In a significant move, Marathon Digital Holdings (MARA), the largest publicly traded Bitcoin mining company, has acquired 6,474 Bitcoin (BTC) valued at approximately $619 million. This acquisition was funded through a $1 billion convertible note offering with remarkable 0% interest rate.

📢JUST IN: CRYPTO MINING FIRM MARA, ANNOUNCES ACQUISITION OF 6,474 BITCOIN $BTC (~$619M) VIA 0% $1B CONVERTIBLE NOTE OFFERING

— BSCN Headlines (@BSCNheadlines) November 28, 2024

This move positions the company as key institutional player in the Bitcoin market. The company now holds a total of 34,794 BTC, currently valued at around $3.32 billion, based on Bitcoin’s spot price of $95,406 per coin.

MARA’s use of a 0% interest convertible note to finance the acquisition is notable. Convertible notes typically offer investors the option to convert debt into equity, making this deal an attractive options for stakeholders. The strategic move mirrors a similar approach taken by MicroStrategy, a company well-known for leveraging corporate debt to amass significant Bitcoin holdings.

Alongside this acquisition, the company repurchased $200 million of its 2026 convertibles notes, effectively reducing future debt obligations. The remaining $160 million from the fundraising round will be allocated for potential future Bitcoin purchases, particularly if prices dip, demonstrating MARA’s long-term commitment to Bitcoin accumulation.

MARA Expanding Institutional Bitcoin Holdings

Marathon Digital’s growing Bitcoin reserve highlights the increasing interest among institutional players in the digital asset space. The firm’s purchase of an additional 703 BTC at an average price of $95,395 per coin further emphasized its belief in Bitcoin’s future value.

By securing this substantial amount of Bitcoin, MARA joins companies like MicroStrategy, which recently increased its Bitcoin holdings to 386,700 BTC. Between November 18 and 24, MicroStrategy acquired 55,000 BTC, solidifying its position as the largest corporate holder of Bitcoin.

Bitcoin’s Path Forward: Will Resistance be Broken?

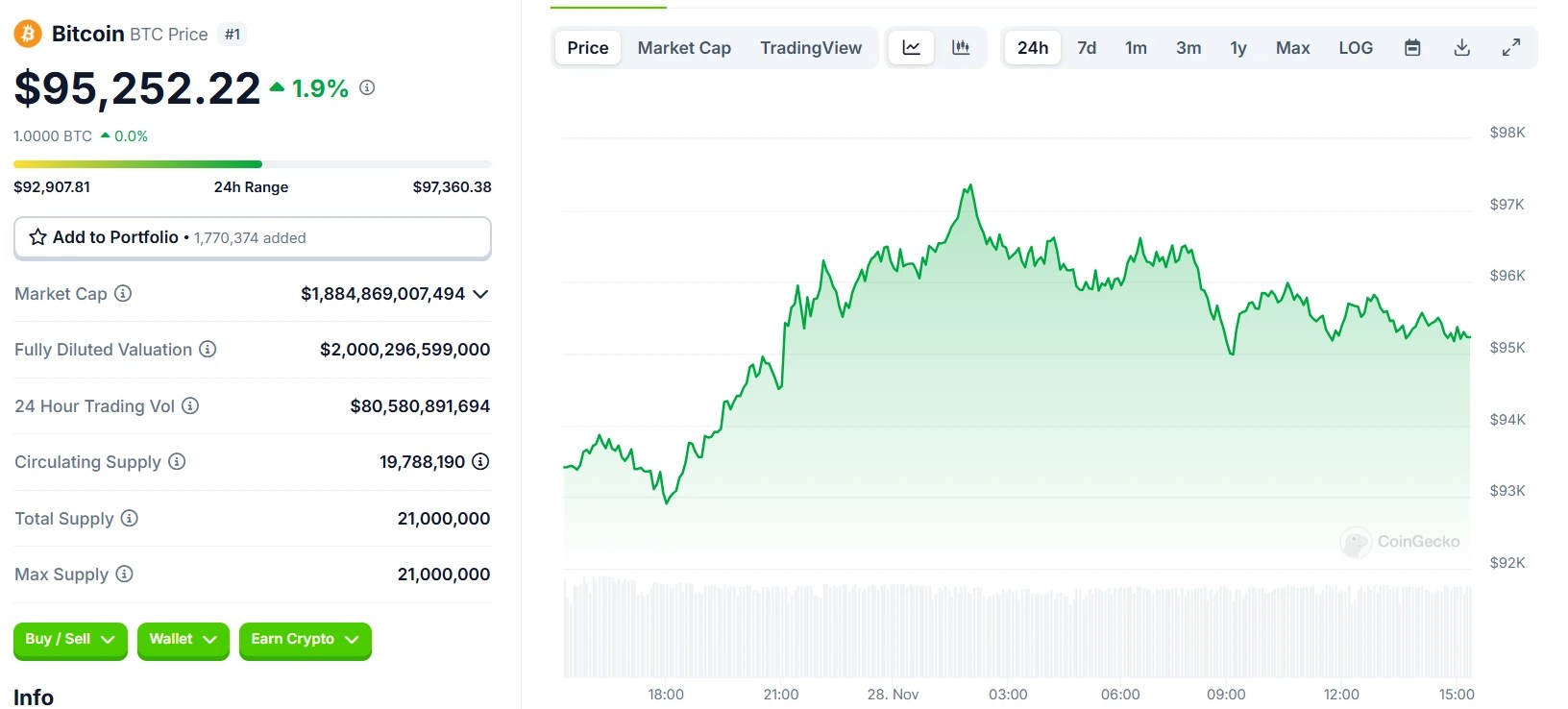

The acquisition raises questions about Bitcoin’s next moves in the market. With BTC currently trading around $95,406, analyst are closely watching whether it can break through key resistance levels at $96,000. Institutional investments such as those made by the company, often signal confidence in Bitcoin’s long-term prospects, potentially driving price momentum.

At press time, the BTC token price stands at $95,252.22 with a surge of 1.9% in the last 24 hours.

MARA’s strategic acquisition not only strengthen its position within the crypto industry but also indicates the growing acceptance of Bitcoin as a mainstream asset. As more institutions follow this move, the question remains: will Bitcoin surge past current resistance and continues its upward trajectory?

Also Read: SlowMist Detects Suspicious Activity in JUMPFUN Project

Source: https://www.cryptonewsz.com/mara-acquires-btc-will-btc-break-resistance/