Bitcoin Crash: The BTC price has been on the investors’ radar lately, especially as the crypto has noted a retreat today. This dip comes as the crypto has recently touched its ATH crossing the $93,000 mark this week. Now, as investors seek clarity on the potential factors that might have triggered the recent pullback, we explore some of the top reasons behind the BTC slump.

Bitcoin Price Crash: Why Is The Crypto Falling Today?

There could be a flurry of reasons that may have contributed to the recent Bitcoin price dip. The investors might be staying on the sideline after several macroeconomic events and current market trends have weighed on the sentiments.

US CPI And PPI Inflation Figures Weights On Sentiment

The current US inflation data shows a spike in the prices, sparking concerns among investors over a potential hawkish move by the Federal Reserve ahead. Notably, the US CPI inflation earlier this week came in at 2.6%, marking its first increase in the last eight months.

Simultaneously, the US PPI inflation figures yesterday came in at 2.4%, exceeding the market forecast and up from the 1.9% reading noted in September. Although the Bitcoin price initially rallied despite the hotter-than-anticipated inflation figures, it appears that the investors are now keeping a distance.

These set of inflation data are closely viewed by the US Federal Reserve to decide their monetary policy plans. Given the recent spike in inflationary pressures, global investors are now eyeing the potential move by the central bank at their December gathering.

BTC Price Slips As Bitcoin Miners’ Selling Spree Continues

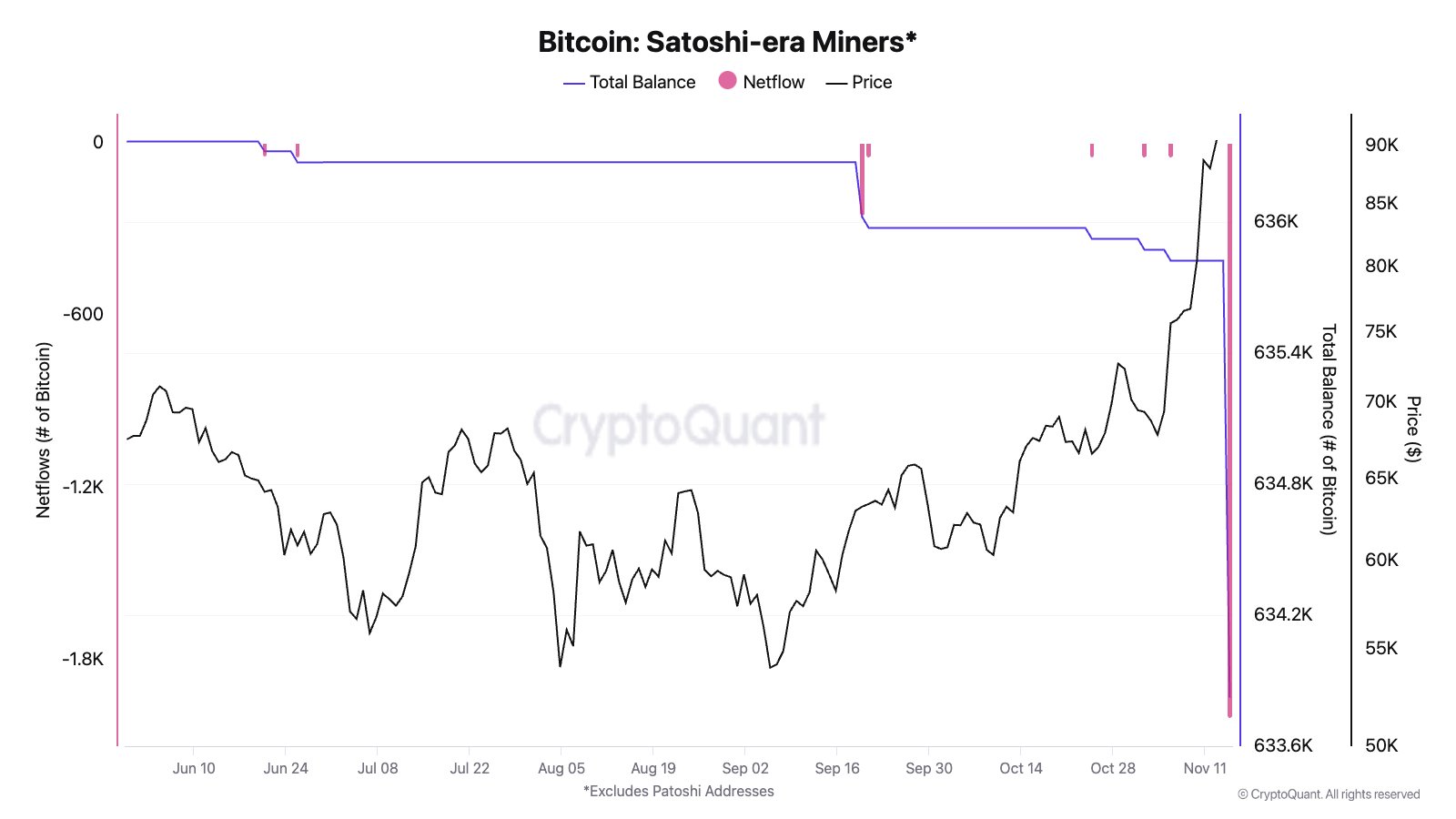

The Bitcoin miners continue to sell their holdings, weighing on the broader market sentiment. It could be one of the top reasons behind the recent BTC price dip. According to CryptoQuant Head of Research Julio Moreno, a Satoshi-era miner has offloaded 2K BTC recently.

According to Moreno, the coins were mined in 2010 and the miner has never moved them. However, as the price soars to new highs now, some of those Bitcoins were moved to exchanges. Besides, another recent report showed that the BTC miners also moved 25,000 BTC yesterday, which has also contributed to the bearish sentiment noted currently.

Bitcoin ETF Outflow Signals At Muted Market Interest

The US Spot Bitcoin ETF has noted robust inflow over the last few days, sparking market optimism. However, on November 14, the investment instruments noted an outflow of $400.7 million, ending its six-day inflow streak, Farside Investors data showed.

Although BlackRock Bitcoin ETF (IBIT) has noted an influx of $126.5 million, others like Fidelity’s FBTC, and Ark Invests (ARKB) have contributed to the outflow. However, despite the latest outflow, the overall inflow to the US Spot Bitcoin ETF recorded was $27.8 billion to date since its launch on January 10.

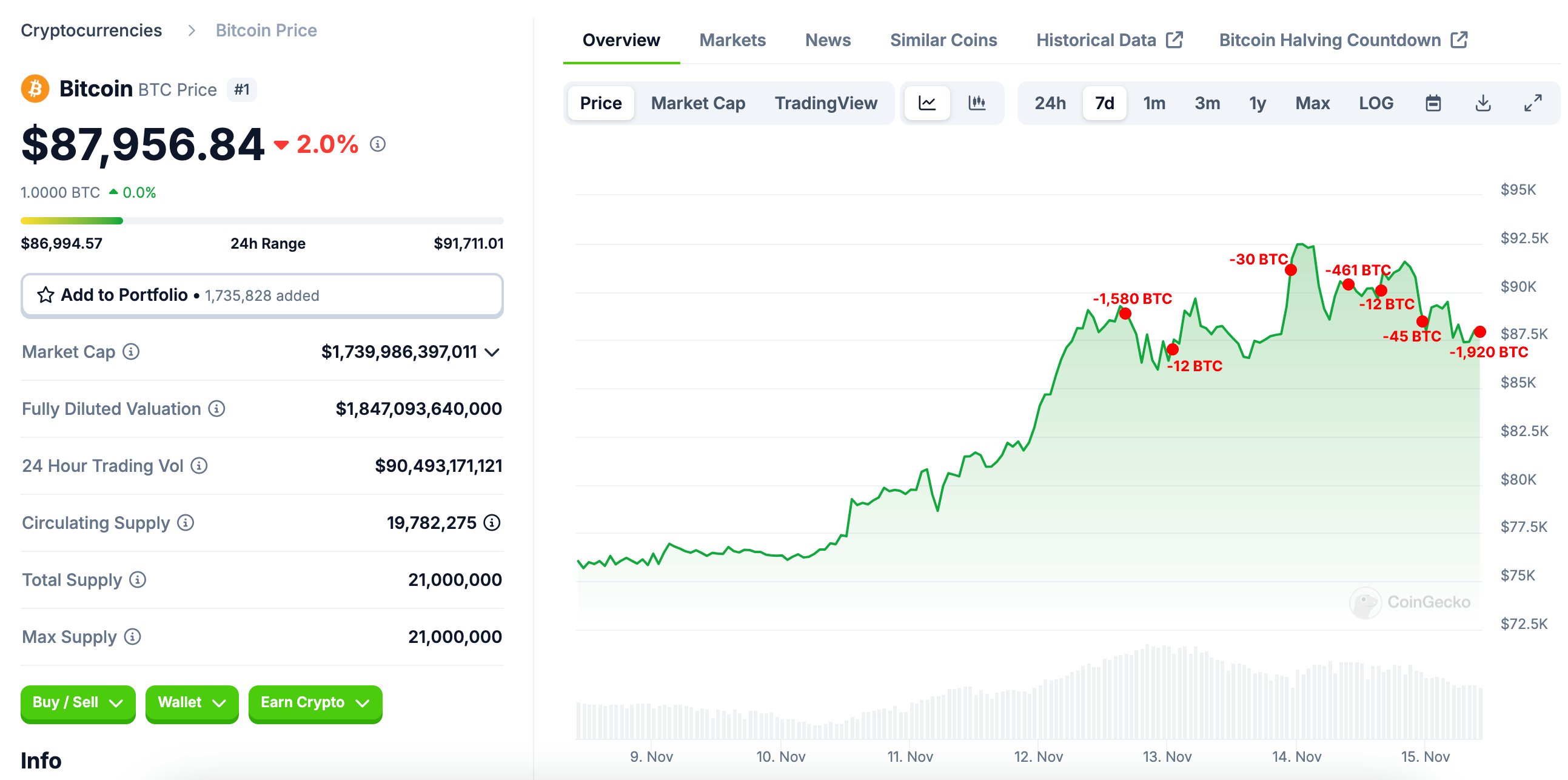

Profit-Booking Opportunity and Whale Dump

As the Bitcoin price rose to its new ATH recently, many investors appear to be taking the opportunity to book profits. For context, according to the latest report by Lookonchain, a whale has offloaded 1,920 BTC, worth around $169 million, to Binance recently. Over the last three days, the whale has dumped a total of 4,060 BTC, valued at around $361 million, to the same leading crypto exchange.

These massive dumps signal that the investors might be booking profits amid the recent price surge. Considering that, the investors are growing concerned that if the selloff continues, it could further weigh on the Bitcoin price, potentially triggering further dip ahead.

Historical Trends Signals At Bitcoin Price Pullback

Despite the recent Bitcoin crash, many analysts remained optimistic about Bitcoin price’s long-term trajectory. For context, the historical data indicates that BTC often faces a slight pullback during the bull run, before continuing its rally to new highs.

Considering that many see the current dip as the normal moving pattern of the crypto while remaining bullish on the long-term trajectory of the crypto. According to prominent market expert Rekt Capital, the Bitcoin dips amid the bull run will offer more opportunities for investors to buy at lower prices. Considering that, the current dip appears to boost the BTC prices further in the coming days.

Will Bitcoin Price Crash Continue?

The BTC price today was down nearly 4% during writing, and exchanged hands at $87,508, while its trading volume also slipped 27% to $85 billion. Notably, the crypto has touched a 24-hour high of $91,765, after touching its ATH of $93,434 on November 13. Furthermore, Bitcoin Futures’ Open Interest fell more than 3%, indicating a muted interest from the market participants.

In addition, in a recent X post, Ali Martinez said that $5.42 billion in Bitcoin profits had been realized as the price surged earlier. This also put the sell-side risk ratio to 0.524%, highlighting caution for the investors.

Also, the Bitcoin RSI was at 74 during writing, indicating that the crypto is currently in an overbought condition. However, despite the short-term concerns and the recent pullback in Bitcoin price, many in the community remain bullish on the long-term trajectory of the crypto. For context, Peter Brandt has recently said that BTC is poised to hit $327K in the coming days.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/bitcoin-price-crash-heres-why-btc-price-is-falling-today/

✓ Share: