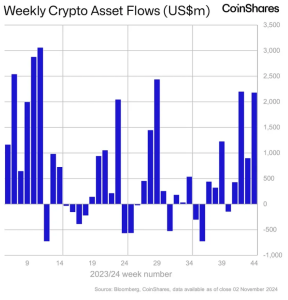

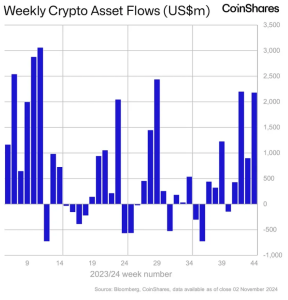

Digital Asset Investments See $2.2B Inflows Last Week, Totalling Record $29.2B Year-to-Date

In a landmark week for the cryptocurrency market, digital asset investment products experienced net inflows of $2.2 billion, pushing the year-to-date total to a record $29.2 billion. This surge in investments underscores the growing confidence and interest in digital assets among institutional and retail investors alike. James Butterfill, Head of Research at CoinShares, highlighted these figures in a recent Medium post, emphasizing the significant contributions from major cryptocurrencies and regional investment trends.

Introduction to the Record Inflows

Overview of the Investment Surge

Last week marked a pivotal moment for digital asset investments, with a substantial $2.2 billion flowing into various investment products. This influx not only sets a new weekly record but also propels the year-to-date (YTD) inflows to an unprecedented $29.2 billion. The surge is primarily driven by robust performance and increasing adoption of major cryptocurrencies, particularly Bitcoin (BTC).

Significance of the Record Inflows

Achieving a YTD total of $29.2 billion in digital asset investments signifies a strong and sustained interest in the cryptocurrency market. This milestone reflects the maturation of digital assets as a legitimate and attractive investment class, comparable to traditional financial instruments.

Detailed Breakdown of the Inflows

Bitcoin Leads with $2.156 Billion

Bitcoin continues to dominate the digital asset investment landscape, attracting a staggering $2.156 billion in inflows last week alone. As the flagship cryptocurrency, Bitcoin’s performance remains a key indicator of market sentiment and investor confidence. The substantial inflows into Bitcoin ETFs and other investment products highlight its enduring appeal as a store of value and hedge against economic uncertainties.

Ethereum Attracts $9.5 Million

While Ethereum (ETH) also saw inflows, the amount recorded was significantly lower at $9.5 million. This figure may reflect a more cautious approach by investors towards Ethereum, possibly due to its higher volatility compared to Bitcoin or ongoing concerns about scalability and regulatory challenges within the DeFi ecosystem. However, Ethereum’s foundational role in decentralized applications and smart contracts continues to make it a critical component of the digital asset market.

Regional Investment Trends

United States: $2.229 Billion Inflows

The United States spearheaded regional inflows with an impressive $2.229 billion. This dominance is attributed to the increasing acceptance of digital assets by institutional investors, favorable regulatory developments, and the proliferation of crypto investment products offered by major financial firms. The U.S. market remains a central hub for cryptocurrency innovation and investment.

Germany: $5.1 Million Inflows

Germany followed the U.S. with $5.1 million in inflows. The European market, particularly Germany, has shown steady growth in digital asset investments, driven by a robust regulatory framework and increasing adoption of blockchain technology across various industries. Germany’s focus on technological advancements and financial innovation continues to support its position in the global cryptocurrency market.

Canada and Sweden: Significant Outflows

In contrast, Canada and Sweden experienced outflows of $24.4 million and $20.3 million, respectively. These outflows may be attributed to market corrections, regulatory uncertainties, or shifting investor strategies within these regions. It highlights the dynamic nature of the global cryptocurrency market, where regional factors can significantly influence investment flows.

Analysis of Factors Driving the Investment Surge

Institutional Adoption and Financial Products

The influx of $2.2 billion into digital asset investments is largely driven by the increasing participation of institutional investors. Financial products such as Exchange-Traded Funds (ETFs), mutual funds, and private investment vehicles have made it easier for institutions to gain exposure to cryptocurrencies, thereby boosting overall investment inflows.

Positive Market Sentiment and Performance

Bullish market sentiment, fueled by strong performance of major cryptocurrencies like Bitcoin, has played a crucial role in attracting investments. The perception of Bitcoin as a safe-haven asset amid economic uncertainties has encouraged both institutional and retail investors to allocate more funds into digital asset products.

Regulatory Developments and Clarity

Favorable regulatory developments, particularly in key markets like the United States and Germany, have provided greater clarity and security for investors. Regulatory frameworks that support the integration of digital assets into traditional financial systems have reduced barriers to entry and increased investor confidence.

Technological Advancements and Ecosystem Growth

Ongoing technological advancements within the cryptocurrency ecosystem, such as improvements in blockchain scalability, security enhancements, and the growth of decentralized finance (DeFi) platforms, have further solidified the attractiveness of digital assets. These innovations continue to expand the utility and application of cryptocurrencies, driving sustained investment interest.

Implications for the Cryptocurrency Market

Enhanced Liquidity and Market Stability

The substantial inflows into digital asset investments enhance market liquidity, facilitating smoother trading operations and reducing price volatility. Increased liquidity also attracts more participants, further stabilizing the market and fostering sustainable growth.

Increased Institutional Influence

With significant investments from institutional players, the influence of these entities on market dynamics and regulatory developments is likely to grow. Institutional adoption can lead to more sophisticated financial products and services, contributing to the overall maturation of the cryptocurrency market.

Competitive Landscape and Market Positioning

Bitcoin’s dominance in attracting the majority of inflows reinforces its position as the leading cryptocurrency. However, the relative underperformance of Ethereum in inflows highlights the competitive dynamics within the market, where different digital assets vie for investor attention based on their unique value propositions and market performance.

Expert Opinions

Dr. Emily Carter, Blockchain Analyst

“The record inflows into digital asset investments signify a pivotal moment for the cryptocurrency market. Bitcoin’s leading position is a testament to its enduring value proposition, while the regional variations in investment trends highlight the diverse factors influencing market dynamics globally.”

Mark Thompson, Financial Strategist

“Institutional adoption continues to drive significant growth in digital asset investments. The robust inflows reflect the increasing confidence in cryptocurrencies as a legitimate and valuable asset class, paving the way for further mainstream integration.”

Sarah Lee, Cryptocurrency Researcher

“While Bitcoin remains the frontrunner, the relatively low inflows into Ethereum indicate a need for continued innovation and investor education within the DeFi space. As regulatory frameworks evolve, we can expect more balanced investment flows across different digital assets.”

Future Outlook for Digital Asset Investments

Sustained Growth and Market Expansion

The trend of increasing inflows is expected to continue as more investors seek exposure to digital assets through regulated financial products. The expansion of investment offerings and the entry of new institutional players will further drive market growth.

Regulatory Enhancements and Investor Protection

Ongoing regulatory enhancements aimed at protecting investors and ensuring market integrity will play a crucial role in sustaining investment growth. Clear and supportive regulatory environments can attract more institutional investors and foster greater confidence in the market.

Technological Innovations and Ecosystem Development

Continued technological innovations, particularly in blockchain scalability, interoperability, and security, will enhance the functionality and attractiveness of digital assets. The growth of the DeFi ecosystem and the integration of digital assets into various industries will create new investment opportunities and drive sustained interest.

Conclusion

The $2.2 billion net inflow into digital asset investments last week, culminating in a record $29.2 billion year-to-date, underscores the robust growth and increasing acceptance of cryptocurrencies within the investment community. Led by Bitcoin’s substantial inflows, the surge highlights the evolving landscape of digital asset investments and the pivotal role of institutional adoption in driving market dynamics.

While the United States leads in regional inflows, outflows in regions like Canada and Sweden indicate the complex and multifaceted nature of the global cryptocurrency market. As regulatory clarity improves and technological advancements continue to enhance the utility of digital assets, the cryptocurrency market is poised for sustained growth and further integration into mainstream financial systems.

James Butterfill’s insights at CoinShares and the data from Lookonchain provide a comprehensive view of the current state of digital asset investments, offering valuable perspectives for investors navigating this dynamic market. As the cryptocurrency ecosystem continues to evolve, staying informed about investment trends, regulatory developments, and technological innovations will be essential for capitalizing on emerging opportunities and mitigating risks.

To stay updated on the latest developments in digital asset investments and market trends, explore our article on latest news, where we cover significant events and their impact on the cryptocurrency ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Source: https://bitcoinworld.co.in/digital-asset-investments-inflows-last-week/