- AVAX declined by 8.3% over the past month.

- Avalanche MVRV score of 0.82 suggested that the altcoin is currently undervalued.

Over the past three days, the crypto market has seen impressive gains, with BTC reaching $73,500.

While some altcoins have made significant gains, Avalanche [AVAX] has not treaded on the green. The altcoin continued its monthly long bearish trend.

At the time of writing, AVAX was trading at $26. This marked a 2.04% decline over the past day.

Also, the altcoin has declined on the weekly and monthly charts, dropping by 4.07% and 8.3% respectively.

As expected, the current market conditions have left analysts deliberating over AVAX’s trajectory.

Adding to this, Cryptoquant analyst Burak Kesmeci suggested that Avalanche is undervalued, citing its MVRV score.

Is Avalanche undervalued?

In his analysis, Kesmeci posited that Avalanche’s MVRV score has increased over the past three months, reaching 0.82.

Source: X

According to him, when MVRV is at this level, it suggests that the altcoin is relatively cheap. Historically, a higher MVRV score for AVAX has implied more gains on its price charts.

For example, in the 2021 bull rally, AVAX surged from a low of $5 to reach an ATH of $146.

During this period, the MVRV experienced an exponential uptrend, rising from a low of 0.64 to 1.27.

However, this uptrend also risks putting AVAX into overheated territory. As such, historical data showed that AVAX’s price was overheated when it exceeded 1.11 points.

This implies that the AVAX MVRV score must remain above 1 and not above 1.11.

When we look at AVAX, we can see that it provided sales opportunities after the previous bull rally at 1.11 points.

Therefore, for this cycle, the market is tied to 1.11 points. For AVAX to realize its true value, AVAX has to rise from the current 0.82 to 1.11 points.

What do AVAX’s charts say?

As observed by Kesmeci, the current network activity and market fundamentals suggest that AVAX may be highly undervalued.

Source: IntoTheBlock

For example, Avalanche’s large transaction volume has surged from a low of 1.87 million to 6.71 million.

When there’s a high volume of large transactions, it implies that whales, large holders, and institutional investors are accumulating Avalanche.

If these entities are accumulating in doves, it implies they view the current prices as undervalued and the market has yet to realize its full value.

Source: IntoTheBlock

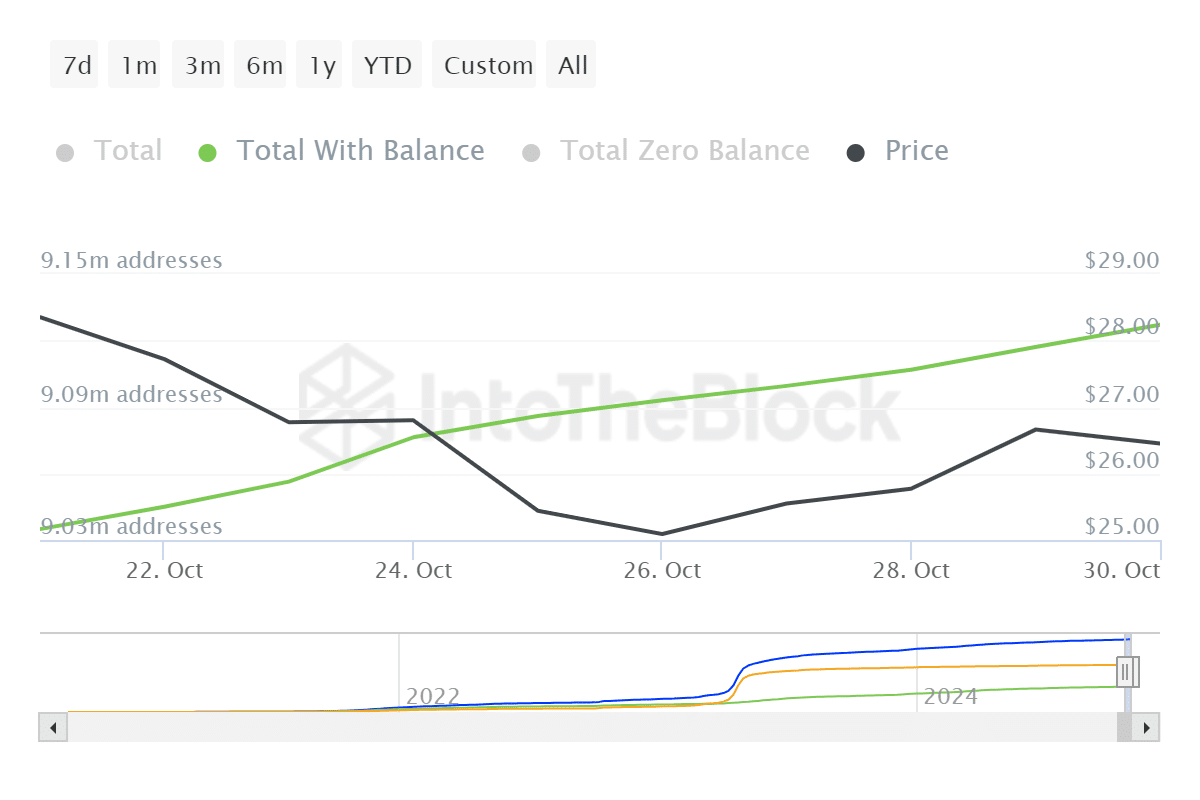

Additionally, Avalanche’s total addresses have experienced a sustained rise from 9 million to 9.13 million.

While the addresses have been rising, the prices have been declining, signaling the disconnect between on-chain activities and market value.

Source: IntoTheBlock

This phenomenon is further evidenced by daily active addresses, which have been rising from 60k to 86.33k.

This implies that the market fundamentals are strong, only the price that has yet to be realized.

Is your portfolio green? Check out the Avalanche Profit Calculator

Simply put, market indicators suggest that Avalanche is highly undervalued. If the MVRV score continues to rise as it has over the past months, AVAX could reach $30.8 in the short term.

Consequently, if the current bearish sentiment holds, Avalanche could decline to $24.

Source: https://ambcrypto.com/analyzing-avax-how-rising-mvrv-points-to-a-buying-window/