TLDR

- Nasdaq plans to launch Bitcoin ETF Options trading, starting with BlackRock’s BTC ETF

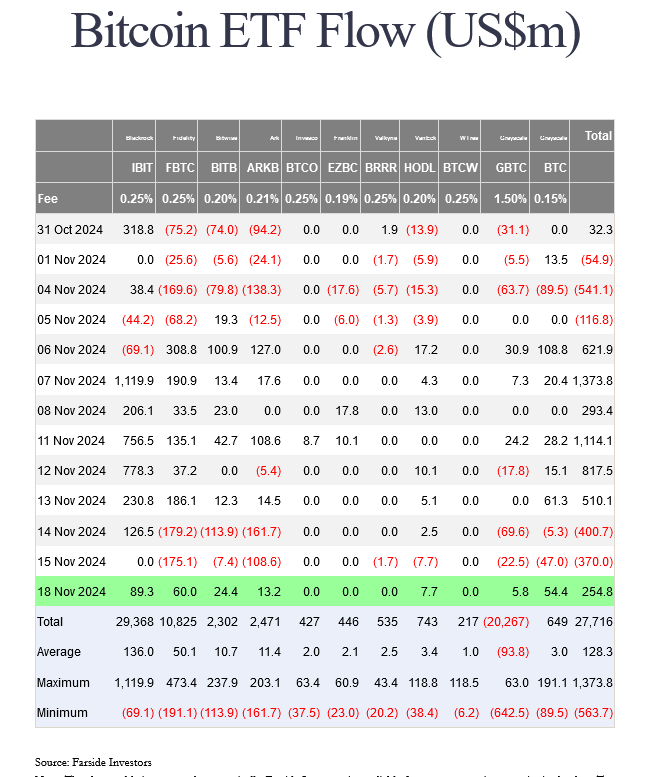

- US Spot Bitcoin ETF saw $254.8M inflow on November 18

- BTC currently trading around $91,800 with 34% monthly gain

- BCA Research predicts Bitcoin could reach $200K

- Multiple analysts including Tom Lee expect continued BTC rally

Nasdaq Inc. has announced the launch of options trading for BlackRock’s Bitcoin ETF, marking another milestone in cryptocurrency’s integration into traditional financial markets.

The move comes as Bitcoin trades near $91,800 and follows recent approval from the U.S. Commodity and Futures Trading Commission (CFTC).

The new options trading capability allows investors to place derivative bets on BlackRock’s Bitcoin ETF, providing additional tools for market participants to manage their cryptocurrency exposure.

Nasdaq ETP Listings head Alison Hennessy confirmed the launch, expressing optimism about trader interest in these new investment vehicles.

Market data shows strong momentum in the broader Bitcoin ETF space. According to Farside Investors, U.S. Spot Bitcoin ETF recorded an inflow of $254.8 million on November 18, rebounding from two days of outflows in the previous week. This surge in investment suggests growing institutional confidence in cryptocurrency products.

The timing of the options launch coincides with robust performance in the cryptocurrency market. Bitcoin’s current price of $91,800 represents a monthly gain of 34%, while daily trading volume has jumped 52% to $73.59 billion. The cryptocurrency reached a 24-hour peak of $92,596 during recent trading sessions.

Market indicators point to sustained investor interest, with Bitcoin Futures Open Interest rising more than 1.5% during the reporting period. This metric typically suggests active market participation and trader confidence in future price movements.

Research firms have issued bullish forecasts following these developments. BCA Research projects Bitcoin could reach $200,000 as the cryptocurrency approaches the $100,000 milestone. Their analysis factors in increased institutional adoption and expanding investment options.

Crypto market expert Ali Martinez has shared analysis based on historical price patterns. According to Martinez’s research of previous market cycles, Bitcoin shows potential to reach $150,000 in upcoming trading periods. This assessment aligns with other market observers who anticipate continued upward momentum.

#Bitcoin is mirroring the behavior of the last two bull cycles!

After surpassing its previous all-time high, $BTC has been consolidating for a week. If history repeats, we could see another breakout in the next day or two, targeting ~$150,000, followed by a ~30% correction. pic.twitter.com/EQlX62BSdE

— Ali (@ali_charts) November 19, 2024

Another market analyst, Crypto Rover, has published technical analysis suggesting Bitcoin could exceed $200,000. These projections have gained attention from mainstream financial analysts, including Fundstrat’s Head of Research Tom Lee, who maintains a positive outlook on Bitcoin’s price trajectory.

The launch of Bitcoin ETF options follows Donald Trump’s election victory, which some market participants view as potentially favorable for cryptocurrency regulations. Traders have noted increased market activity amid expectations of clearer regulatory frameworks for digital assets.

Trading volume metrics underscore market engagement with Bitcoin investment products. The combination of spot ETF inflows and growing futures open interest suggests broad-based participation across different investor categories.

Nasdaq’s move to list Bitcoin ETF options builds on the foundation established by spot Bitcoin ETFs. These investment products have attracted substantial capital since their introduction, indicating demand for regulated cryptocurrency exposure.

Market data shows the Bitcoin ETF sector maintaining steady growth despite occasional volatility. Trading patterns indicate active participation from both institutional and retail investors as new investment tools become available.

The CFTC’s approval of Bitcoin ETF options trading reflects evolving regulatory comfort with cryptocurrency investment products. This regulatory milestone enables traditional financial institutions to offer more sophisticated trading strategies to their clients.

Price stability in the underlying Bitcoin market has accompanied the launch of these new investment vehicles. Recent trading sessions show consistent volume and price action above $90,000.

Technical indicators and market metrics continue to show strong fundamentals for Bitcoin trading. The latest data indicates sustained trading volume and growing open interest across various cryptocurrency investment products.

Source: https://blockonomi.com/bitcoin-etf-options-begin-trading-as-btc-holds-above-90000/