A recent US Treasury report reveals that low-income families are increasingly using profits from crypto investments to secure mortgage loans for buying homes.

According to the report, in regions with higher crypto adoption, mortgage rates among low-income households have surged by over 250%, with average mortgage balances rising from approximately $172,000 in 2020 to $443,000 in 2024.

US Treasury on Crypto Exposure and Household Financial Conditions:

The study, based on tax data, classified “high-crypto” zip codes as areas where more than 6% of households reported crypto-related tax events. These areas experienced significant growth in both mortgage and auto loan originations and balances, signaling broader financial impacts. However, researchers noted that many low-income families in these regions carry mortgage debt-to-income ratios above recommended levels, raising concerns about potential financial instability.

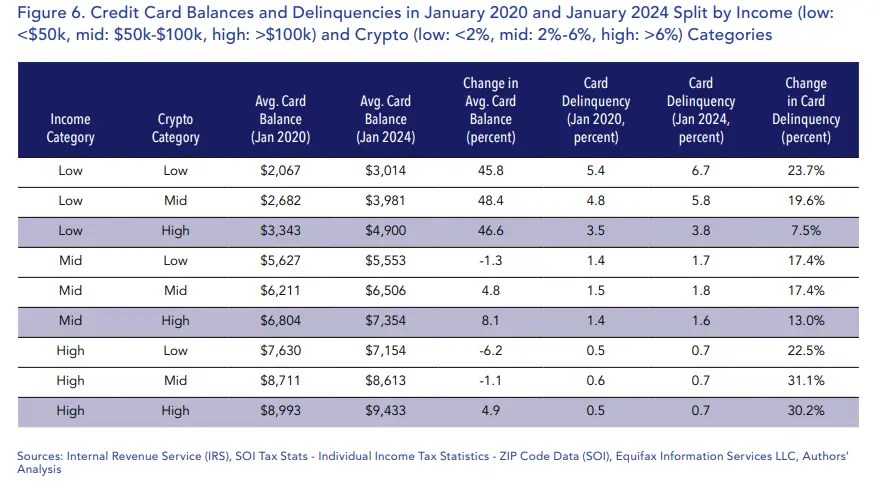

Despite these concerns, delinquency rates(ie., percentage of loans that are past due or in default) in high-crypto exposure areas remain low.

The US Treasury paper states, “The considerable increase in usage of crypto assets, the values of which are substantially more volatile than other asset classes, could present a financial stability risk if there are spillovers onto household balance sheets or sectors in the real economy.”

The report highlights that even if there is currently little evidence of financial distress, increased leverage among low-income households could pose risks if economic conditions deteriorate or if cryptocurrency markets experience a downturn.

The researchers concluded that monitoring this trend is crucial, as rising financial strain among leveraged crypto investors could affect systemically important institutions. The US Treasury paper suggests that future monitoring of the increased debt balances and leverage among low-income households with crypto exposure is necessary. Although the situation looks stable for now, future economic shifts could aggravate risks in these high-exposure areas.

Also Read: Japan’s FSA Proposes Lighter Regulations for Crypto Brokerages

Source: https://www.cryptonewsz.com/us-treasury-low-income-crypto-profits-buy-home/