- Popular analyst predicted a breakout to $3 for Optimism (OP) if it surpasses $1.90

- Recent on-chain data showed a 50% hike in active addresses, signaling growing interest in $OP

Layer 2 solutions are expected to note major growth in the coming months, according to market analyst Michaël van de Poppe. In fact, Poppe believes that Optimism (OP), one of the leading Layer 2 protocols, is currently positioned for a major price breakout. He stated,

“Once it reaches the $1.80-1.90 range, a breakout to $3 is likely.”

He also emphasized that the ongoing accumulation and rising higher lows are early signs of a bullish trend, setting the stage for a potential move north.

Accumulation phase with a crucial resistance zone

OP’s price chart indicated that the token has been on a downtrend historically. However, it appeared to be building a base around its press time levels. A technical analysis suggested an accumulation phase, one characterized by the creation of higher lows – A sign of high buying interest.

The price was also approaching a resistance zone around $2.27, identified as a “crucial breakout area.” This level acts as a barrier that, if breached, could shift market sentiment towards a more bullish outlook.

Source: X

The presence of an ascending trendline suggested further support, reinforcing the possibility of a breakout. On the price chart, momentum appeared to be steadily building as buyers absorbed selling pressure, creating a strong foundation for a potential move upwards.

Target price and potential resistance levels

If OP breaks above the $2.27 resistance zone, the next potential target is estimated to be between $2.68 and $2.80. This target range represents an 18% profit opportunity from its press time breakout point. This area could serve as a new resistance level, as traders may look to take profits within this range.

The market has also been showing signs of a bullish buildup, as the price continues to consolidate near the horizontal resistance.

On-chain data reflects growing network activity

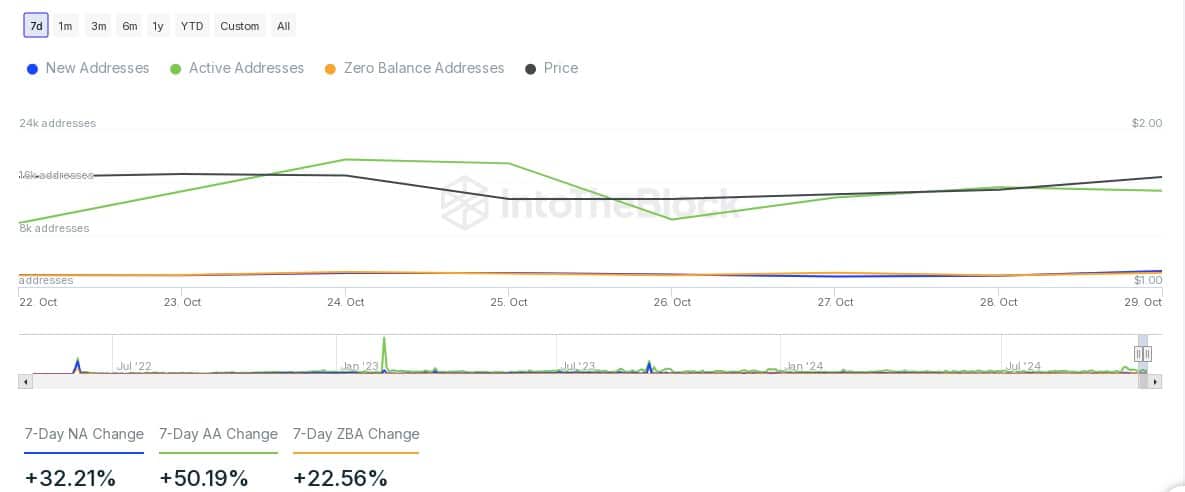

Recent on-chain data from IntoTheBlock supported the optimistic outlook for OP. Over the past week, new addresses have risen by 32.21%, active addresses by 50.19%, and zero-balance addresses by 22.56%, indicating rising network engagement.

Despite this growth, the token’s price remains relatively stable, suggesting that the network expansion may be laying the groundwork for a bullish trend.

Source: IntoTheBlock

Large transaction volumes fluctuated between 1.5k and 2.07k over the past week, with a slight decline towards the week’s end.

This trend indicated sustained interest from major holders, although the dip might reflect caution or potential profit-taking.

Source: IntoTheBlock

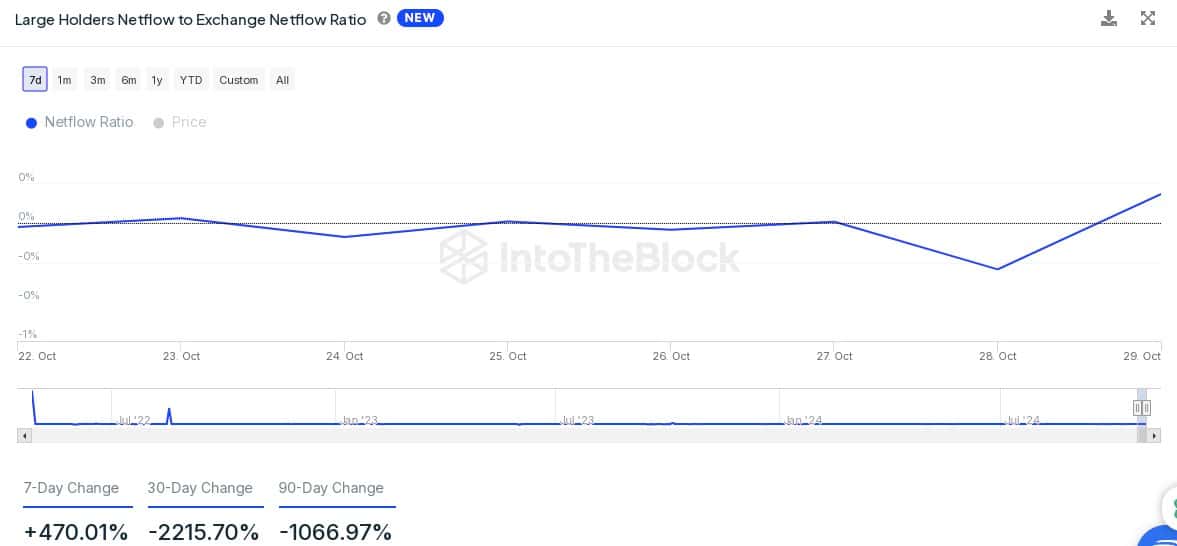

Exchange netflows and DeFi metrics

Exchange netflows for large holders of OP has risen by 470.01% over the past week, indicating that more tokens are moving to exchanges. This could signal potential selling pressure in the short term.

On the contrary, the 30-day and 90-day netflows have been heavily negative, suggesting prior accumulation and longer-term bullish sentiment.

Source: IntoTheBlock

Finally, data from DeFiLlama revealed that Optimism’s Total Value Locked (TVL) stood at $684.51 million at press time, with a stablecoin market cap of $1.01 billion.

Also, over the last 24 hours, the network recorded $13,070 in fees and $12,901 in revenue, alongside $11.27 million in inflows.

Together, these metrics indicated steady growth in the protocol’s ecosystem amid ongoing user interest.

Source: https://ambcrypto.com/op-eyes-3-breakout-as-layer-2-adoption-and-on-chain-activity-surge/