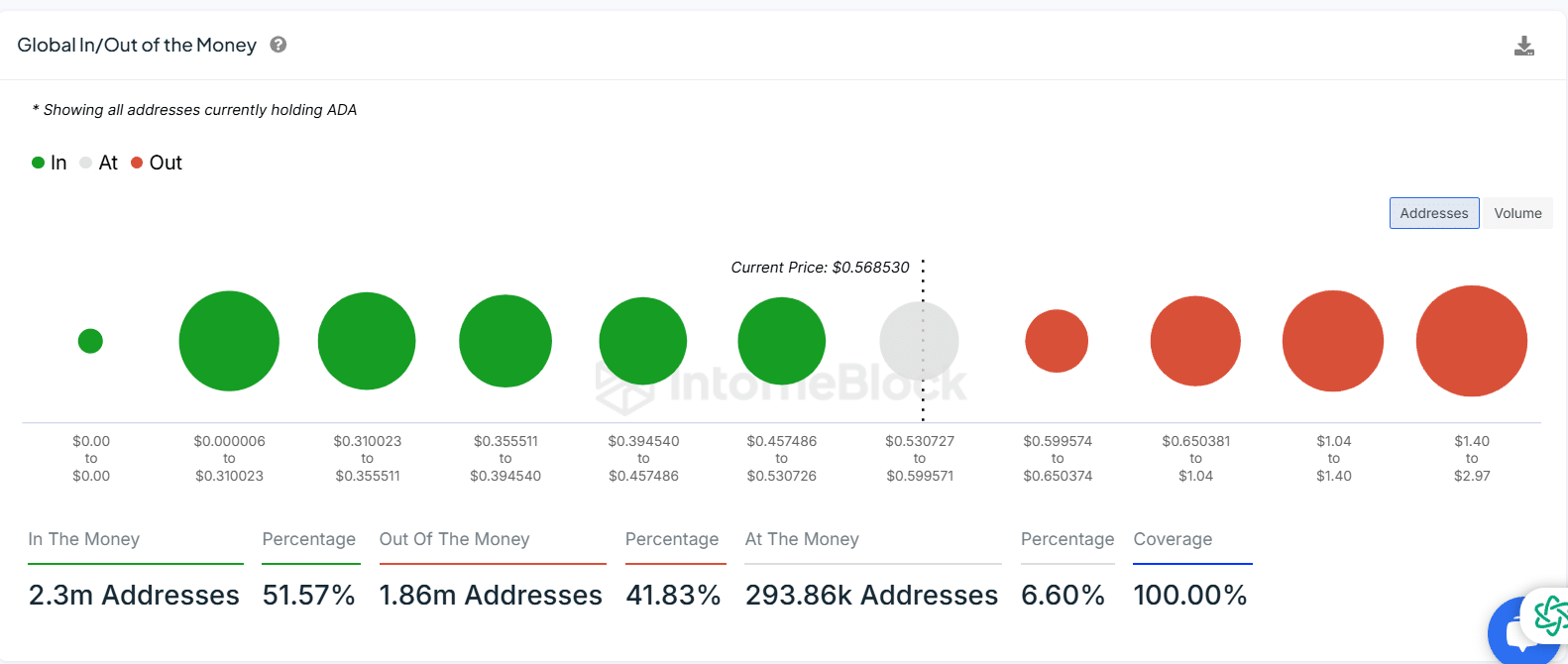

- In/Out of Money data revealed $0.2 and $1.99 as key ADA price levels.

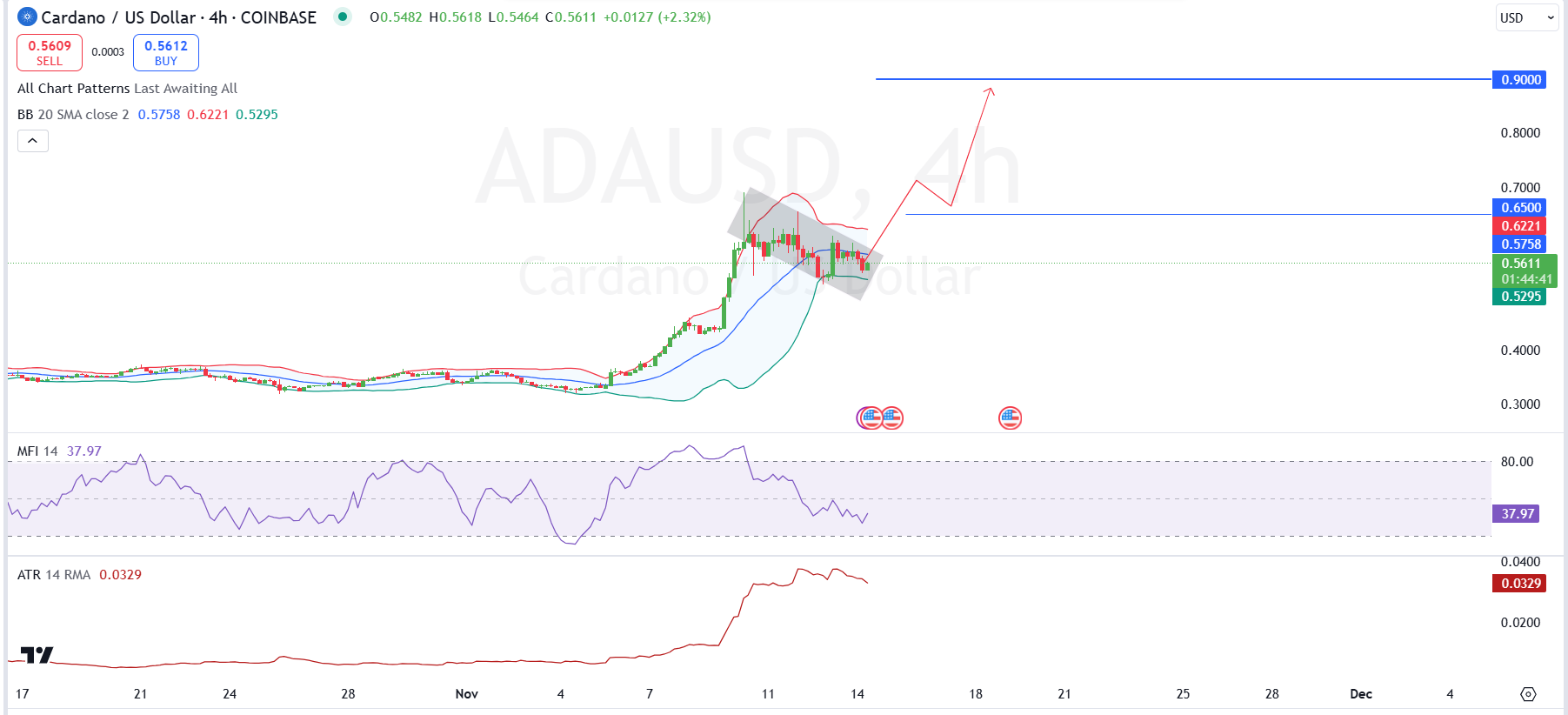

- Tightening Bollinger Bands shows ADA is gearing up for a breakout.

Cardano [ADA] has been on a winning streak in recent weeks, with its value climbing by 42% over the past seven days to reach $0.50, a price last seen in April.

As of 14th November, ADA was trading at $0.55, showing a slight 4.07% dip over the past 24 hours. Cardano recently reclaimed its spot in the top 10 cryptocurrencies, surpassing Tron in market capitalization.

Is Cardano consolidation a buildup for breakout?

Cardano was trading within a consolidation phase after a strong rally, moving in a narrow range at press time with slight bullish undertones.

The Bollinger Bands on this 4-hour chart showed a tight squeeze, suggesting that ADA might be preparing for a breakout. The upper boundary of the channel around $0.65 serves as the next resistance, with a longer-term target marked near $0.90.

Supporting indicators add to the optimism. The Money Flow Index sits at 37.97, indicating there’s still room for upward movement without approaching overbought conditions.

Meanwhile, the Average True Range shows decreasing volatility, which may signal that a sharp movement is approaching.

Source: Tradingview

If ADA breaks above the $0.65 resistance, it could initiate a new leg-up, with traders eyeing $0.90 as the next significant target.

On-Chain data shows $0.2 and $1.99 as key levels

An analysis conducted by AmbCrypto reveals two important price levels for Cardano that could impact market activity significantly.

At the $0.2 level, around 540,000 addresses holding ADA would be “Out of the Money,” meaning they’d be facing losses. If ADA’s price drops to this threshold, many holders may decide to sell, leading to increased liquidation pressure that could push prices even lower.

Source: IntoTheBlock

Conversely, at the $1.99 level, about 726,000 addresses would move into profitability, shifting from “Out of the Money” to “In the Money.”

If ADA’s price reaches $1.99, we could see a wave of profit-taking from these holders, which might create resistance and slow further price gains as many choose to cash out.

These two levels, $0.2 as a possible support with a high risk of sell-offs and $1.99 as a strong resistance with profit-taking pressure, are crucial for ADA’s market outlook.

Price movements toward either level could significantly impact liquidity and volatility, making them key points to watch.

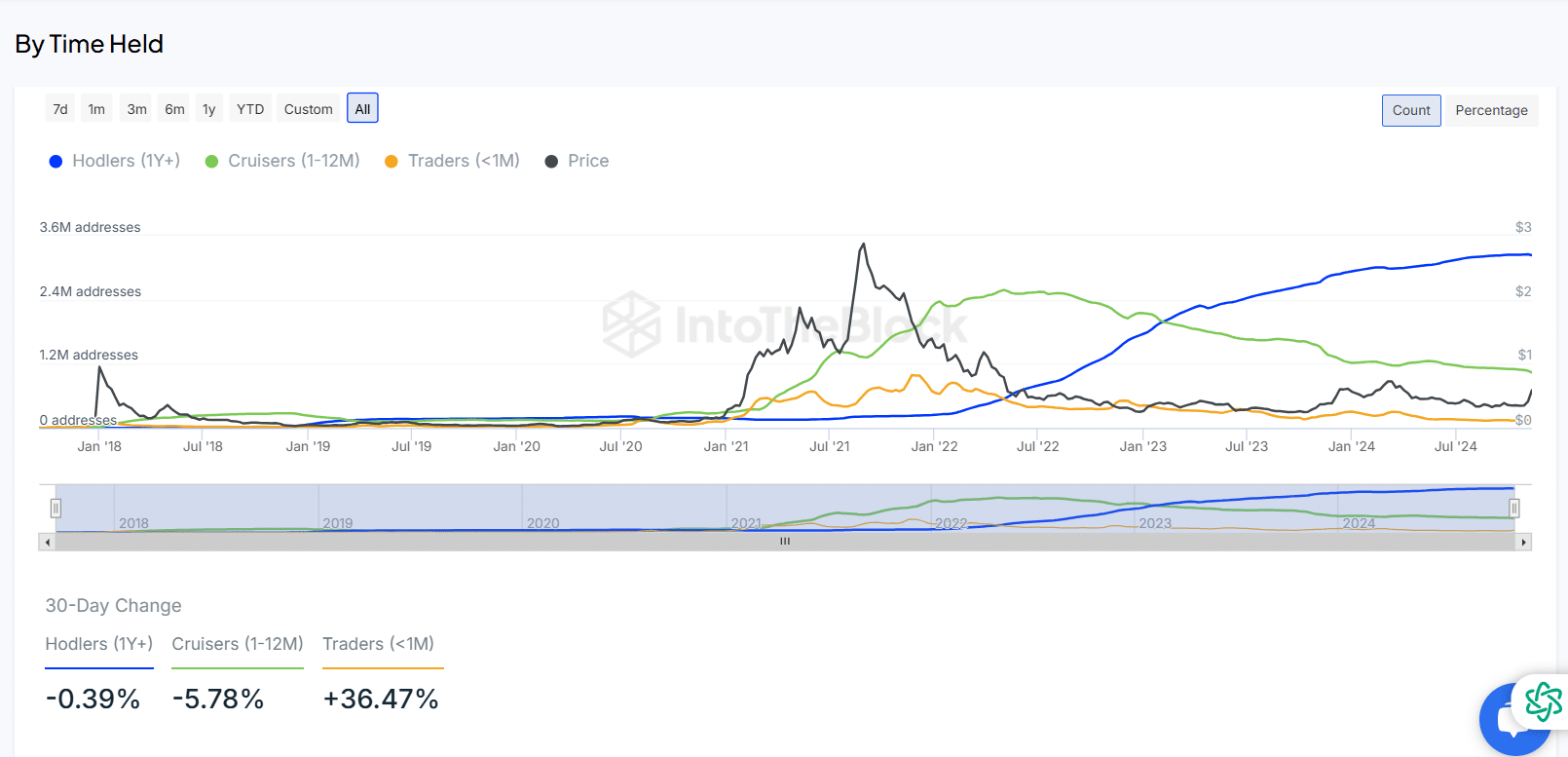

ADA holder trends: 5.78% drop in cruisers, 36.47% rise in traders

Analysis of the IntoTheBlock data provides a breakdown of Cardano addresses by holding time, highlighting key trends in holder composition.

Overall, the number of long-term holders (1 year or more), represented by the blue line, has been steadily increasing, suggesting growing confidence and commitment among ADA investors.

This group has consistently held ADA over the years, reflecting a strong belief in the asset’s future potential.

Meanwhile, the cruisers (1–12 months), indicated by the green line, have shown a recent decline of 5.78% over the past 30 days. This suggests that mid-term holders may be either cashing out or moving to a shorter holding period, possibly taking profits or reassessing positions amidst market shifts.

Source: IntoTheBlock

The traders (less than 1 month), represented by the orange line, have surged by 36.47% over the last 30 days.

Realistic or not, here’s ADA’s market cap in BTC terms

This increase reflects heightened trading activity and short-term interest in ADA, likely driven by recent price movements or speculative trends.

The general trend shows Cardano’s holder base shifting slightly, with long-term holders remaining stable while short-term traders increase, adding a layer of short-term activity to ADA’s market dynamics.

Source: https://ambcrypto.com/cardanos-accumulation-phase-is-0-90-within-reach-now/