- Solana’ rapid appreciation against Ethereum reflects a significant price action shift.

- Now, ETH’s long-term outlook needs reassessment to restore its former dominance.

While market volatility is inherent to the crypto world, recent analysis by AMBCrypto suggests that Solana price [SOL] may not be experiencing a fleeting surge, but rather the beginning of a larger trend that could shape future market cycles.

In simple terms, this emerging pattern points to a deeper shift. The upward momentum of Solana against Ethereum [ETH] may become a more persistent feature, rather than a short-term anomaly, threatening Ethereum’s longstanding dominance in the blockchain ecosystem.

A recurring pattern

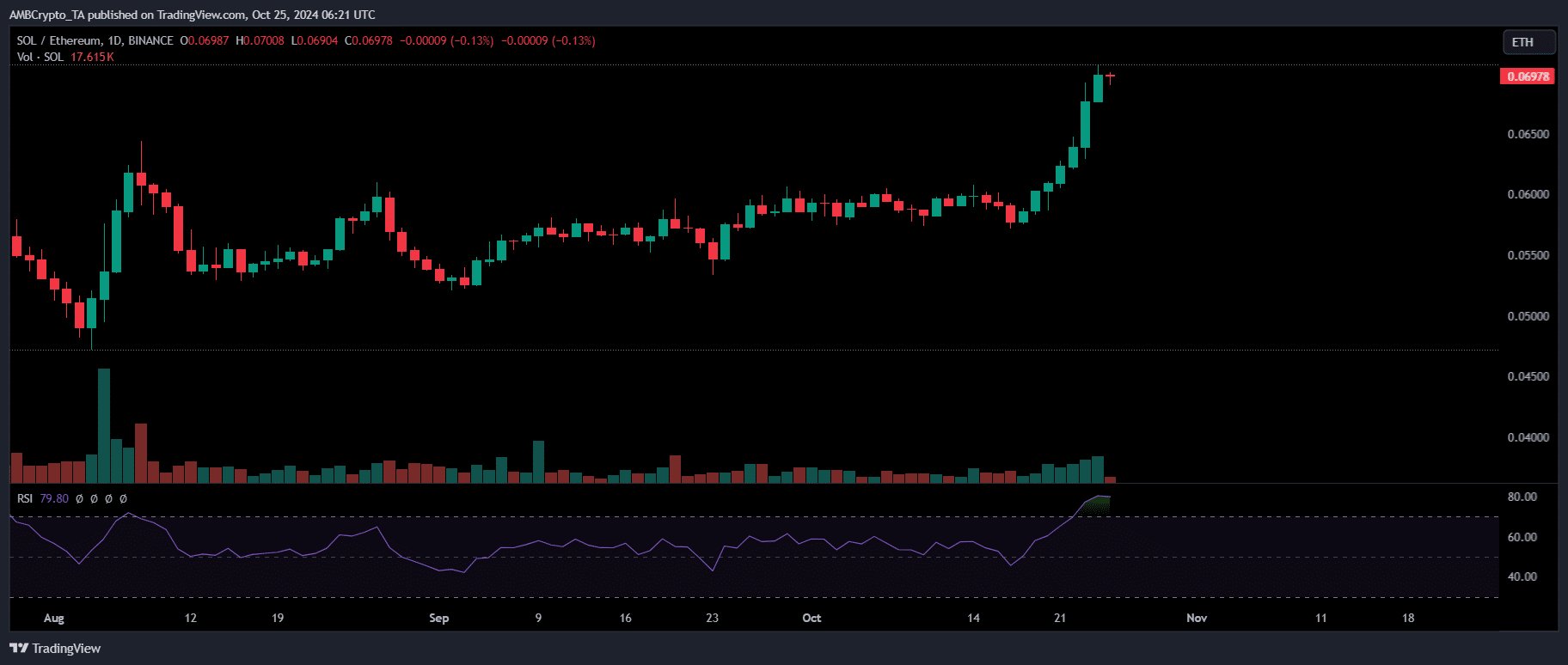

In August, the Solana to Ethereum ratio (SOL/ETH) reached an unprecedented high of 0.06179, indicating a significant surge in Solana’s value relative to Ethereum. This achievement came amid a tumultuous $500 billion sell-off in the markets.

Despite these challenges, SOL rebounded impressively, jumping 48% from a low of $110 to $163 in just three days. Meanwhile, ETH saw a more modest 15% recovery, rising from $2,157 to $2,463.

Source : TradingView

Currently, the SOL/ETH pairing has surged to a new ATH of 0.06987, coinciding with an overheated market as Bitcoin reached a peak of $70K.

However, unlike previous cycles, ETH has shown no signs of recovery. Instead, it has recorded daily higher lows accompanied by long red candlesticks, falling from $2.7K to $2.4K in under five trading days.

In contrast, SOL has held steady, breaking through the key psychological barrier at $160 to trade at $174 at press time, bolstered by a bullish MACD crossover.

This recurring pattern during high volatility, particularly when BTC hits resistance, reveals a notable capital shift toward SOL over ETH.

If this trend continues – which appears likely – SOL’s rising value could threaten ETH’s dominance, making it the preferred high-cap asset for those looking to mitigate risks whenever Bitcoin peaks.

Factors driving Solana upward

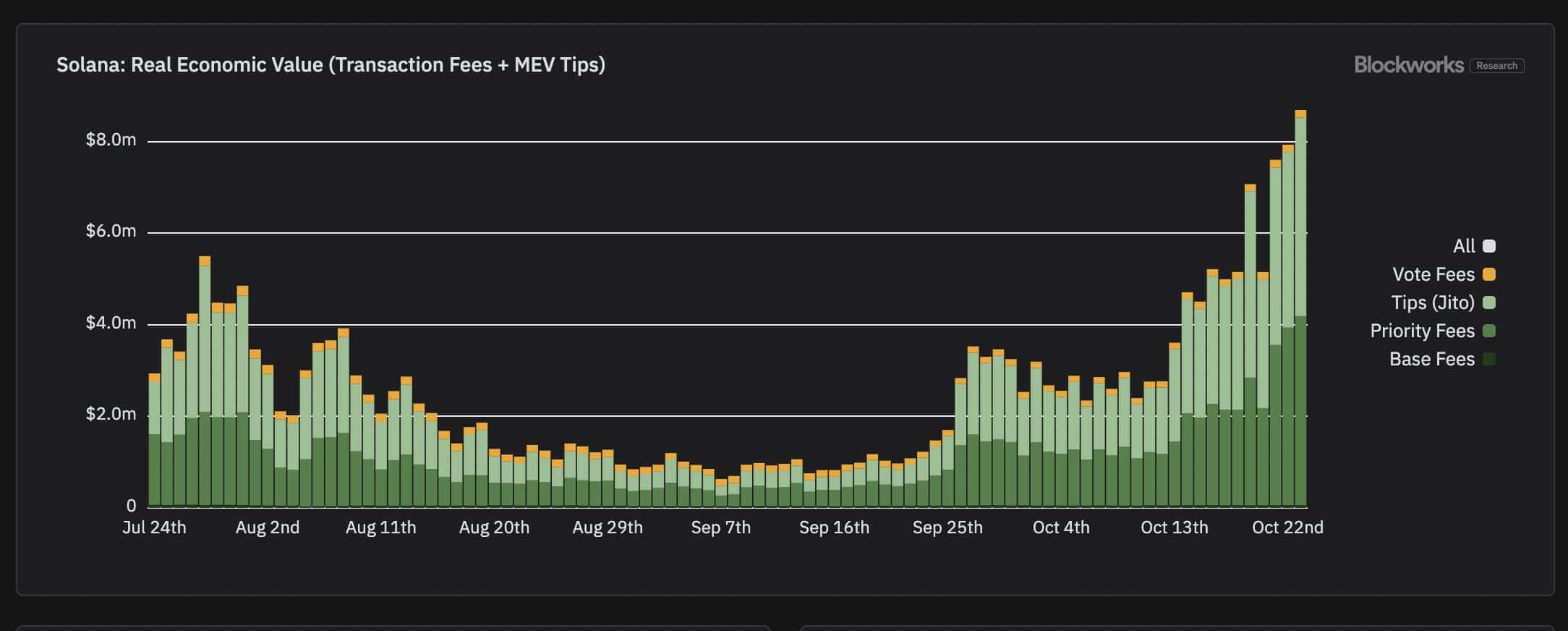

Earlier, critics claimed Solana’s low fees made the chain economically unsustainable. Fast forward less than 12 months, and Solana has not only flipped Ethereum in transaction fees but also in miner extractable value (MEV) tips.

This shift illustrates that Solana’s price action is not solely influenced by Bitcoin’s fluctuations; rather, it is driven by its robust internal design.

Source : Blockworks

Additionally, Solana has garnered significant attention from the memecoin community, with half of the top eight memecoins by market cap now based on the Solana network.

One standout, Goatseus Maximum [GOAT], an AI-driven memecoin, has experienced nearly a 100% weekly surge, prompting wallets to hold SOL to capitalize on the memecoin craze.

This is supported by a recent post that revealed a substantial stash of SOL staked in a new wallet, totaling over 150K SOL acquired in the past three days, valued at approximately $26 million.

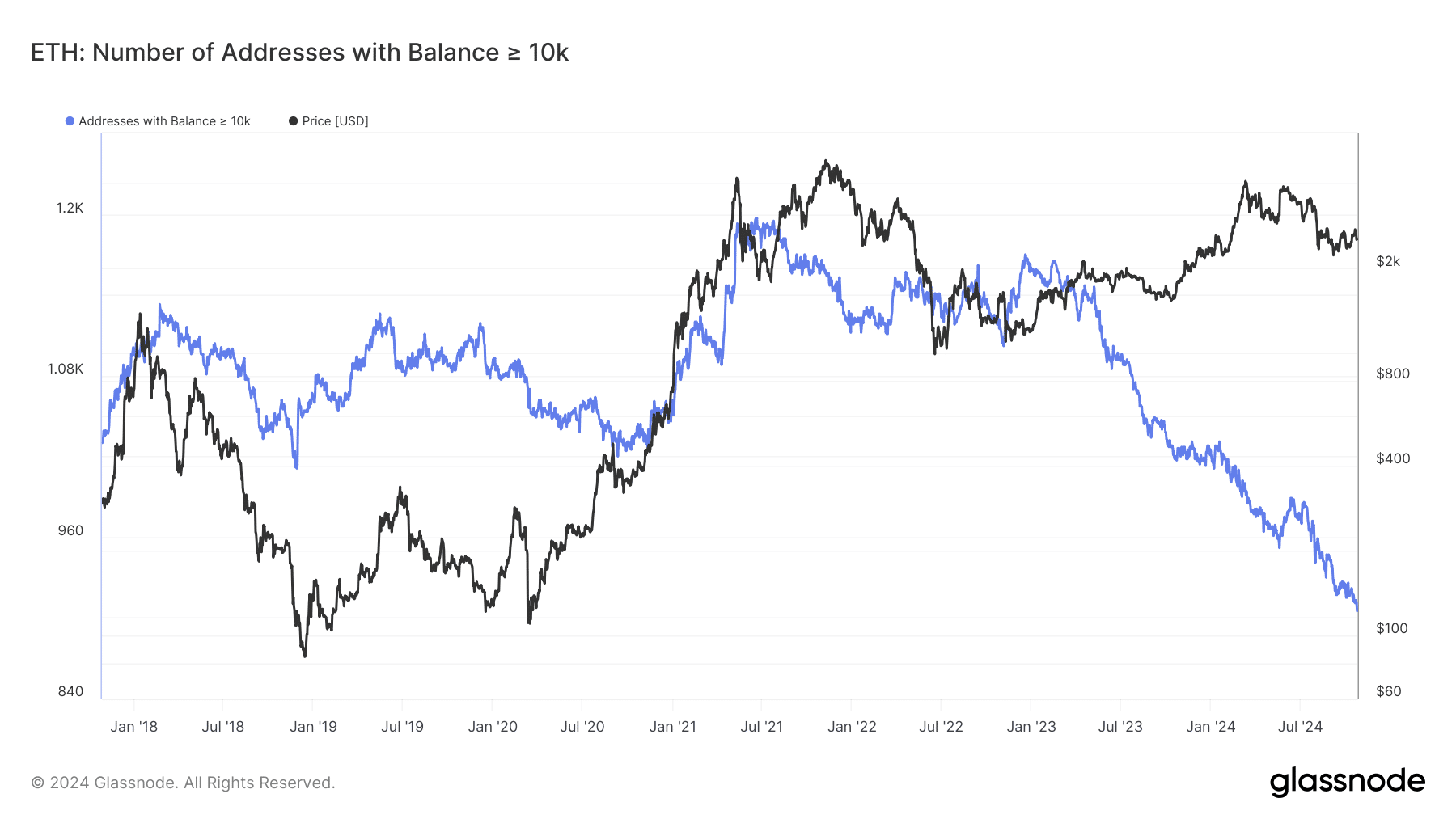

ETH fundamentals are under pressure

The fundamentals that once positioned ETH as the leading altcoin are now under pressure, as the number of wallets holding more than 10K ETH has fallen to a seven-year low.

Source : Glassnode

Certainly, ETH’s long-term prospects require reevaluation. As investor confidence wanes, Ethereum must address these challenges to reclaim its position.

Read Ethereum’s [ETH] Price Prediction 2024–2025

If not, issues such as scalability, high fees, and competition from emerging platforms like Solana could reverse the altcoin hierarchy, hindering ETH’s ability to benefit from capital shifts in the market.

Currently, Ethereum is valued at $2,464, reflecting a 6% decline over the week, with its market cap down by 4%.

Source: https://ambcrypto.com/solana-price-hits-ath-against-ethereum-can-eth-reclaim-its-dominance/