- Long-term holders’ dominance rose sharply over the last few days

- At the time of writing, Ethereum seemed to be testing its support level

Ethereum [ETH] is once again in the news, with the altcoin slowly approaching the $2.5k-level at press time, sparking hope for a bull rally. This steady hike might have instilled more bullish sentiment in the market. However, will that be enough to propel further growth on the price charts?

Long term holders show confidence in Ethereum

Ethereum’s price has moved slightly over the last 24 hours and at press time was trading at $2,465.36. In the meantime, Ali, a popular crypto analyst, shared a tweet highlighting a key development.

ETH’s price has been moving inside an up channel, with the altcoin judiciously testing the support and resistance for quite some time.

The tweet also mentioned that the risk-to-reward ratio on Ethereum is too good to pass up for a long position. The analyst set his stop below $1,880, aiming for a target of $6,000.

Therefore, AMBCrypto took a deeper look at whether long term holders are actually showing confidence in the king of altcoins. As per our analysis of Glassnode’s data, ETH’s Futures long liquidation dominance surpassed 80. When the metric hits 50, it means that STH and LTH dominance are the same.

Hence, at press time, it was clear that LTHs were showing confidence.

Source: Glassnode

The fact that LTHs were dominant in the market was further proven by the token’s Futures long liquidations, which, after a sharp decline, once again started to move up. Apart from this, we also checked ETH’s long-term holder NULP.

For starters, the metric takes into account only UTXOs with a lifespan of at least 155 days and serves as an indicator to assess the behavior of long-term investors. At press time, the metric flashed optimism, meaning that LTHs’ confidence in ETH was high.

Source: Glassnode

In fact, AMBCrypto also reported previously that not only LTH, but whales have been optimistic too. The report mentioned whale balances grew significantly over the last two weeks as they held 56.68 million ETH by mid-October.

What to expect in the short term?

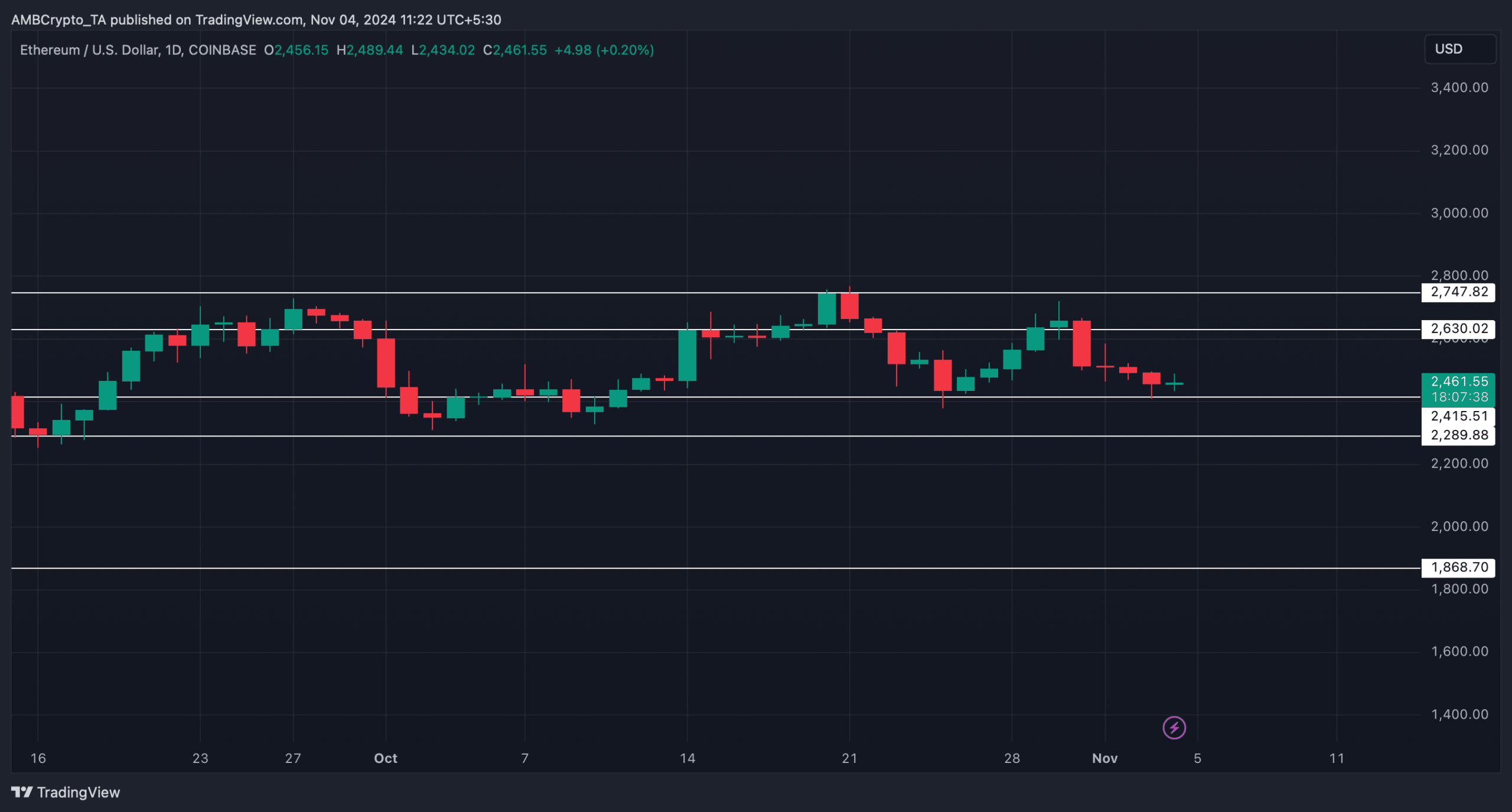

Though long-term sentiment seemed positive at press time, AMBCrypto looked at where ETH might head in the near term. As per our analysis, at the time of writing, ETH was testing the support at $2.415k. A successful test could push ETH towards $2.6k on the charts.

Read Ethereum’s [ETH] Price Prediction 2024–2025

In case of a jump above that resistance, it won’t be surprising to see Ethereum hit $2.7k in the short term.

Source: TradingView

Source: https://ambcrypto.com/heres-why-ethereums-long-term-holders-could-push-eth-past-2-5k/