- Solana’s $10 million BGSOL staking surge and bullish indicators signal potential for sustained upward momentum.

- Whale accumulation and short squeezes further support SOL’s rally prospects amid strong social dominance.

Solana [SOL] is making waves as its BGSOL staking program skyrocketed past $10 million within 24 hours of launch, driven by a highly attractive 22% APY.

This swift accumulation of staked assets, combined with SOL’s price trading at $173.30—up 3.44% at press time—suggests renewed community confidence. Can Solana’s momentum spark a broader crypto market rally? Let’s find out.

SOL technical analysis: Strong indicators point to further upside

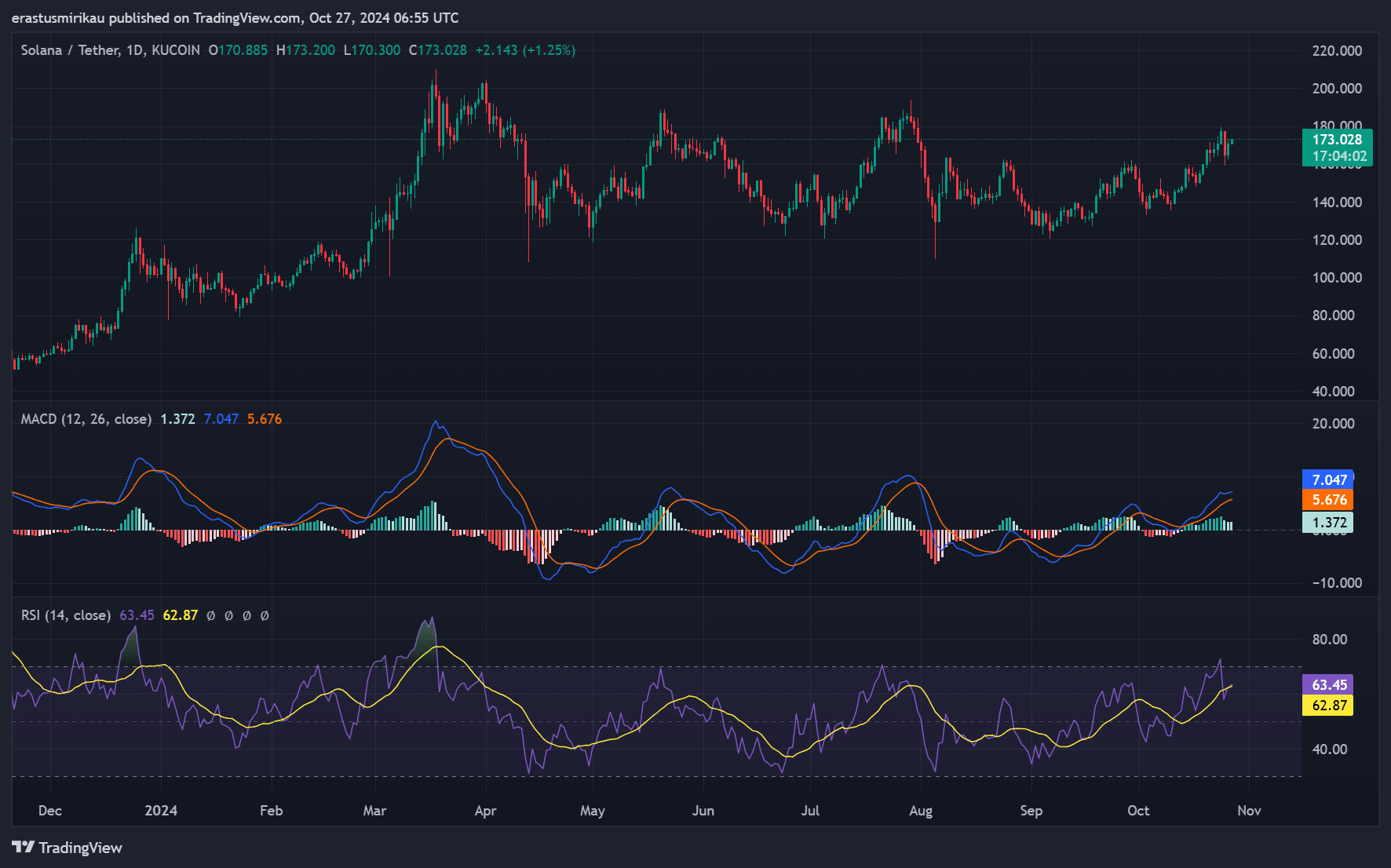

Examining Solana’s technical indicators reveals a promising outlook. The Moving Average Convergence Divergence (MACD) shows a bullish crossover, with the MACD line positioned above the signal line and trending upward.

This crossover often foreshadows continued price appreciation.

Additionally, the Relative Strength Index (RSI) stands at 63, signifying a healthy level of buying strength without reaching overbought conditions.

Therefore, both the MACD and RSI reinforce a bullish perspective, suggesting that SOL could sustain its upward trajectory in the near term.

Source: TradingView

Social dominance: Is Solana capturing attention?

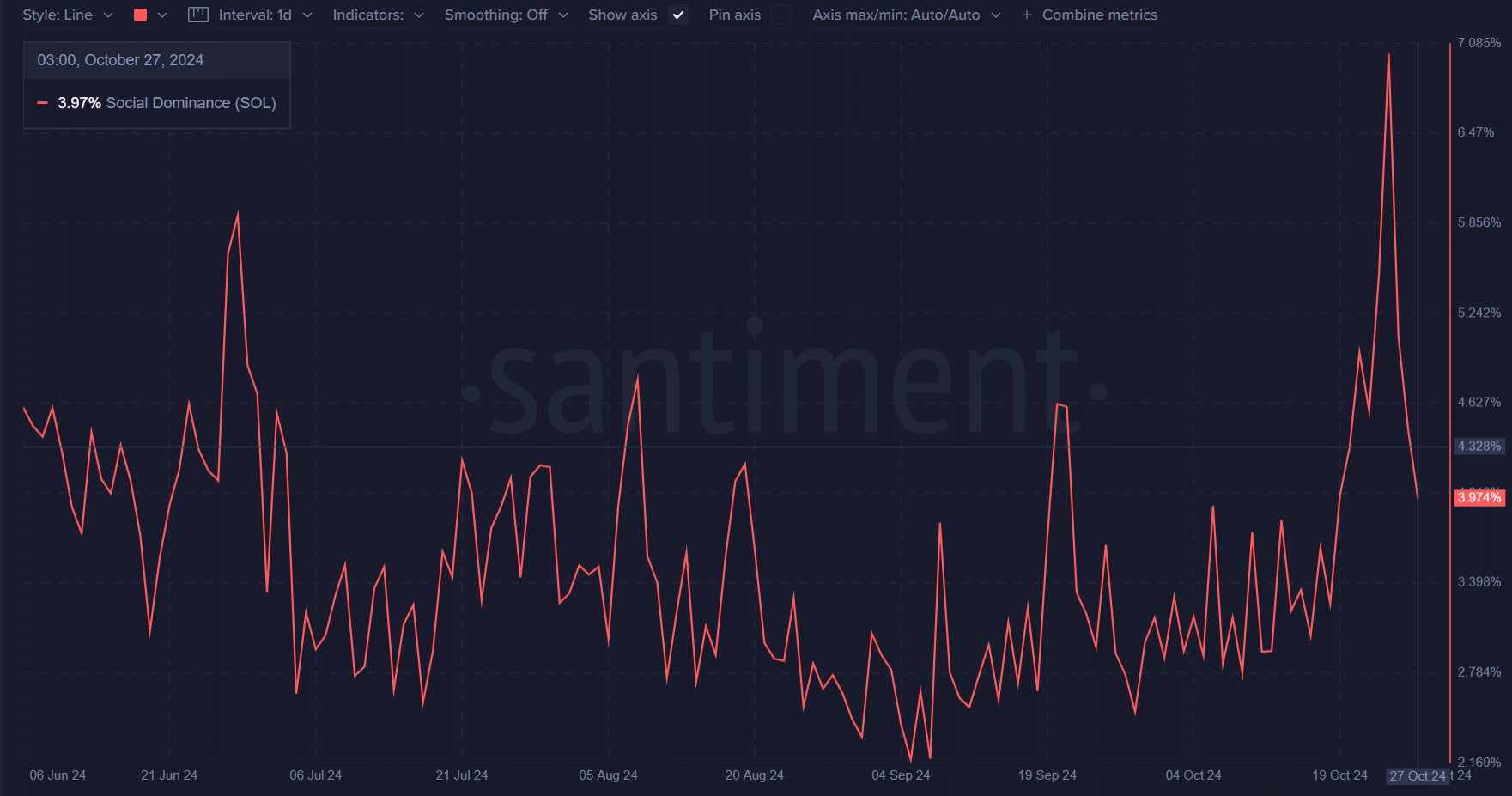

Social engagement data highlights Solana’s rising influence within the crypto space. Recent figures show Solana’s social dominance at 3.97%, indicating a strong presence across social platforms.

This increase in social attention often translates to heightened investor interest, which, in turn, can drive prices higher.

Consequently, Solana’s expanding visibility among crypto enthusiasts is enhancing its appeal and market traction. As more investors turn their focus toward Solana, the asset’s potential to influence the broader market strengthens.

Source: Santiment

Whale activity signals confidence in SOL’s potential

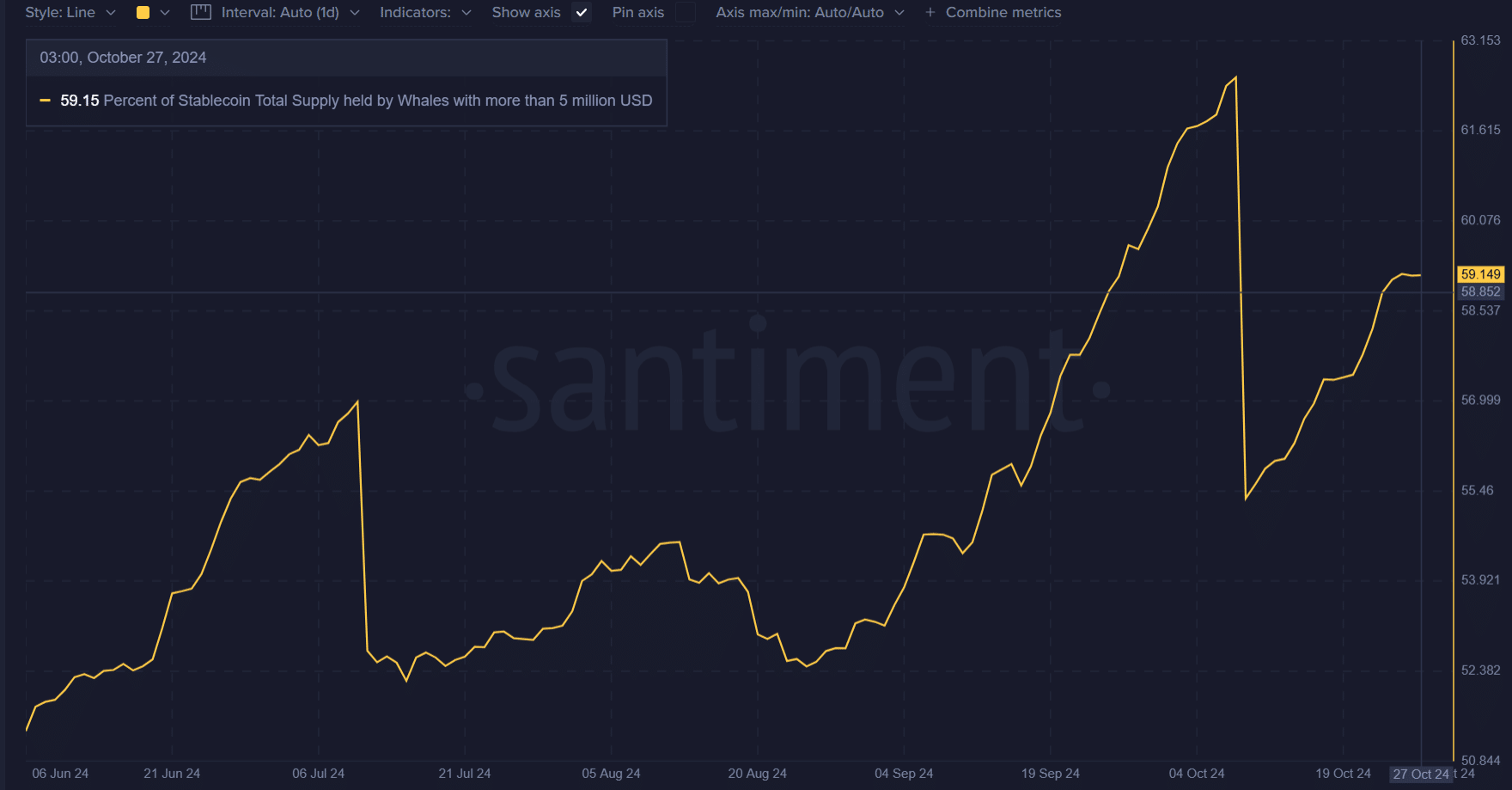

Notably, Solana’s whale activity shows an uptick, with the top holders accumulating approximately 59.15% of stablecoin reserves. This high percentage suggests that large players are positioning themselves with ample liquidity, possibly to invest heavily in SOL.

Additionally, stablecoin concentration among top holders implies readiness for further investments, which could contribute to sustained upward momentum in SOL’s price.

Therefore, whale accumulation becomes a critical factor in assessing Solana’s potential for long-term growth.

Source: Santiment

Liquidation analysis: Is a short squeeze supporting SOL’s rally?

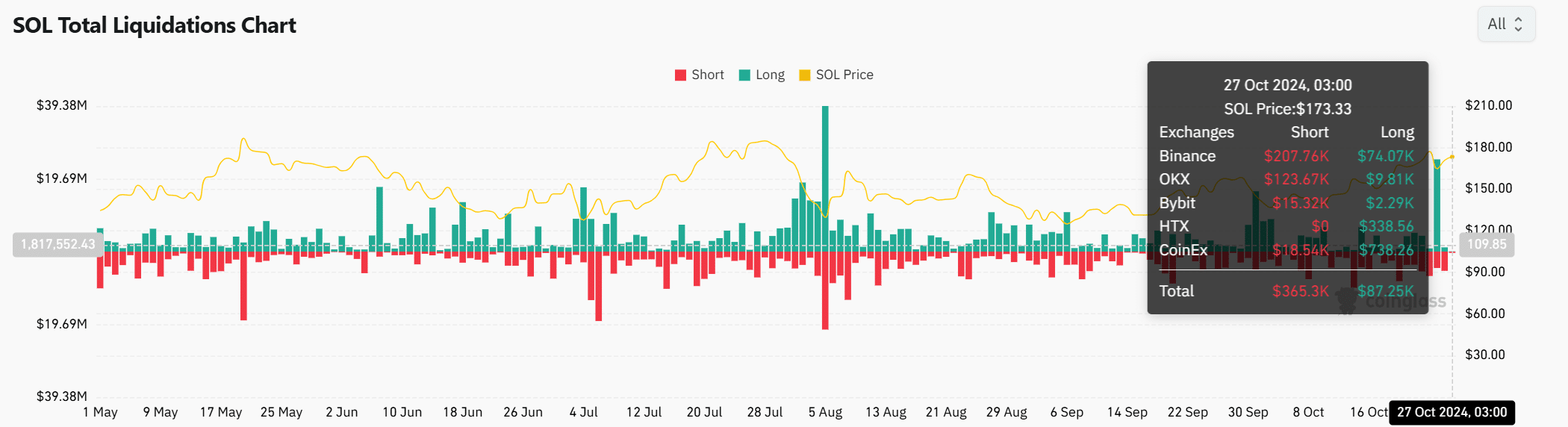

Analyzing liquidation data reveals that $365.3K in shorts were liquidated, compared to just $87.25K in longs. This disparity suggests a potential short squeeze, where rising prices force traders holding short positions to close them, pushing the price higher.

This liquidation pattern adds to Solana’s bullish outlook, as the short squeeze effect often amplifies upward price movements in assets experiencing strong demand.

Source: Coinglass

Is your portfolio green? Check out the SOL Profit Calculator

Can Solana sustain its rally and lead the market?

Solana’s rapid staking success, positive technical indicators, increasing social presence, substantial whale accumulation, and favorable liquidation data create a compelling case for continued growth.

If these factors persist, Solana may maintain its momentum and play a pivotal role in the next crypto bull market. However, sustained community engagement and large-scale interest remain essential for long-term success.

Source: https://ambcrypto.com/solanas-bgsol-staking-hits-10m-will-it-push-sol-higher/