- Bitcoin hunting down any long entries but it still may not be too late.

- Demand for crypto in US rising as MSTR makes a record BTC purchase.

Bitcoin [BTC] long positions entered during current uptrend are swiftly being “hunted” down, leading to abrupt exits while the prices continues to rally.

This repeated pattern indicated a volatile trading environment where long positions are quickly targeted for liquidation particularly after Bitcoin hit the $90K level.

The ongoing cycle of long entries followed by swift downturns suggested that traders attempting to capitalize on the uptrend are facing significant risks.

Source: Hyblock Capital

This trading behavior prompts the question: with such aggressive targeting of long positions, is it currently too late, or still feasible, to consider going long on Bitcoin without facing immediate setbacks?

Bitcoin SOPR for STH

Analyses of the Short-Term Holders’ SOPR (STH SOPR) suggested a balanced market sentiment.

Currently positioned midway between the extremes of greed and fear, the SOPR indicated there was still potential for further price increases without the immediate risk of a major correction.

The analysis, supported by the 30DMA, showed that while STHs were indeed taking profits, their actions were not indicative of market euphoria.

Historically, once the SOPR ventures into ‘extreme greed’, it typically presages a pullback as the market becomes overheated.

Source: CryptoQuant

Conversely, the ‘extreme fear’ zones have traditionally been where significant market lows form, offering prime buying opportunities.

The current moderate reading suggested a period of steady growth and cautious optimism among traders. A swift move towards the greed end could signal the need for strategic profit-taking to preempt a downturn.

The period offered an opportunity for strategic investments, with a balanced approach being crucial to navigating the ongoing volatility and capitalizing on the uptrend.

Rising demand and MSTR’s record purchase

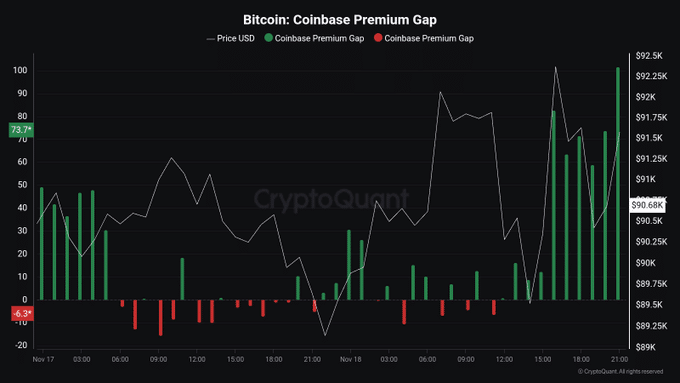

Post-elections in the US continued to spark uptick in Bitcoin demand, as indicated by the surging Coinbase Premium Index. This gauge reflected a heightened buying fervor among US traders, sustaining the current bull run.

The data from the past days showed significant premiums, with the index hitting peaks concurrently with Bitcoin’s price pushing towards $92,000.

This trend indicated optimism and the potential for further upside, suggesting that entering long positions now could still be opportune.

Additionally, institutions continued to buy with Michael Saylor announcing that they could raise $42 Billion to buy Bitcoin “much before” the 3 year plan for MicroStrategy.

Read Bitcoin (BTC) Price Prediction 2024-25

MSTR has already bought 66% of next year’s $10 Billion target in just 10 days.

The rise in demand and MSTR’s continued buying that have announced another proposal to buy BTC shows that it is still not late to buy BTC for the long-term run.

Source: https://ambcrypto.com/is-it-too-late-to-go-long-on-bitcoin-market-insights-amid-rising-demand/