The relationship between Bitcoin and traditional markets like the S&P 500 and commodities, including gold and copper, suggests challenges ahead.

Two recent charts from Bloomberg’s Senior Commodity Strategist Mike McGlone discuss Bitcoin’s position in the market. The charts suggest that Bitcoin may face challenges going forward, especially in maintaining its status as a high-beta risk asset.

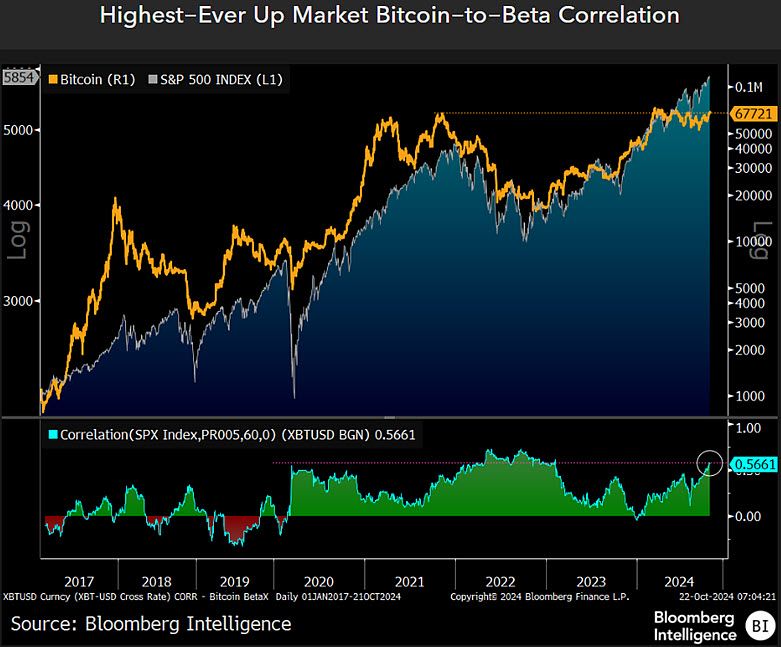

Bitcoin’s High Correlation with S&P 500

The first chart shows the highest-ever 60-day correlation between Bitcoin and the S&P 500 during a rising market. Notably, the correlation hit 0.5661, indicating that both assets are aligning strongly. This trend had stalled earlier in the year, per a previous report from The Crypto Basic.

The renewed correlation suggests that Bitcoin, which some market watchers have viewed as a decentralized and independent asset, is now trading in lockstep with traditional equity markets.

This trend could signal a change in Bitcoin’s behavior. Investors have historically seen BTC as a hedge against traditional financial assets, but its growing correlation with the S&P 500 indicates that it is now behaving more like a high-beta risk asset.

https://x.com/thecryptobasic

McGlone noted that this strong correlation may place a burden on Bitcoin’s beta to keep rising. Essentially, this means Bitcoin’s ability to outperform may depend on broader market performance, particularly in the context of economic growth and risk appetite.

Additionally, McGlone drew a parallel between Bitcoin and copper, suggesting that both assets face similar issues in terms of their beta performance. Veteran trader Brandt has also confirmed Bitcoin’s bearish consolidation, but he remains optimistic.

Meanwhile, copper has seen a trajectory that mirrors Bitcoin’s, indicating that both assets are sensitive to the shifts in economic growth expectations. This suggests Bitcoin may struggle to maintain its upward momentum if economic conditions weaken.

Gold Outperforming Bitcoin

The second chart points out Bitcoin’s underperformance relative to gold, despite the S&P 500 remaining relatively elevated. Brandt also previously discussed this position.

Gold Outperforming Bitcoin and Elevated Risk Assets – #Bitcoin lagging #gold despite the record-setting S&P 500 may augur headwinds for risk assets. At 24 ounces of the metal equal to the crypto on Oct. 22, the Bitcoin/gold ratio is below a high of 34 in March and a 2021 peak of… pic.twitter.com/oqYxi2yZht

— Mike McGlone (@mikemcglone11) October 23, 2024

For context, the Bitcoin-to-gold ratio has fallen to 24 ounces of gold per Bitcoin, down from a high of 34 in March 2024 and a peak of 37 in 2021. This decline suggests that while Bitcoin has seen growth since 2021, it has not kept pace with gold’s recent strength.

McGlone suggested that this lagging performance could signal headwinds for Bitcoin and other risk assets. Gold’s outperformance during periods of economic uncertainty or market volatility has long established it as a safe-haven asset.

The fact that Bitcoin, which most market commentators call “digital gold,” is struggling to keep up with physical gold raises questions about its long-term position as a store of value.

The continued growth of the S&P 500, despite Bitcoin’s lag relative to gold, may also point to market risks. While equities have remained strong, Bitcoin’s decoupling from gold may show growing investor caution cryptocurrencies.

Discouragingly, this caution could become more pronounced if inflationary pressures, geopolitical risks, or other macroeconomic factors continue to weigh on global markets. At press time, BTC currently trades for $66,702, down 1.03% over the past 24 hours.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/10/23/bloomberg-analyst-bitcoin-could-face-challenges-ahead-amid-correlation-with-sp-500/?utm_source=rss&utm_medium=rss&utm_campaign=bloomberg-analyst-bitcoin-could-face-challenges-ahead-amid-correlation-with-sp-500