After Scroll’s listing was postponed by an hour on Binance last Tuesday, there was a wave of excitement after the token finally started trading. However, the excitement soon died down as the token’s value dropped over 30% soon after its launch.

This shift is certainly worth looking into, especially since it happened along with movements in Scrolls total value locked (TVL) and its bridging activities. SCR, the native token of Scroll, was first anticipated to show an increase in liquidity.

However, unfortunately, the price for the token fell drastically below $0.08, a significant decline of more than 30% from its trading highs before the listing. Further, the trading volume of the token has increased to $53.82M, as the market cap dropped by 5.29% in the last 24 hours.

The decline in the token is not uncommon in the crypto markets, as early investors often take advantage of the initial excitement, resulting in sell-offs that push prices further down. However, what is particularly interesting about this scenario for Scroll is its significance within the larger context of the Ethereum layer-to-ecosystem.

All those Scrolls are positioned as a cost-effective and efficient led-to-network. The recent price decline suggests that there may be a disconnect between what the market initially anticipated and the current level of adoption.

Decline In Scroll’s TVL By 15.4%:

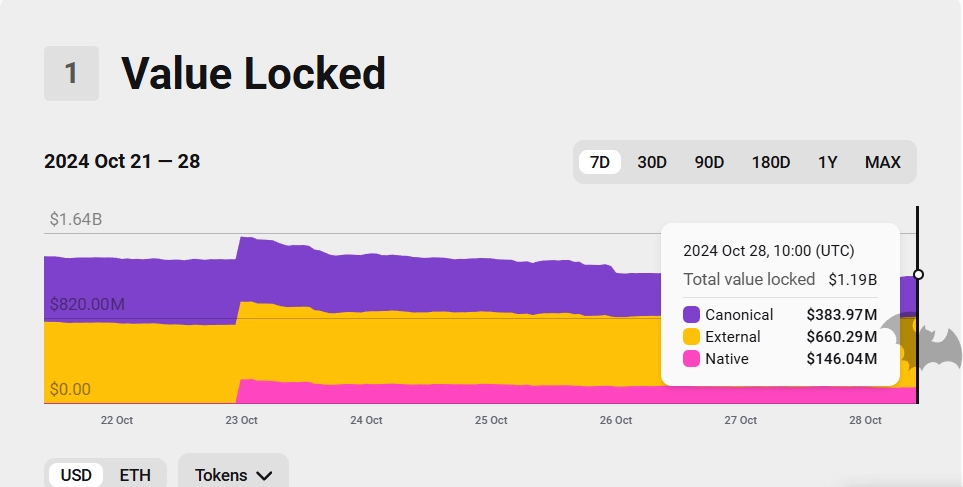

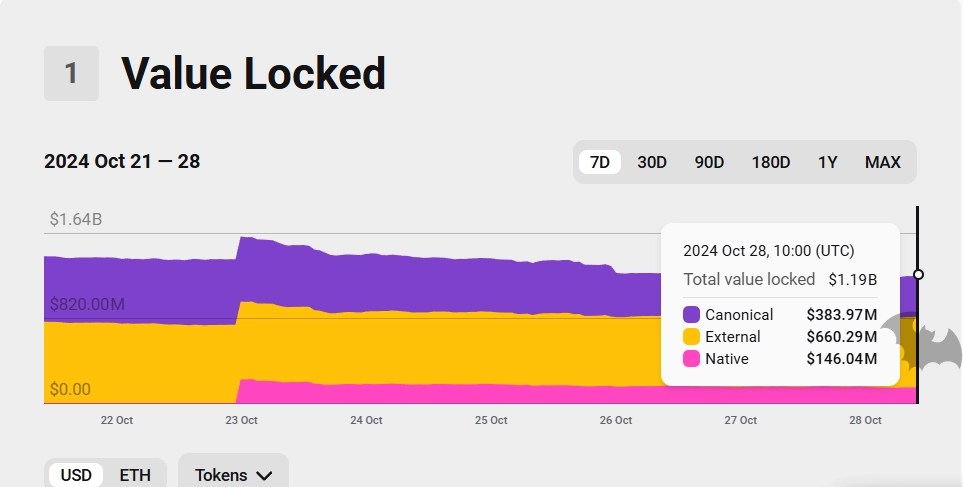

The SCR network’s TVL dipped by 15.4% over the last week. It now stands at $1.18 billion, as reported by L2beat, an analytics and research platform for Ethereum’s Layer 2 solutions. TVL is an important metric that reflects the amount of assets secured within a network and serves as a gauge of user confidence in the project.

The decline. of scroll networks TVL could be broken down into three main factors: Natively Minted Tokens, which accounts for one.$146.02 million, Externally Bridged value at $654.94 million, and Canonically Bridged Value where there has been the most significant drop.

In the context of canonically bridged ETH fell from 129.7k to 100.6k, a drop of over 22%. This points to a slowdown in bridging activity and. hints at a possibly waning user confidence.

The network has recently launched updates like the Darwin upgrade to lower its gas fee, although it has had its setbacks, including a bug that necessitated a batch reversion in July 2024. Presently, Scroll is in roll-up stage zero and currently lacks some essential node software required for complete verification.

What To Keep An Eye Out For?

The current challenges that SCR is facing—from the token price drop to the TVL decline—represent the volatile nature of blockchain projects. For investors and users, the upcoming technical upgrades pertaining to security and bridging capacity will be crucial to determining the course of Scroll and its token SCR, which is currently priced at $0.7626.

If Scroll cannot navigate these changes, further manage its volatility, optimize its technical performance, and address concerns from its community, it risks losing its foothold in the layer-2 ecosystem, with chances of further price dips on the way.

Also Read: Coinbase Launched Based Agent: Creates AI Bots in 3 Minutes!

Source: https://www.cryptonewsz.com/scroll-token-dips-30-post-binance-listing-what/