- SOL Global Investments plans to raise $2.5M to buy more Solana tokens.

- The fund’s share surged over 850% as SOL rallied from $138 to $248.

SOL Global Investments, a Canadian-based fund focused on Solana [SOL] and its tech ecosystem, plans to raise C$3.6 million (about $2.5M) to buy more SOL tokens.

The fund aims to raise capital through stock issuance (common shares), a similar playbook used by MicroStrategy, which uses debt and shares to buy Bitcoin [BTC] to boost its MSTR’s stock.

However, unlike MicroStrategy, the fund generates yield for its shareholders through SOL staking and price appreciation.

But has the fund’s share (SOL) benefited from Solana’s rally like MSTR has rallied from BTC’s new all-time highs?

SOL Global Investments share

Source: SOL vs. Sol Global performance, TradingView

The latest plan comes just two days after it bought $2M SOL (8,123 tokens) on the 18th of November.

Interestingly, the fund’s bet appeared to be paying out on the fund’s share price. Its share (SOL) has surged to new highs as Solana climbed higher since October.

On a year-to-date (YTD) basis, its share soared 73%, compared to SOL’s nearly 300% gains. The share’s correlation with Solana price intensified from October after decoupling at the beginning of Q4 2024.

Since October lows, the fund’s share price surged from $0.02 to nearly $0.2, an over 850% upswing in a few weeks.

Over the same period, SOL jumped from 82%, from $138 to over $248. Given the positive sensitivity to Solana’s price, the fund’s share could witness more windfall if the SOL climbs higher on the charts.

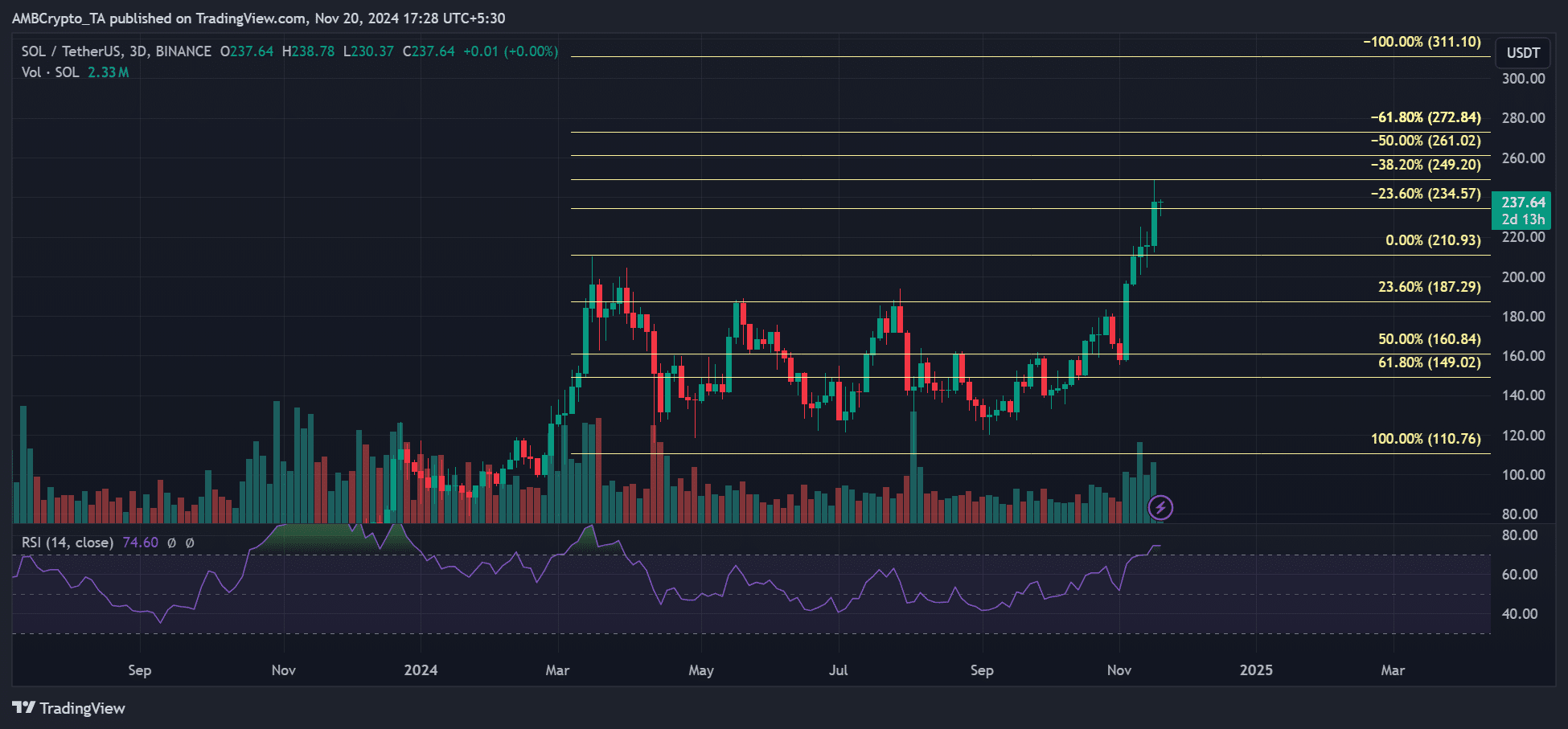

At press time, SOL was valued at $237 and could eye $250 and $260 levels.

Source: SOL/USDT, TradingView

Source: https://ambcrypto.com/canadian-firm-sol-global-investments-fund-eyes-2-5m-to-buy-more-solana/