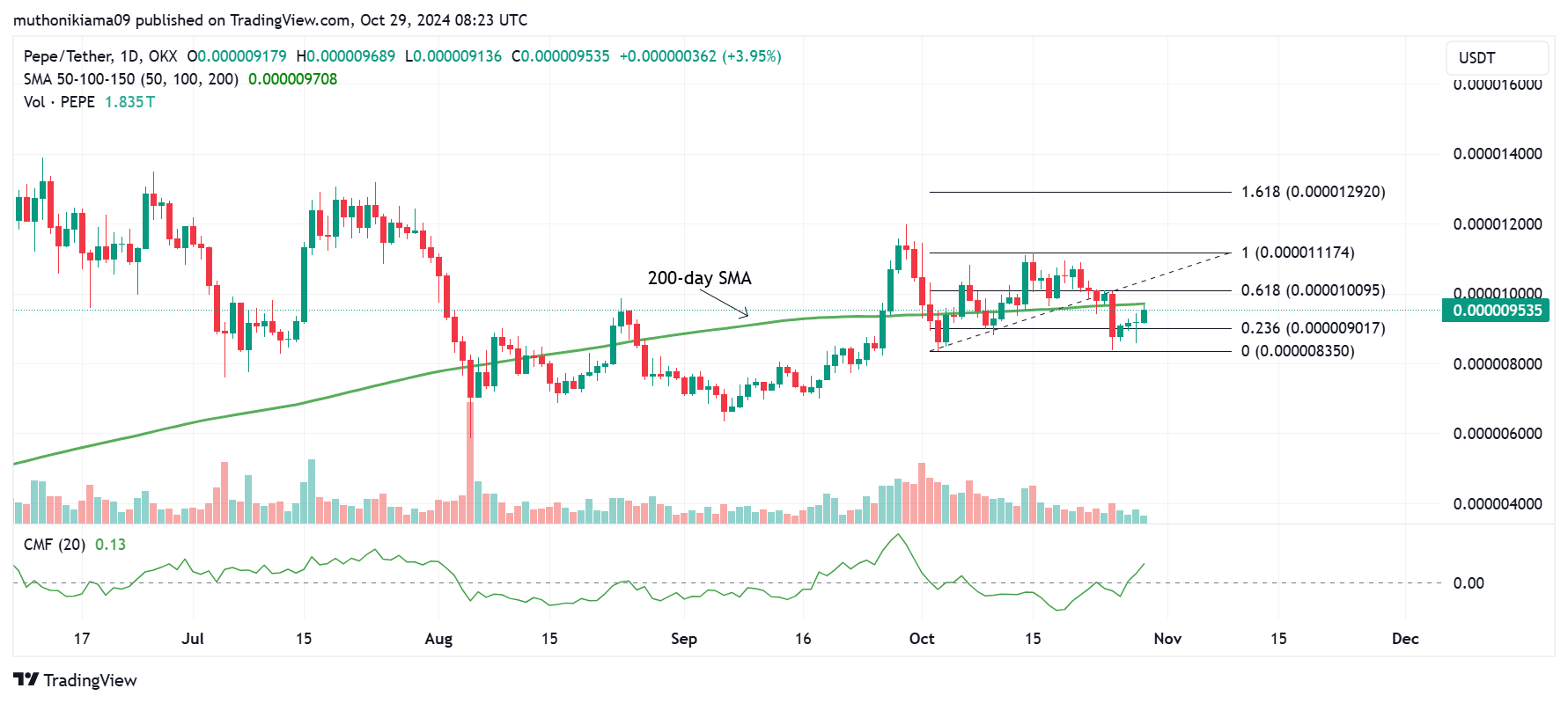

- PEPE has tested resistance at the 200-day SMA as bullish signs emerge.

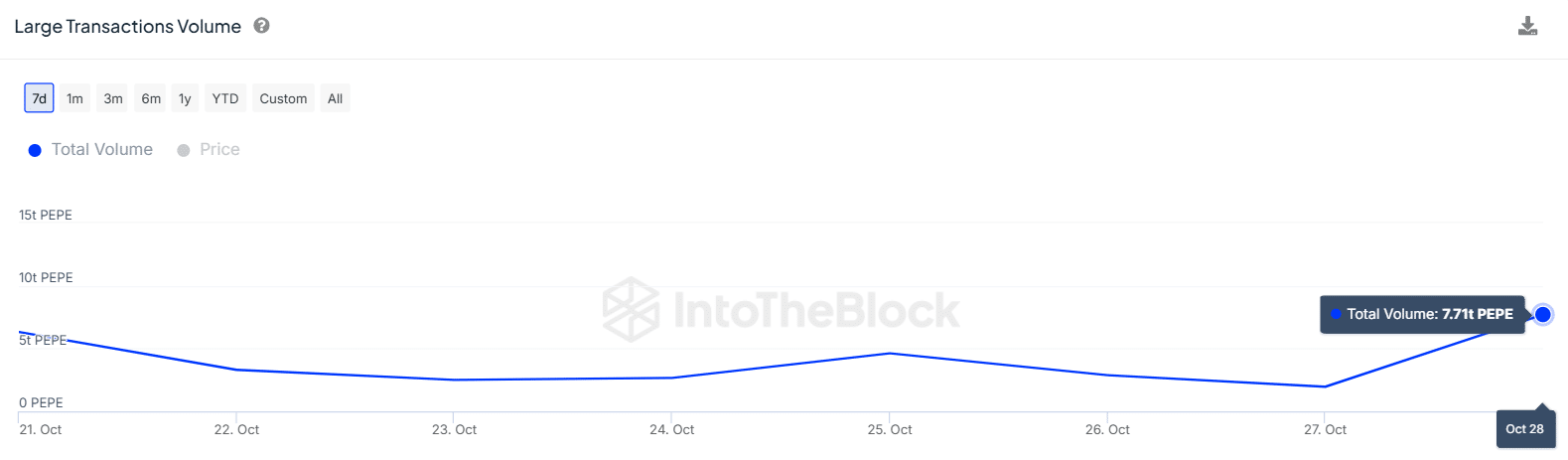

- Large PEPE transactions have also increased from 1.96 trillion to 7.71 trillion.

PEPE [PEPE] traded at $0.00000947 at press time after a 5.6% gain in 24 hours. The recent gains come amid a bullish trend across the broader cryptocurrency market. Despite these gains, PEPE remains down by around 7% in the last seven days.

Several bullish signs have formed around PEPE on the one-day chart suggesting that the meme coin could be poised for another rally.

PEPE has been trading below the 200-day Simple Moving Average (SMA) on the one-day chart since mid-October, indicating a long-term downtrend. However, a reversal could be on the way after the price tested resistance at this level.

If it flips this resistance, it could strengthen the uptrend as it will confirm that the momentum has shifted to bullish.

Source: Tradingview

The Chaikin Money Flow (CMF) shows that buying pressure is rising while the selling pressure is waning.

At press time, the CMF had a positive value of 0.18 suggesting rising interest in the meme coin. The green volume histogram bars further show that buyers have been more than sellers in the last four days.

If these bullish trends continue, and PEPE flips resistance at $0.0000097, it could stir a 36% rally to the 1.618 Fibonacci level (0.0000129).

PEPE whale transactions surge

Data from IntoTheBlock shows a significant increase in large PEPE transactions. These transactions increased from 1.96 trillion, valued at around $17M, to 7.71 trillion, valued at $70M, in 24 hours.

Source: IntoTheBlock

Whales control 48% of PEPE’s supply while retail traders control 27%. Therefore, an increase in whale transactions is bound to affect price volatility.

These whales could be buying PEPE as the rise in activity coincided with the price gain and an increase in buying pressure. Therefore, if the positive sentiment across the broader market continues, the meme coin could trend higher.

Read Pepe’s [PEPE] Price Prediction 2024–2025

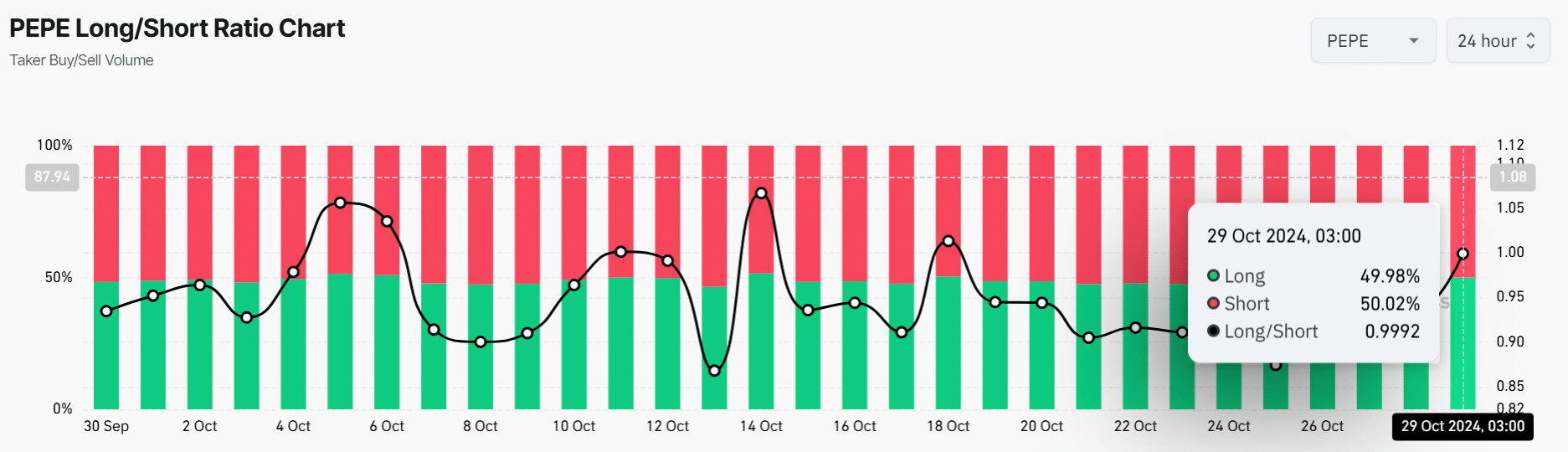

The long/short ratio shows that positive sentiment around PEPE has been increasing steadily. In the last three days, the long/short ratio has increased from 0.87 to 0.99, showing that traders are closing long positions in favor of short positions.

Source: Coinglass

Data from Coinglass also shows that PEPE funding rates recently reached a weekly high. This suggests that more traders are opening more long positions.

Source: https://ambcrypto.com/pepe-flips-bullish-on-rising-demand-is-a-36-rally-next/