target, questioning why XRP is bigger than BlackRock if market cap actually matters.

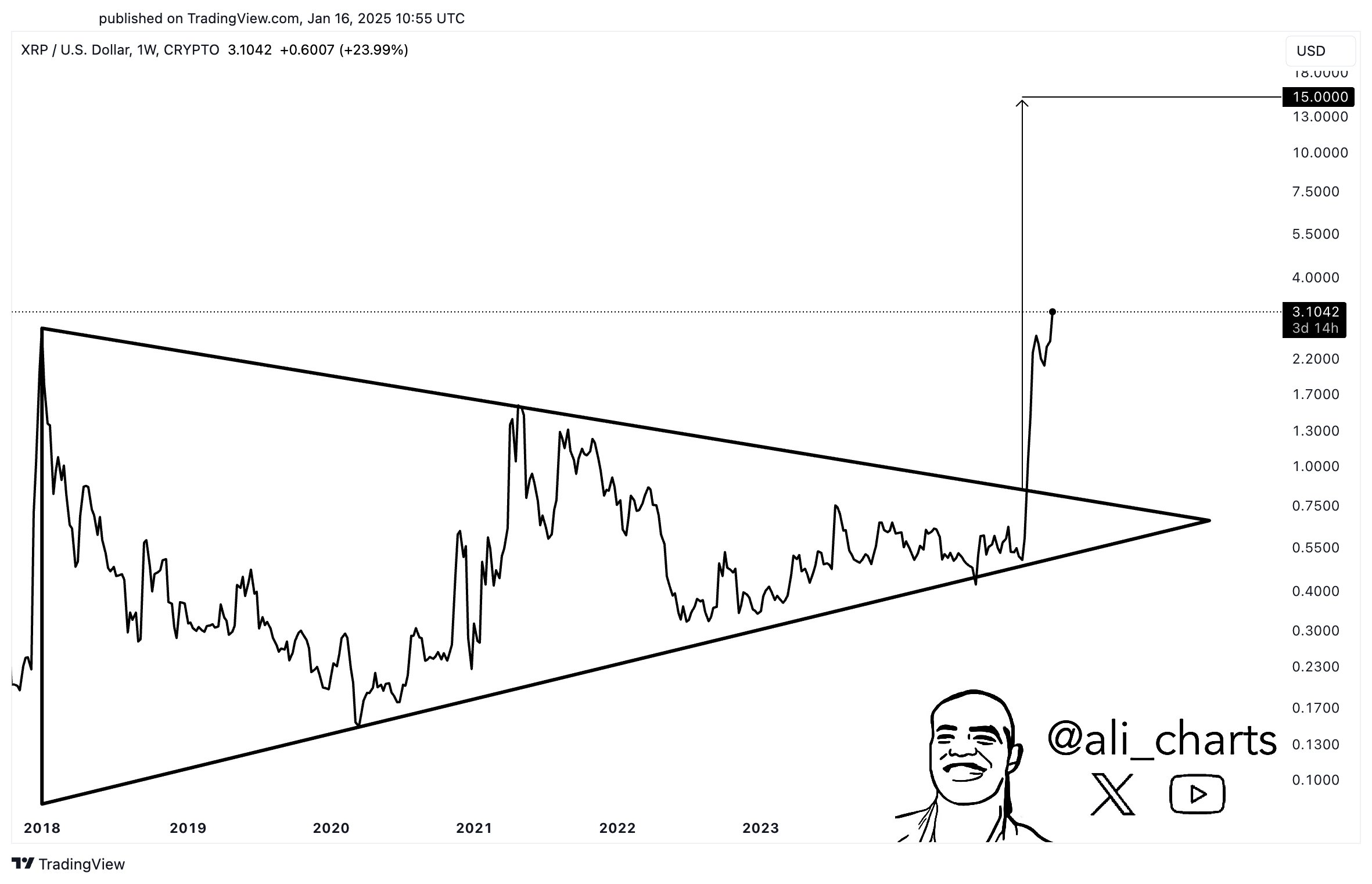

In his latest analysis, the market watcher predicted a potential surge to $15. He based his assessment on the breakout of a symmetrical triangle pattern visible on the monthly chart. Such a move typically signals bullish momentum.

Several analysts called attention to this pattern last year, especially when XRP remained traded for $0.50. Data from the chart shows that XRP slipped into the symmetrical triangle pattern when it collapsed from the $3.8 all-time high in January 2018.

Within this structure, XRP witnessed a years-long consolidation. An attempt to breakout occurred in April 2021, but XRP faced resistance at the $2 mark. Interestingly, its latest rally from November 2024 has now triggered a successful breakout from the symmetrical triangle.

Martinez believes this breakout could push XRP to $15, a 5-fold increase from current levels. Notably, XRP recently retested the resistance at $3.4 just days ago after moving beyond $3 for the first time in seven years. This latest strong momentum bolstered Martinez’s bullish outlook.

Martinez Responds to Criticisms

Not all analysts share Martinez’s optimism. Crypto proponent Tribal Trader questioned the feasibility of the $15 prediction. Tribal Trader accused Martinez of receiving incentives from “XRP” and not disclosing them.

He raised concerns about XRP’s market cap requirements to achieve such a price. Essentially, his argument suggested that reaching $15 would require an extraordinary market cap, which he thinks might be unfeasible.

For context, at a price of $15, XRP’s market cap would balloon to $862.5 billion, nearly double Ethereum’s current valuation. In response, Martinez dismissed the concerns, pointing out that XRP already has a higher market cap than BlackRock.

If market cap matters why is XRP’s market cap bigger than BlackRock’s market cap?

— Ali (@ali_charts) January 16, 2025

He argued that if market cap were a limiting factor, XRP surpassing BlackRock—a global financial giant—wouldn’t have occurred. Notably, BlackRock, the world’s largest asset manager, has a market cap of $155 billion despite managing $11.6 trillion in assets. XRP’s current market cap, at $180 billion, already surpasses BlackRock’s.

A History of XRP Predictions

It bears mentioning that Martinez has been vocal about his bullish stance on XRP in recent months. In November 2024, as XRP reclaimed $1 for the first time in three years, he suggested that the resignation of SEC Chair Gary Gensler could be bullish for the altcoin.

‘@GaryGensler leaving the @SECGov is the best thing that could happen to @Ripple. Now, $XRP targets $2! https://t.co/YEDiZtrnB1 pic.twitter.com/LLE4n0MC8z

— Ali (@ali_charts) November 21, 2024

At the time, Martinez forecasted XRP would hit $2 soon after breaching the $1 level. Interestingly, this forecast materialized a week later, with XRP eventually breaking above the $2 mark on Dec. 1, 2024.

Following this, Martinez identified $4 as the next target. So far, XRP appears to be moving closer to this level, having recently crossed the $3 psychological level. Meanwhile, his latest analysis, based on the symmetrical triangle breakout, projects an ultimate target of $15.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/01/19/xrp-to-15-analyst-says-if-market-cap-matters-why-xrp-is-bigger-than-blackrock/?utm_source=rss&utm_medium=rss&utm_campaign=xrp-to-15-analyst-says-if-market-cap-matters-why-xrp-is-bigger-than-blackrock