Veteran trader Peter Brandt has reignited the Bitcoin vs Gold debate, highlighting how the flagship crypto has performed against gold. Renowned economist Peter Schiff has also fuelled this debate by arguing that gold deserves more attention than BTC.

Bitcoin Vs. Gold: How BTC Is Performing

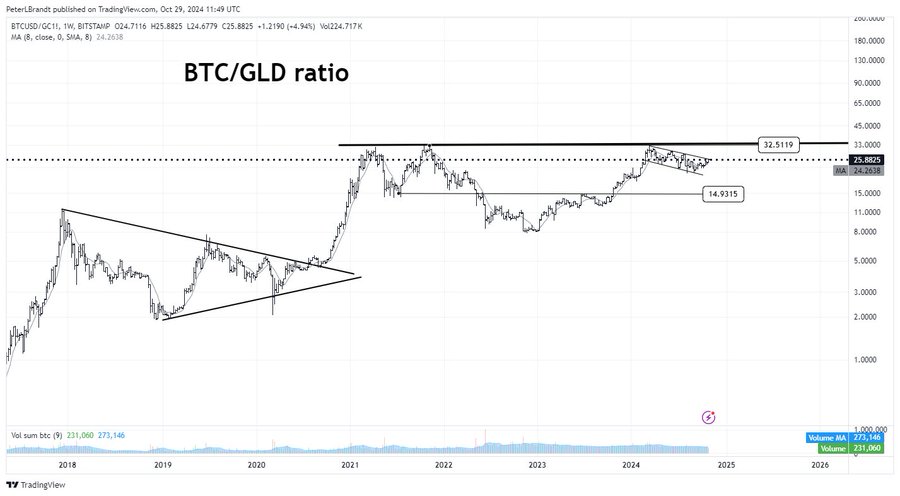

Peter Brandt claimed in an X post that Bitcoin has made “no progress” in 42 months in its Gold pair. He remarked that the flagship crypto remains below the March 2024 high and the double highs in 2021.

Indeed, the Bitcoin price remains below its current all-time high (ATH) of $73,000, which it reached earlier this year in March. Meanwhile, gold continues to reach new highs, rising to a new ATH of $2771. BTC and gold have always been compared, as experts view both assets as a store of value.

Some experts have also argued that the flagship crypto has an edge against gold, although it is commonly called ‘digital gold.’ Peter Brandt also highlighted the significance of these assets while noting that they are in the “heavyweight division” in the battle against fiat depreciation.

Given BTC’s underperformance against gold, the latter seems to live up to the hype more as a store of value. There is also the argument that crypto’s correlation with the stock market shows that investors view it more as a risk asset than a hedge against inflation.

Peter Schiff Also Fuels The Debate

Gold proponent and renowned economist Peter Schiff has also sparked the Bitcoin vs. gold debate. Following the BTC price rally above $71,000 for the first time in four months, Schiff mentioned that gold is trading at another record high, just shy of its ATH. However, Schiff remarked that no one will notice because the flagship crypto is trading back above $71,000.

The economist believes that gold should receive more attention than it currently does, especially as it reaches new highs while BTC attempts to break its current ATH of $73,000. However, despite Schiff’s reservations, it is worth mentioning that the flagship crypto is a victim of its success.

Bitcoin hit a new ATH earlier in the year, just before the halving event in April, which was unusual considering it had never reached a new ATH until after the halving. As such, that development weighed on the flagship crypto since analysts like Rekt Capital claimed that it had to consolidate for this long so it could synchronize with past halving cycles.

For context, despite consolidating for this long, BTC is up over 62% year-to-date (YTD) while gold is up just over 33% since this year began.

Meanwhile, it is worth mentioning that Peter Schiff has also extended the BTC vs gold debate to their related stocks. The economist compared MicroStrategy to gold stocks. He noted that MSTR stock is worth more than the stocks of all gold mining companies except Newmont.

However, Schiff questioned MicroStrategy’s value and suggested it could suffer a price crash soon enough. MSTR is one of the best-performing assets this year, outperforming even BTC and gold.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/bitcoin-vs-gold-peter-brandt-comments-on-btcs-underperformance/

✓ Share: