- LTC has declined by 3.74% over the past week.

- Despite the decline, Litecoin’s on chain activity surges with 512.8 million moving on-chain.

After a sustained decline, Litecoin [LTC] saw a brief uptrend breaking out of a descending channel. However, since hitting a local high of $76, the altcoin has experienced a sharp decline.

Despite the dip on weekly charts, LTC’s on-chain activities have surged to a 17 months high.

Litecoin on-chain activities surge to 2023 levels

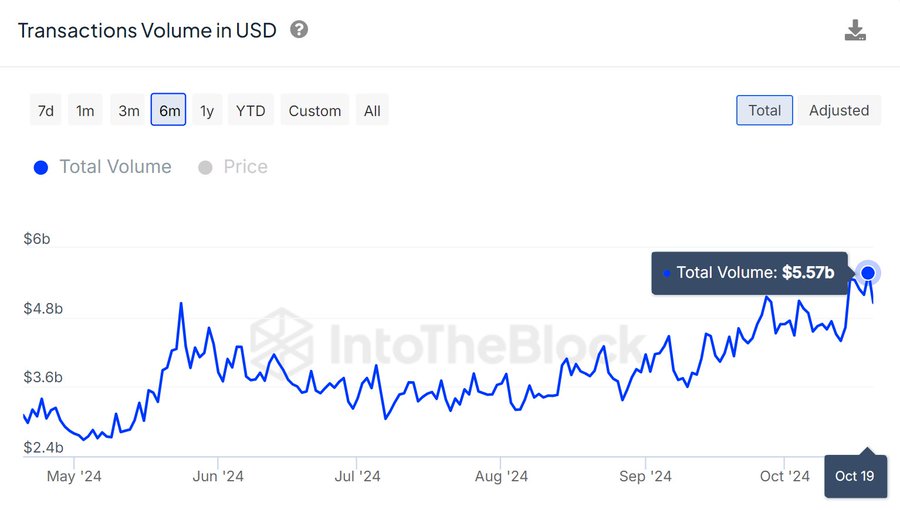

According to IntoTheBlock data, Litecoin has experienced one of the most active weeks in the past year.

Source: X

As such, the Litecoin blockchain has seen 512.8 million tokens move on-chain over the past week, amounting to $36.6 billion.

Such levels were last experienced in May 2023 with an average of $5 billion daily. Based on this observation, it indicates that Litecoin is continually active with many participants across various platforms.

Usually, a surge in on-chain activity points to increased adoption, signaling a higher demand for LTC.

What it means for LTC price charts

As observed above, LTC has experienced a high demand with a rise in chain activities. This suggests the altcoin is enjoying positive market sentiment.

Notably, the past week has seen LTC decline after enjoying a strong upswing. In fact, as of this writing, LTC was trading at $68.81. This marked a 3.01% decline over the past day with the altcoin also dropping by 3.74% on weekly charts.

Prior to this, Litecoin had been on an upward trajectory hiking by 2.47% over the past month.

Although the altcoin has declined over the past week, the overall market remains positive.

Source: Tradingview

For instance, +DI of DMI at 23 sits above -DI which is at 18. This suggests that the uptrend momentum still remains positive and is likely to continue.

This phenomenon was further supported by a positive Chaikin Money Flow (CMF) at 0.03. This signals a higher buying pressure suggesting that buyers are still dominant.

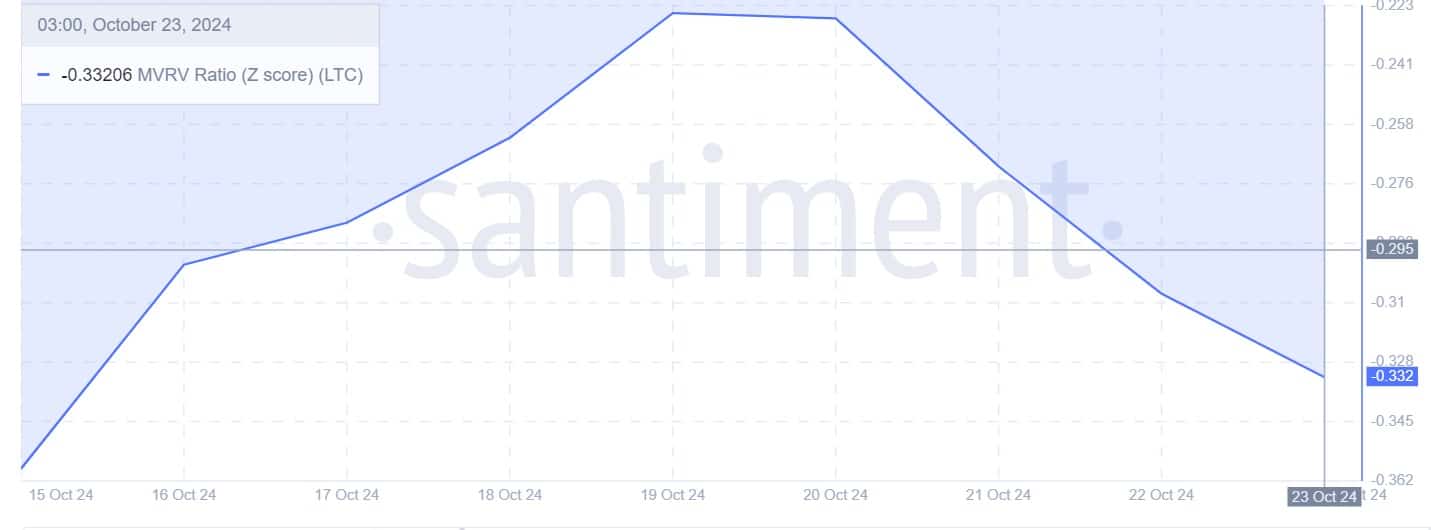

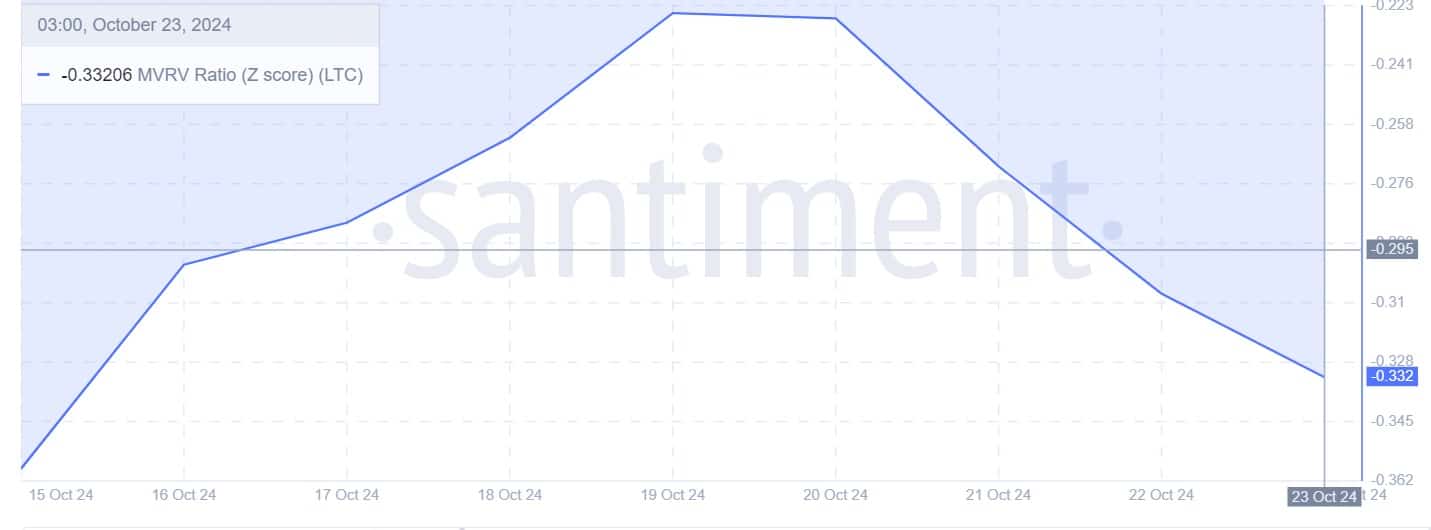

Source: Santiment

Looking further, the MVRV ratio Z score 0f -0.3 suggests a good buying opportunity for long-term holders and investors to accumulate. Thus, with the dip, buyers can enter the market which in turn increases buying pressure, thus driving prices up.

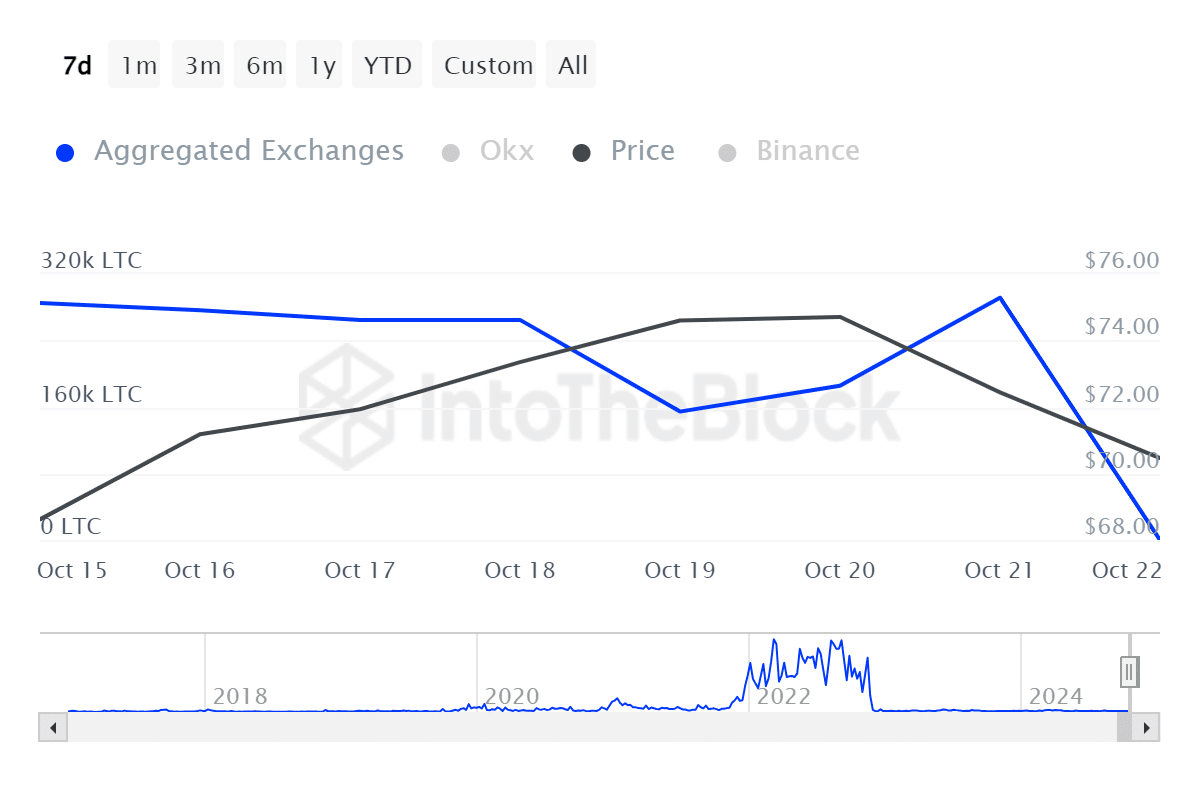

Source: IntoTheBlock

Additionally, Litecoin’s Total Flows have declined from a high of 291.5k to a low of zero. This suggests that there are reduced flows into exchanges signaling holding behavior. Therefore, investors are keeping their LTC off exchanges anticipating price appreciation.

Read Litecoin’s [LTC] Price Prediction 2024–2025

Simply put, the surge in on-chain activities suggests that LTC is experiencing a high demand. With positive positive sentiment and investor favorability, LTC is well-positioned to reclaim, the monthly trend.

Therefore, if these conditions hold, will reclaim the $76 resistance level where it has faced multiple rejections. Consequently, if the downside persists, LTC will find the next support at $63.4.

Source: https://ambcrypto.com/litecoin-set-for-recovery-ltcs-36b-on-chain-activity-suggests/