- Bullish sentiment and strong technical indicators suggested an ongoing upward trend for Solana.

- Despite a dip in social volume, balanced long/short ratios and technical strength showed more gains.

Solana [SOL] was experiencing strong bullish sentiment from both crowd and smart money at press time, with crowd sentiment sitting at 0.51 and smart money sentiment notably higher at 3.94, per Market Prophit.

This dual optimism suggested increasing confidence in SOL’s potential for upward movement.

At press time, SOL was trading at $218.01, reflecting a 4.93% gain in the last 24 hours. But with all eyes on its recent price surge, the question arises: can this momentum persist?

SOL’s technical outlook reveals strength

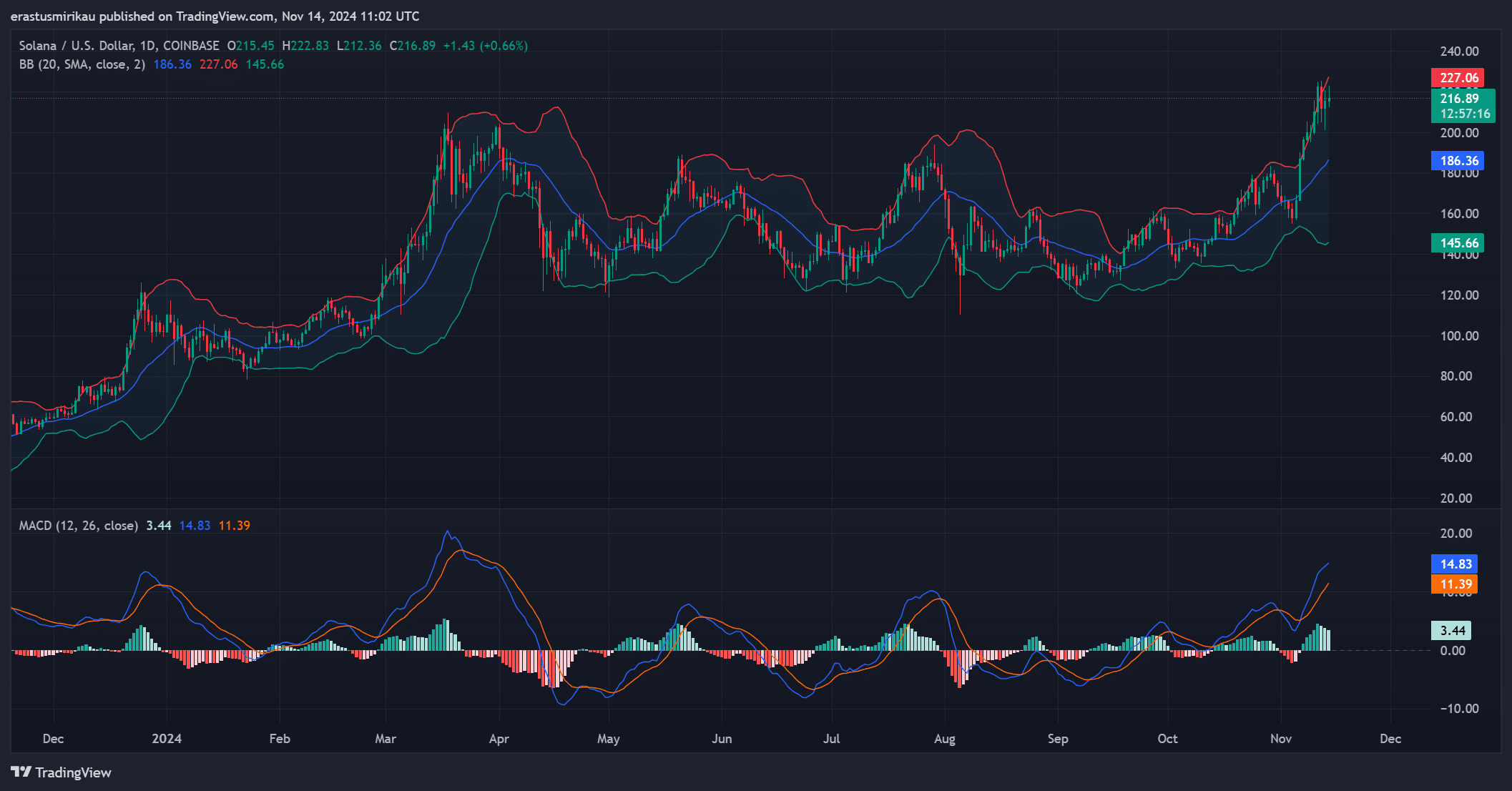

On the technical front, SOL’s indicators painted a promising picture. The Bollinger Bands showed that SOL was trading close to the upper band at $227.06, suggesting a strong upward push.

This positioning near the upper boundary indicated a period of increased volatility and hinted at potential further gains if the momentum holds.

Additionally, the MACD (Moving Average Convergence Divergence) registered at 3.44 at press time, with its histogram and signal line showing a bullish crossover.

This development underscores a building positive momentum, aligning with the overall bullish sentiment.

If SOL maintains its position near the top Bollinger Band, it could drive a fresh wave of buying interest, propelling prices even higher.

Source: TradingView

Cooling interest or consolidation phase?

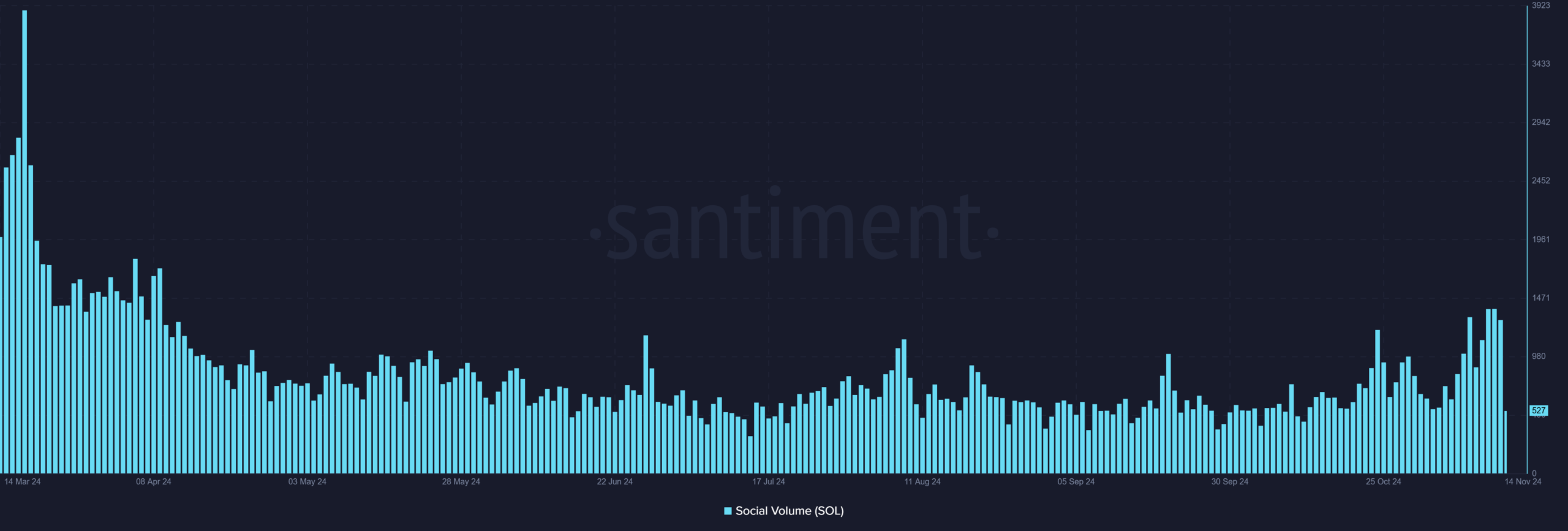

Despite this bullish momentum, SOL’s social volume has seen a notable drop, decreasing from 1,289 the previous day to 527.

This dip in social engagement may signal a cooling of interest, potentially indicating that some retail traders are pausing as they watch for SOL’s next moves.

However, this decline in social volume does not necessarily counteract the strong technical setup and bullish sentiment indicators.

If SOL continues to rally, social volume may quickly rebound, bringing renewed community interest and engagement.

Source: Santiment

Cautious optimism

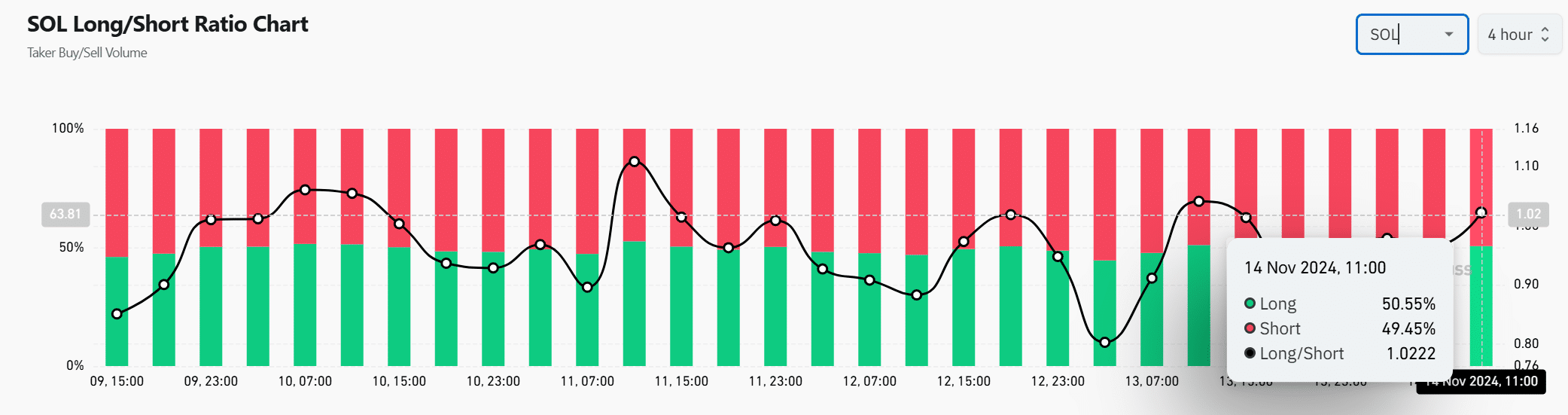

The long/short ratio for Solana stood at 1.0222, with 50.55% of positions being long and 49.45% short.

This slight tilt toward longs suggested that more traders were betting on a price increase, yet the balance was close enough to reflect cautious optimism.

Consequently, while traders expected SOL’s price to rise, they were also prepared for possible resistance.

Source: Coinglass

Read Solana’s [SOL] Price Prediction 2024–2025

SOL is primed for further gains

Solana’s bullish sentiment from both crowd and smart money, combined with its strong technical indicators, positions it well for continued upward movement.

Although social volume has dipped, Solana’s price momentum and balanced long/short ratio suggest the potential for further gains.

Source: https://ambcrypto.com/solana-nears-220-will-bullish-sentiment-drive-sol-even-higher/