Market News

Market News- Italy has raised the capital gains tax on cryptocurrencies from 26% to 42%, effective January 1, 2025.

- The Italian government expects to generate €68 million (around $73M) from the increased tax to boost revenue.

Italy has officially introduced a major tax hike on cryptocurrency gains, raising concerns among investors. As part of the country’s 2025 Budget Law, capital gains on Bitcoin and other cryptocurrencies will be taxed at 42%, up from the current 26%. This significant increase, signed into law by President Sergio Mattarella, is part of the government’s broader effort to boost revenue by regulating the rapidly growing crypto sector.

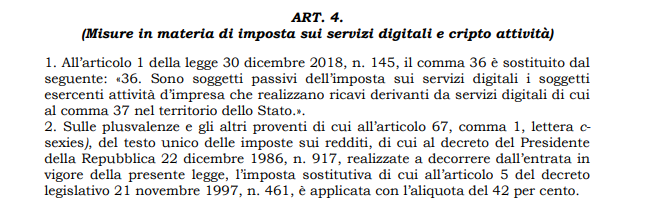

The law comprises 144 articles and outlines several budgetary measures. Article 4 specifically addresses the taxation of digital services and crypto activities. Starting January 1, 2025, this new tax will impact investors engaging in crypto trading. Many are now questioning the future of crypto investments in Italy.

Previously, Deputy Minister of Economy Maurizio Leo announced the new tax law, explaining that the government expects to generate around €68 million (approximately $73 million) via these stricter measures, as part of its plan to tap into new revenue sources.

Additionally, the law removes the minimum revenue requirement for Italy’s Digital Services Tax (DST), which was initially introduced in the 2019 budget. Commonly referred to as the “web tax,” the DST impacts digital services provided by large tech companies operating in Italy.

However, as the crypto world continues to evolve, tax policies like these could have far-reaching impacts on the global market.

Highlighted News Of The Day

Binance Partners with Paymonade for Seamless Crypto to Card Sales

Source: https://thenewscrypto.com/italy-raises-crypto-tax-to-42-in-2025-budget-law/