- Stellar (XLM) could soar by 25% to reach the $0.45 level if it holds the $0.35 level.

- Currently, 65.4% of top traders on Binance hold long positions, while 34.6% hold short positions.

XLM, the native token of Stellar, is poised to reverse its downside momentum due to the formation of bullish price action, as reported by a prominent crypto expert.

Buy signal for XLM, says expert

On 23rd December, the expert shared a post on X (formerly Twitter), highlighting that a technical indicator called TD Sequential is flashing a buy signal for XLM.

Source: X (previously Twitter)

In addition, the expert further noted that the altcoin’s price could rally only if it holds the $0.33 level; otherwise, it may fail.

XLM technical analysis and key levels

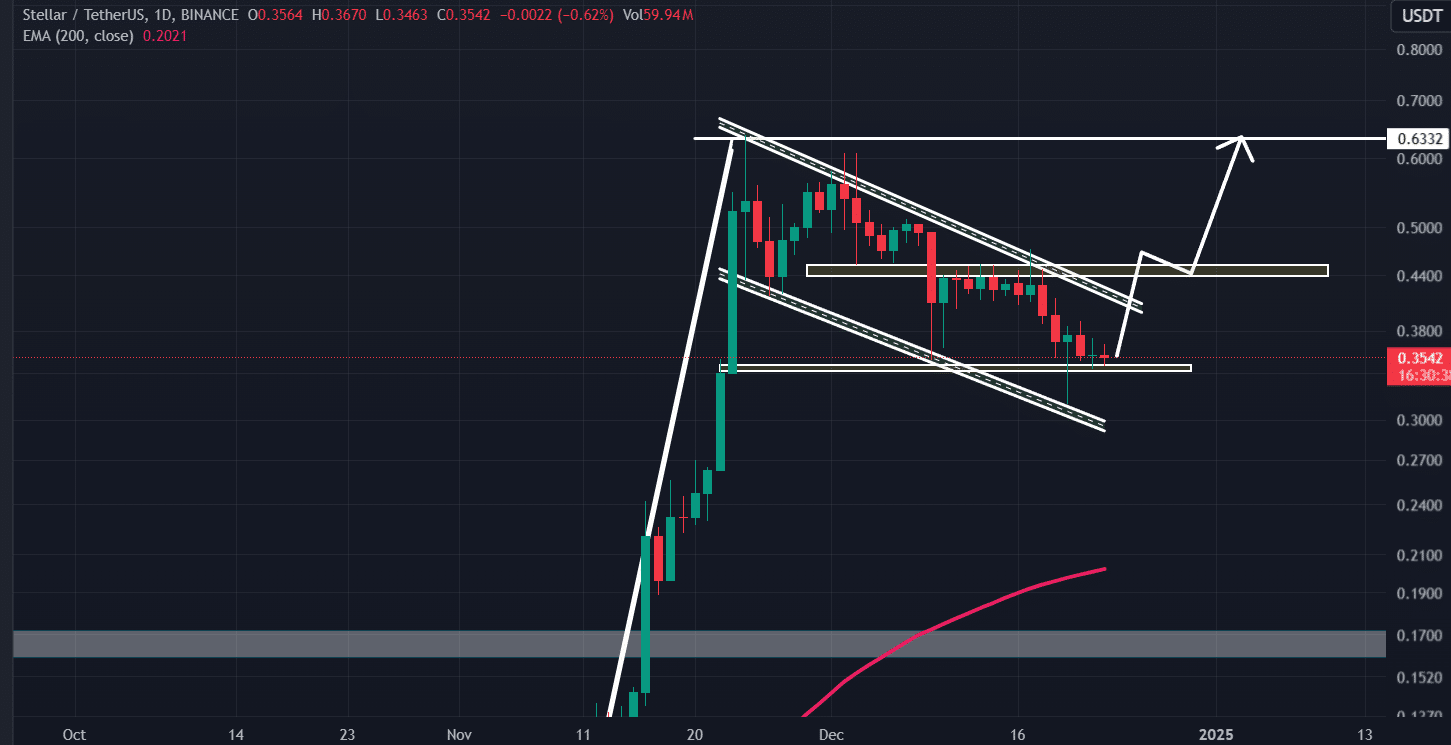

According to AMBCrypto’s technical analysis, XLM appears to be consolidating in a tight range between $0.34 and $0.39, near a crucial support level of $0.347, over the last four trading days.

Source: tradingView

This ongoing consolidation will determine the future direction of XLM’s price. Based on recent price action and historical momentum, if the altcoin holds this support level, there is a strong possibility it could soar by 25% to reach the $0.45 level.

Conversely, if it fails to hold this level and closes a daily candle below the $0.33 mark, the price could decline by 33% to reach the $0.22 level in the future.

The XLM daily chart indicates that the price is overstretched and significantly far from the 200 Exponential Moving Average (EMA), though it suggests that the asset remains in an uptrend.

Bullish on-chain metrics

In addition to this bullish outlook, long-term holders and traders have started showing interest in the token as it approaches a key support level, according to the on-chain analytics firm Coinglass.

Data from XLM spot inflow/outflow metrics reveal that exchanges have experienced a significant outflow of $6.5 million worth of XLM, indicating increased buying pressure, potential upside momentum, and an ideal buying opportunity.

In addition to the participation of long-term holders, traders have demonstrated strong bullish market sentiment.

Currently, the long/short ratio for Binance’s XLMUSDT pair stands at 1.87, with a ratio above 1 indicating bullishness. Data further reveals that 65.4% of top traders on Binance currently hold long positions, while 34.6% hold short positions.

Read Stellar’s [XLM] Price Prediction 2024–2025

When combining all these on-chain metrics with technical analysis, it appears that the bulls are currently dominating the asset and could maintain control to hold the $0.35 level in the future.

At press time, XLM was trading near $0.358 and has witnessed a price decline of 3%, in the past 24 hours. During the same period, its trading volume dropped by 19%, indicating reduced participation from traders and investors amid market uncertainty.

Source: https://ambcrypto.com/xlm-trading-insights-potential-25-increase-if-this-key-level-holds/