Ripple has fought a long battle with the government; however, in the wake of Donald Trump being elected as the 47th president of the USA, the crypto market is finally hopeful for changes. However, according to recent data from Crypto Quant, market indicators showcase major developments in XRP’s trading action.

Ripple’s metrics point towards substantial outflows from exchanges, increased activity from XRP whales, and shifts in market sentiment. CryptoQuant data, along with recent technical indicators, paints an interesting picture that could influence XRP’s price movements and the overall health of the market.

Ripple Outflows Surge:

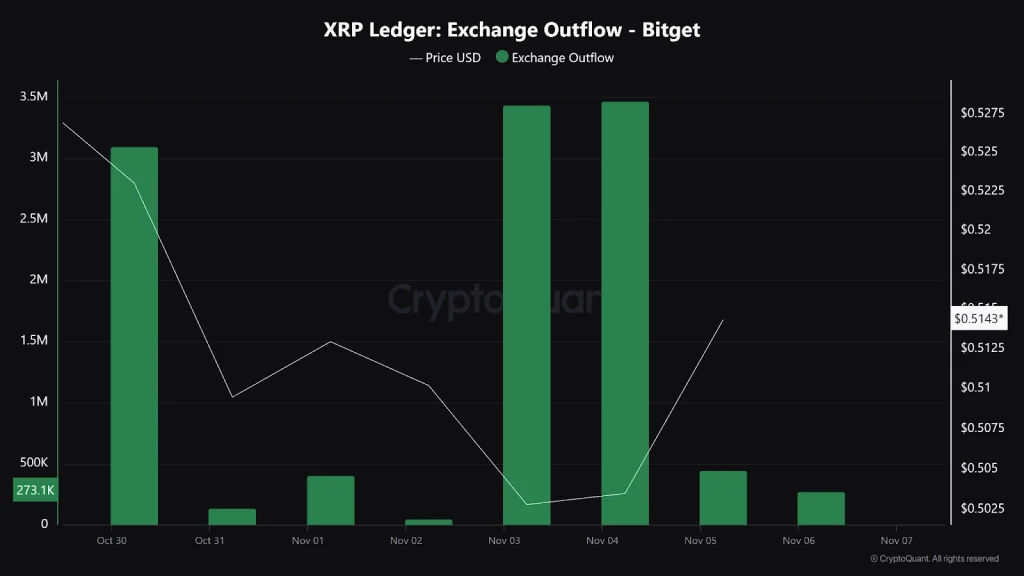

The past week, Ripple’s analysis revealed a significant increase in withdrawals from major exchanges like Binance, Bidget, OKX, and Bitfinex. For instance, Bynans saw nearly 900 million XRP leave its platform on October 30th, with another notable spike on November 4th, the day before the US elections.

OKX also reported a similar trend, with 390 million XRP withdrawn on November 5th; both Bidget and Bitfinex also noted large outflows during this time. This likely points to whales taking XRP off exchanges, a move typically linked to long-term holding or part of an accumulation strategy.

When large amounts of cryptocurrency are withdrawn from exchanges it usually reduces selling pressure as the assets are kept in private wallets instead of being available for trade. If this pattern continues, it may create a supply shortage on exchanges which could drive prices higher if demand stays strong.

Long/Short Ratio And Market Sentiment

Looking at the long/short ratio can provide insights into how the market currently feels about Ripple. Recently the total long/short ratio for the token has been around 4.386, which indicates that there are significantly more long positions than short. This further confirms that many traders are feeling rather optimistic about Ripple and are anticipating a price increase soon.

However, a high long/short ratio also means there is a greater risk of liquidation in case the price happens to drop suddenly which could then result in a sharp market correction.

Cautiously Optimistic?

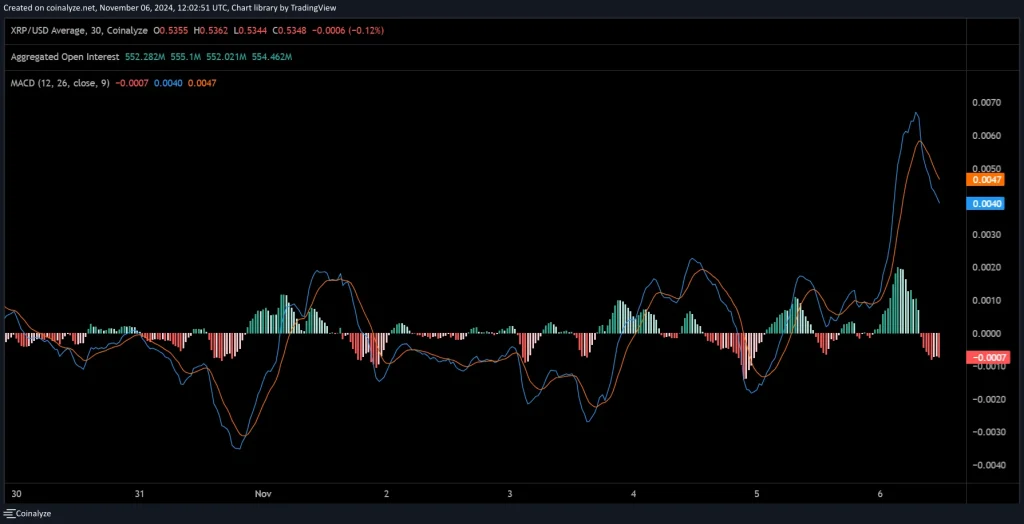

The open interest in Ripple, along with the MACD, supports the observation that XRP price is steadily making headway. Typically, a high open interest rate often reflects strong market interest and could point to possible volatility, especially if large positions are liquidated or adjusted in the market.

On the flip side, a sudden price drop might amplify volatility as leverage positions get unwound.

Further, in the MACD chart for XRP, investors can see positive movements. The MACD line has crossed above the signal line, suggesting a bullish trend, yet it is undeniable that there is also a hint of the trend weakening as the MACD histograms are starting to contract.

This indicates that the upward momentum is slowly weaning off, despite the current positive reflection of the trend. Investors might need to enforce caution and look for more evidence before implementing strategies.

Given the current price movement, Ripple, in the near term, seems to have a quite volatile outlook, and any potential optics will depend on how these technical and on-chain metrics take shape over the week.

Also Read: Joe Rogan, Trump, and the Free Speech Revolution in Decentralized Media

Source: https://www.cryptonewsz.com/ripple-outflow-exchange-surge-amid-whale-moves/