- XRP’s selling pressure has been waning in the near-term, based on metrics and price action

- Rising leverage ratio was a result of bullish optimism, but also a warning to futures/perp traders

XRP has been in the news this week after it hit a 7-year high and pushed beyond the $3-mark on the charts. Since 01 January, the altcoin has gained by 52%, with whale accumulation being strong too. In fact, whales have bought more than 1.4 billion XRP in the last two months – A 35% hike in demand.

Metrics also revealed reduced deposits of XRP to exchanges. Thus, AMBCrypto analyzed this development alongside other metrics to understand if they bode well for XRP bulls or not.

XRP – Mixed signals need decoding

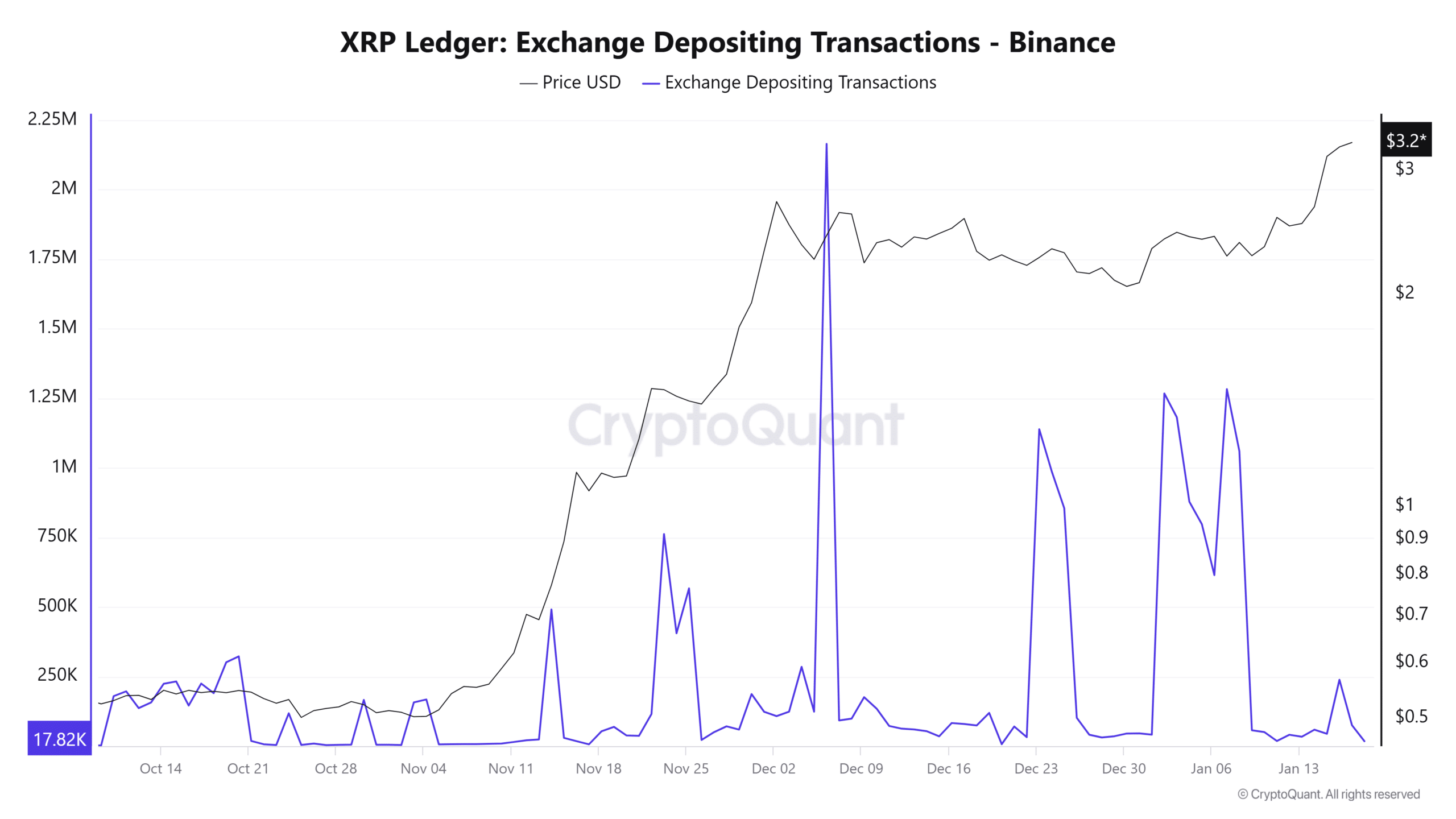

Source: CryptoQuant

This metric tracks the total count of deposit transactions to exchanges. The higher the number, the greater the likelihood of an imminent wave of selling. Greater deposit counts generally point toward selling pressure. It could also imply more margin trading, using XRP as collateral.

During the consolidation phase in December, XRP deposits saw significant upward spikes. However, the bulls were able to hold the $2 psychological support against the selling pressure. In fact, its latest rally saw low deposits, meaning selling pressure remained relatively low in recent days.

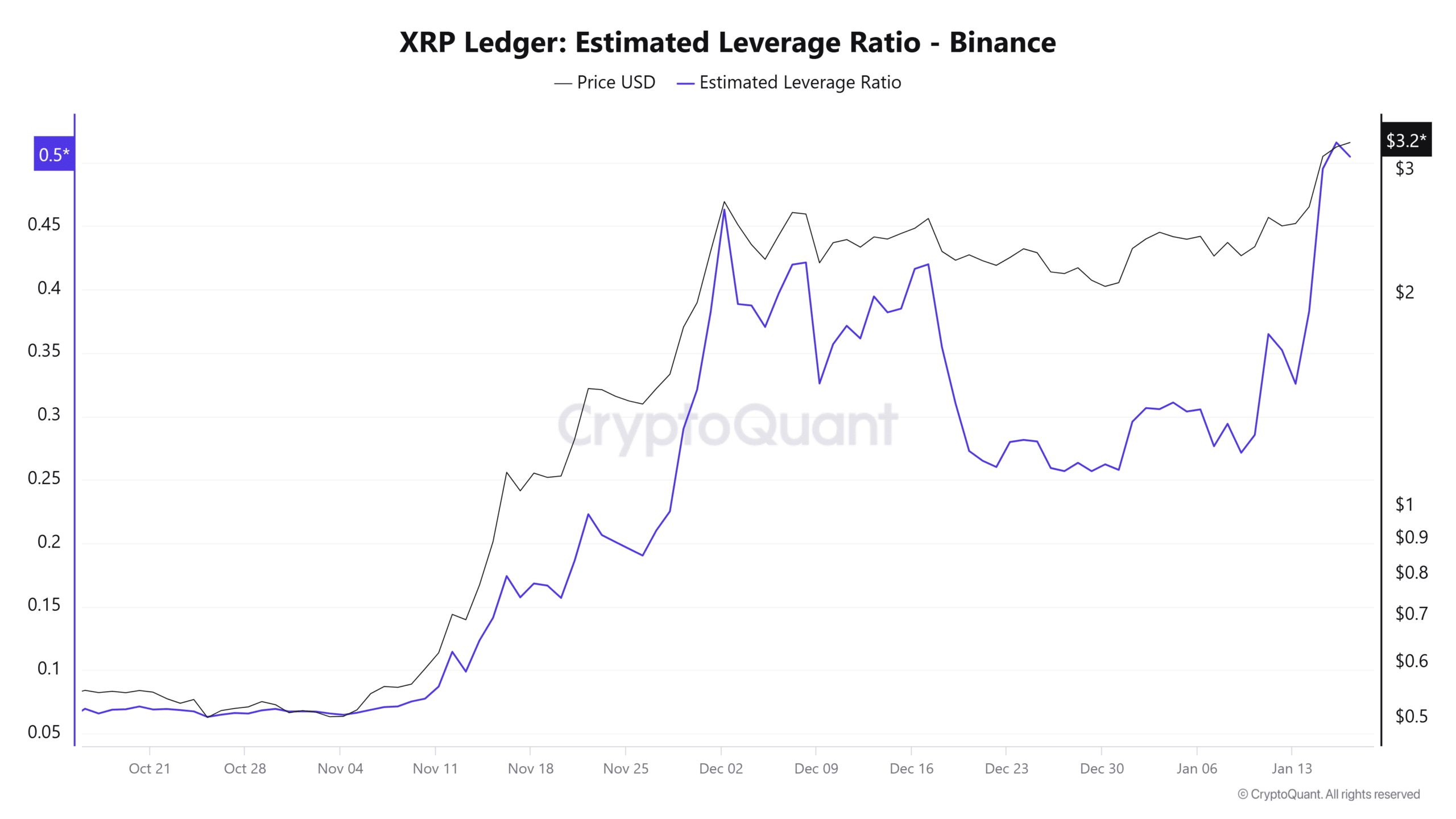

Source: CryptoQuant

In early November, the price of XRP began to trend higher quickly. The estimated leverage ratio (ELR) metric also advanced higher. The ELR is the exchange’s Open Interest divided by its coin reserves. It lends insights into whether participants are engaged in greater leverage trading or not, which usually happens during a strong uptrend.

The ELR saw some respite in the second half of December due to the consolidation. The recent breakout past $3 spurred the ELR higher, flashing a warning signal to traders.

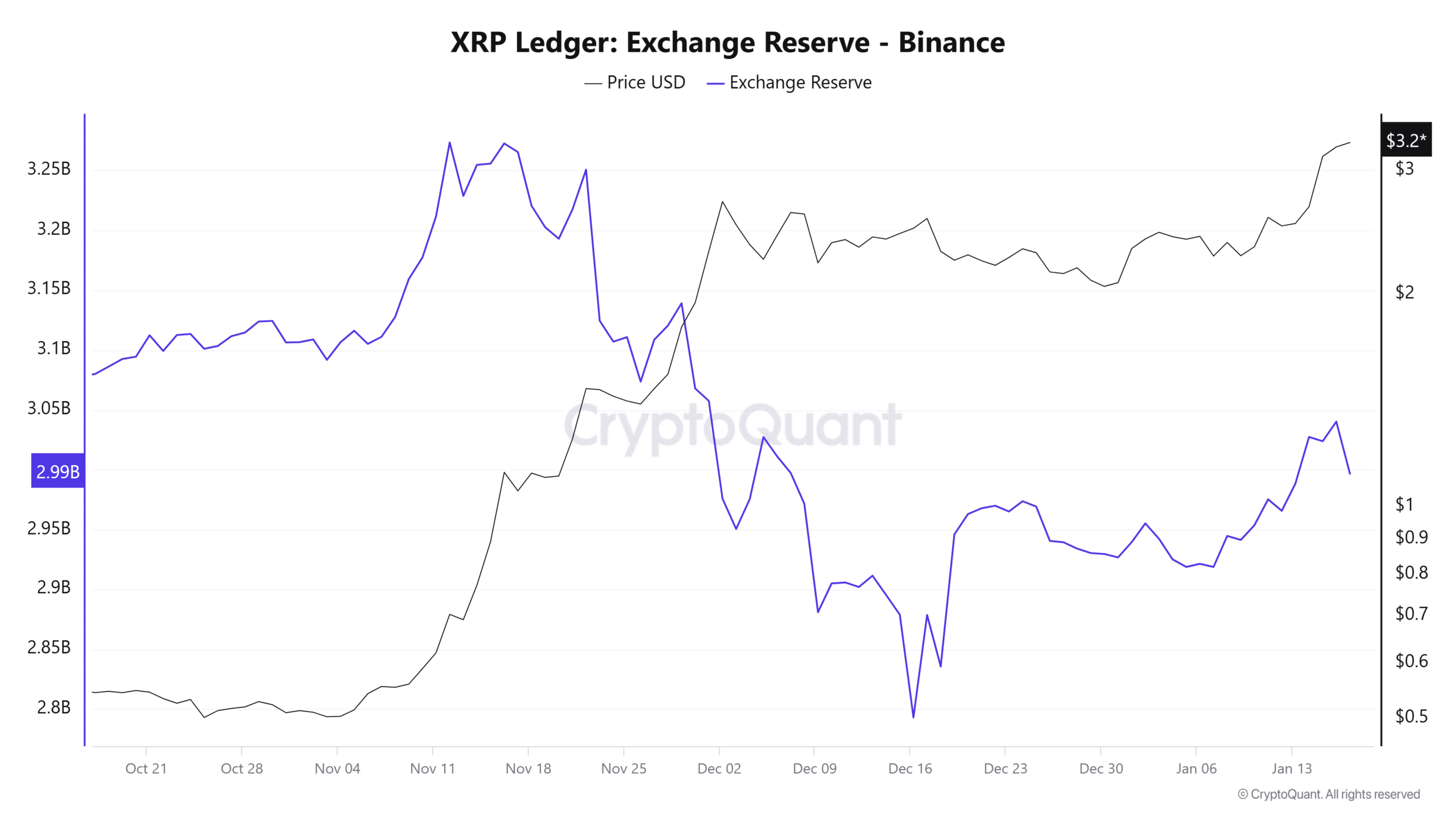

Source: CryptoQuant

Over the last two weeks, XRP exchange reserves have been on the rise. This can be seen as a bearish sign, one not in agreement with the deposits count falling.

The conclusion is that there may be some selling pressure from profit-taking, but not enough to halt the bulls. This finding makes it more likely that traders used XRP as collateral in margin trading.

Read Ripple’s [XRP] Price Prediction 2025-26

The rising ELR and exchange reserves, together, suggested that volatility could hurt traders in the short-term. Liquidity hunts and a consolidation period could follow, but it is uncertain when that might be.

Source: https://ambcrypto.com/xrp-price-prediction-despite-bullish-metrics-traders-still-face-these-volatility-risks/