- Solana’s whale concentration reached 60%, historically a bullish signal.

- With $6 billion in total value locked and strong technical support, upward momentum seemed likely for SOL.

Solana’s [SOL] ecosystem is seeing an interesting confluence of whale accumulation and technical resilience. As Solana moves through a turbulent market, on-chain data revealed a promising story.

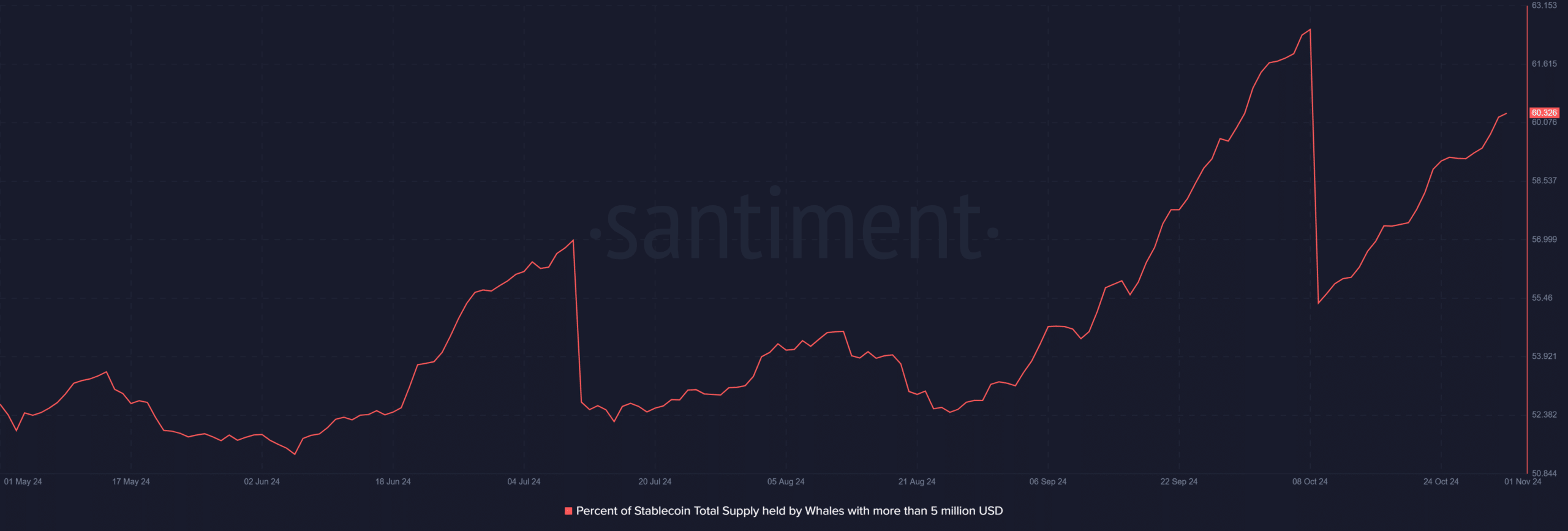

Whale wallets with over $5 million worth of SOL have piled up a massive 60% of the total supply, while the network’s TVL stood at $6 billion. This seems to be painting a picture of institutional confidence amid market uncertainty.

Solana’s network value solidifies

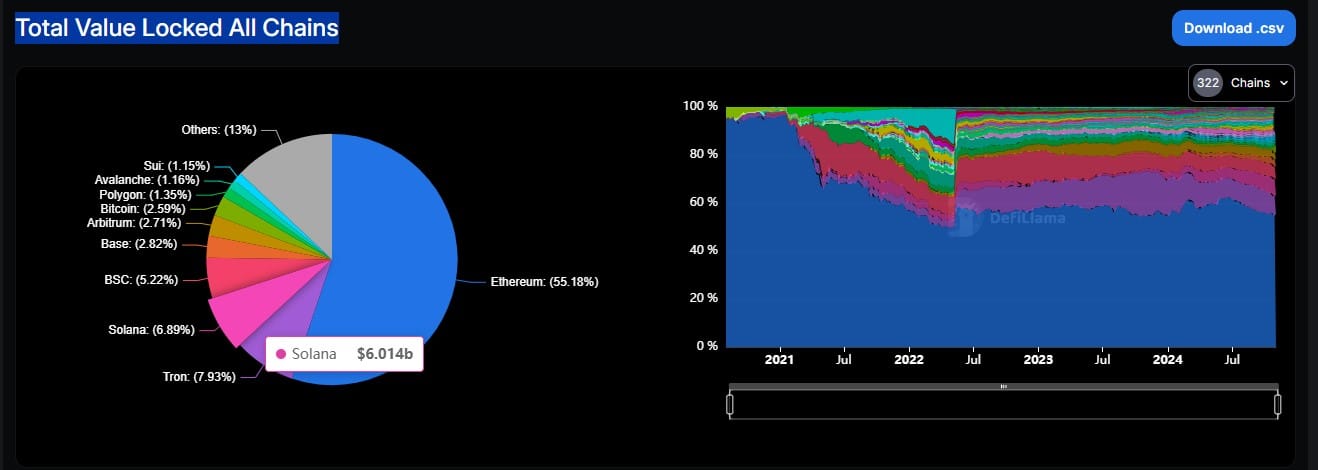

Underpinning this whale activity, Solana’s position in the DeFi ecosystem has remained strong, with a total value locked of $6.014 billion. In fact, this places SOL firmly as the third-largest chain by TVL, capturing 6.89% of the cross-chain market share.

Only Ethereum and TRON currently maintain larger network valuations, highlighting Solana’s growing prominence in the DeFi landscape.

Source: DefiLlama

Technical sentiments highlighted a bullish trend

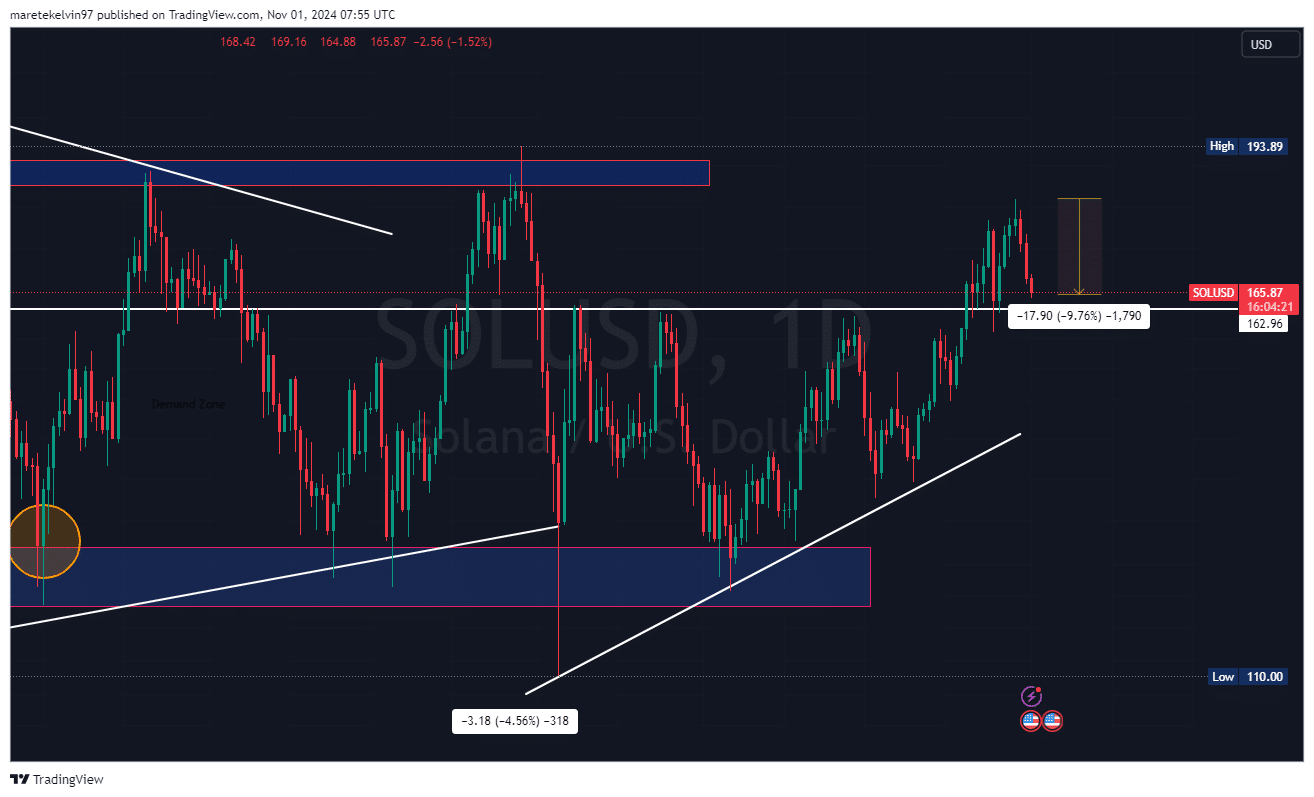

At the time of writing, SOL was approaching a crucial support of around $163 after a 9.7% dip over 3 days.

AMBCrypto’s analysis showed that Solana’s longer timeframes indicated a series of higher lows. This formed a potential reversal pattern, suggesting accumulation at these levels.

Also, the market structure remained intact, despite the recent pullback from local highs.

Source: Tradingview

Whale activity signals a potential reversal

Previous chart patterns revealed sharp drops in whale holdings on 10 July and 10 October, preceded by rapid accumulation phases. This further supported the technical setup on the charts,

Solana’s press time whale concentration levels matched its previous peaks that catalyzed upward movements. This trend highlighted that similar market dynamics may be on the cards.

Source: Santiment

What next for SOL?

The key support level at $163 is crucial for confirming the bullish scenario. A break below this level could indicate further dips for the altcoin.

Solana’s on-chain metrics seemed optimistic, but the market needs validation through higher buying pressure.

Realistic or not, here’s SOL’s market cap in BTC’s terms

The convergence of institutional interest and network value, together, implied a strong foundation for a potential bullish reversal on the charts. This is especially true if the broader market sentiment remains supportive.

Source: https://ambcrypto.com/solana-heres-what-these-metrics-say-about-sols-reversal-odds/