- SUI set a new record with 298 million daily transactions.

- This came as an analyst predicted that SUI could trigger a “banana” rally.

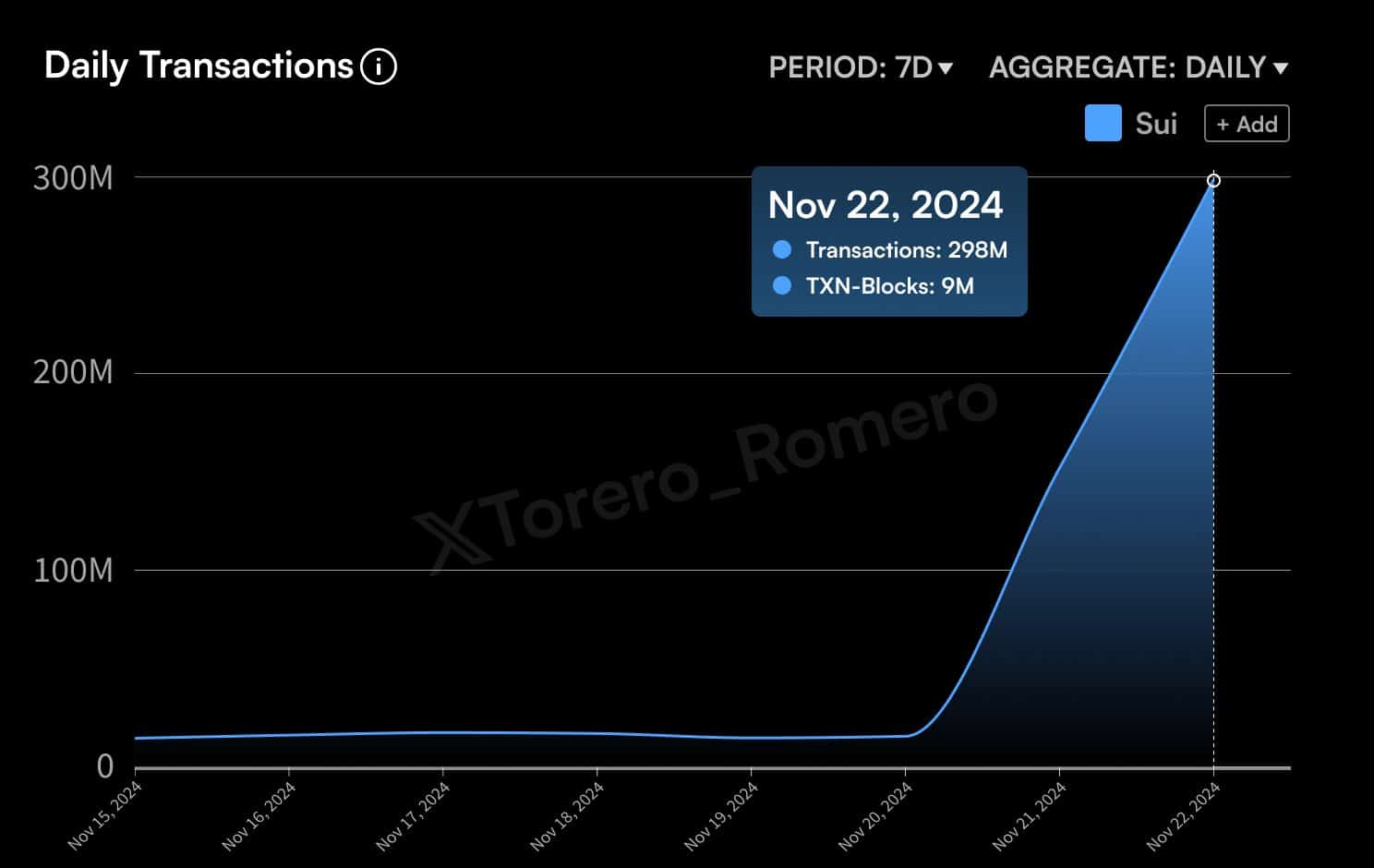

Sui [SUI] recently hit a groundbreaking milestone by processing an astonishing 298 million transactions in a single day.

This surge in activity has fueled growing speculation about the blockchain’s potential for future price growth, as the increasing adoption and utility of the token continue to gain momentum.

Adding to the excitement, renowned analyst Raoul Pal has sparked hope with his prediction that certain cryptocurrencies could soon experience what he describes as a “banana rally,” a sudden and dramatic rise in value.

The ripple effect of SUI’s record transactions

Source: X

On the 22nd of November, the blockchain processed an unprecedented 298 million daily transactions, far outpacing its previous activity levels.

This sharp uptick reflected heightened network utility, likely driven by increasing adoption across decentralized finance and gaming applications.

Notably, the network generated over 9 million blocks within the same period, proving its scalability.

Source: TradingView

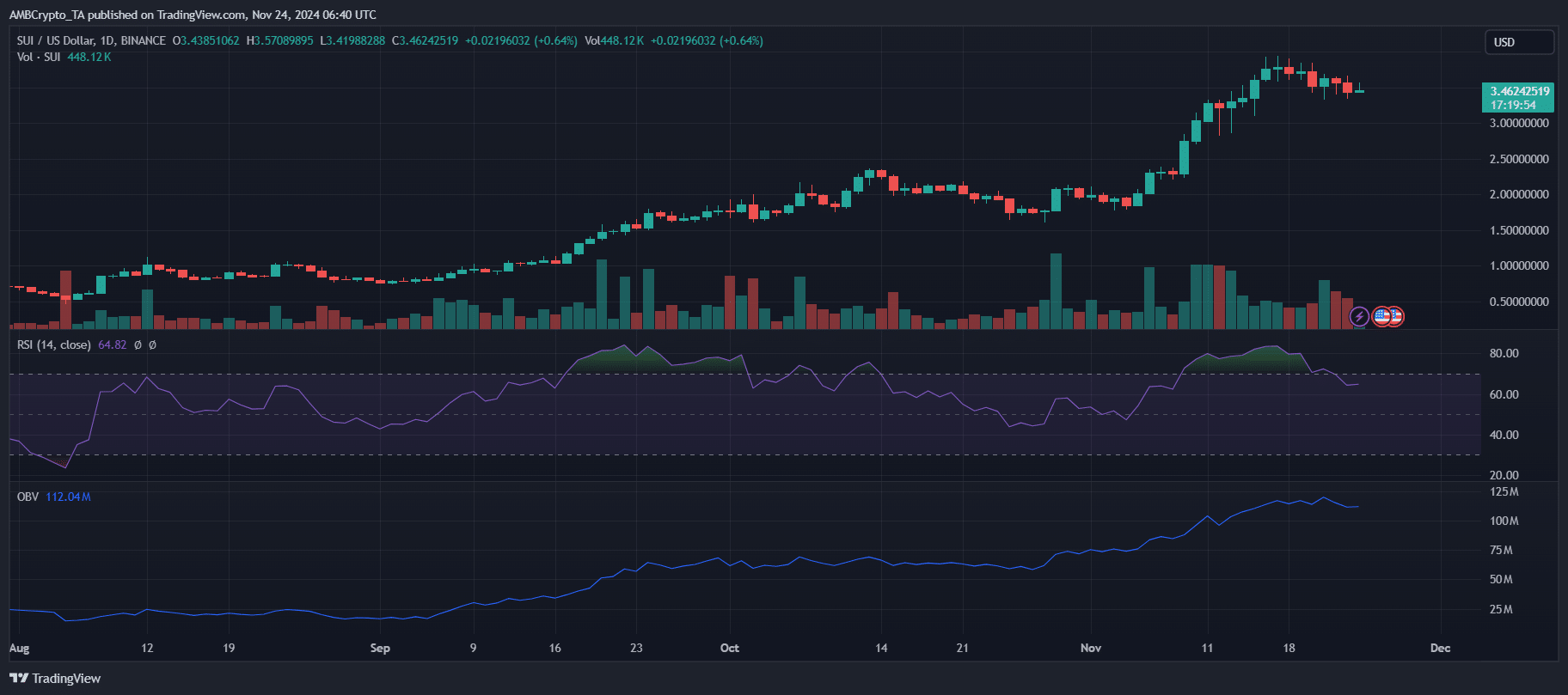

This activity surge correlated with the token’s robust price movement. Trading at $3.46 at press time, the token has climbed steadily, with an RSI of 64.7 signaling strong but not overbought momentum.

OBV trends indicate consistent accumulation, aligning with the transaction explosion.

This highlighted the symbiotic relationship between SUI’s price and its growing utility, as transaction volume acted as a critical driver of investor confidence.

With these figures, SUI’s ability to sustain high transaction throughput could solidify its position as a leader in next-generation blockchain ecosystems.

Is SUI poised for a banana rally?

This uptick in SUI’s performance comes as crypto analyst Raoul Pal spotlighted SUI as a frontrunner in what he dubs the “Great Banana Rotation,” predicting a meteoric rise alongside Dogecoin [DOGE].

Pal’s bullish sentiment is rooted in SUI’s explosive network growth, highlighted by its 298 million daily transactions’ milestone.

Such activity points to expanding use cases and widespread adoption, particularly in DeFi and gaming.

Investor sentiment around SUI also remained positive, bolstered by its consistent price performance and robust technical stability.

As a proof-of-stake blockchain, the token has demonstrated the scalability and efficiency needed to attract institutional interest, aligning with Pal’s criteria for tokens poised for exponential growth.

Additionally, market trends indicated an increasing appetite for high-throughput networks capable of supporting real-world applications.

With the cryptocurrency sector entering a renewed bullish phase, SUI’s unique value proposition could position it as a key player.

Can SUI sustain the momentum?

While the token’s remarkable growth is promising, sustaining this momentum presents challenges. High transaction volumes strain network infrastructure, necessitating continuous upgrades to prevent bottlenecks.

Additionally, the broader cryptocurrency market remains volatile, with macroeconomic factors capable of dampening bullish trends.

Investor confidence hinges on SUI’s ability to maintain scalability and real-world adoption.

Read Sui’s [SUI] Price Prediction 2024–2025

Competition from other high-performance blockchains, such as Solana [SOL] and Ethereum [ETH], further adds pressure.

For SUI to solidify its position in the long term, consistent network upgrades, developer engagement, and ecosystem expansion will be critical.

Source: https://ambcrypto.com/sui-in-the-spotlight-from-3-46-to-banana-rally-whats-next/