- Bitcoin ETF cumulative inflows reach $21 billion, with BTC around $2,500 shy of $70,000.

- IBIT emerges as the market leader.

Bitcoin’s [BTC] recent price journey has been nothing short of impressive. The coin has continued to make headlines be it for crossing critical price thresholds or hitting milestones in exchange-traded funds (ETFs) inflows.

This week, BTC surged past the critical $68,000 mark, inching ever closer to the $70,000 valuation.

However, at press time the price had dipped to $67,442. While this marked a 2.25% drop over the past day, the monthly gains remained strong at 6.86%.

Now, the king coin remains around 3.65% away from reaching $70,000, and with the record inflows in Bitcoin ETFs, achieving this target wouldn’t be too far-fetched.

According to data from SoSo Value, on 21st of October, the total net inflows stood at $294.29 million, contributing to a cumulative total inflow of $21.23 billion.

Moreover, the total net assets stood at $65.34 billion, representing 4.88% of the cryptocurrency’s total market capitalization.

Source: SoSo Value

BlackRock’s IBIT dominates the Bitcoin ETF market

Worth noting that a major contributor to these inflows was BlackRock’s iShares Bitcoin Trust (IBIT). Despite the price dip, IBIT recorded inflows of $329 million on 21st October.

Moreover, it outperformed all spot Bitcoin ETF products, surpassing $23 billion in total net inflows.

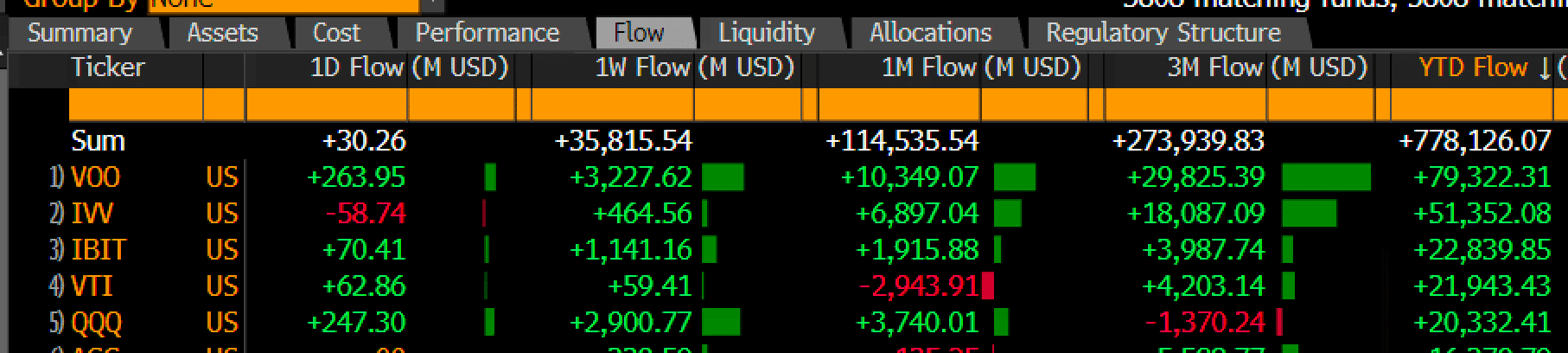

Eric Balchunas, senior ETF analyst at Bloomberg, noted on X that IBIT had an exceptional week. The ETF attracted $1.1 billion in new cash. Furthermore, it surpassed Vanguard’s VTI for third place in YTD flows.

Source: Eric Balchunas/X

As per the analyst, what made this achievement even more remarkable was that IBIT is a relatively new launch, competing with ETFs that have been established for over 20 years and manage hundreds of billions of dollars.

BlackRock’s IBIT now boasts $26 billion in AUM, placing it in the top 2% of all ETFs globally.

Bitcoin ETFs vs gold ETFs

These remarkable inflows raise questions about whether Bitcoin ETFs are pulling investors away from traditional safe-haven assets.

Balchunas weighed in on this competition between Bitcoin and gold. In an interview with Bloomberg Surveillance, he remarked,

“Bitcoin and the ETFs that launched may have stolen the thunder that would have otherwise gone to gold this year.”

The analyst estimated that gold could have seen inflows of up to $10 billion, without the emergence of Bitcoin ETFs.

Much of this shift, he suggested, is a result of Bitcoin’s rising popularity and its increasing role as a competitor to gold in the asset market.

Institutions stack as retail interest fades

BTC ETFs’ market position is a testament to rising institutional interest. Meanwhile, retail engagement has slowed. According to recent data from Google Trends, searches for “Bitcoin” and “Bitcoin ETF” have seen a marked decline.

Interest in “Bitcoin ETF” has remained subdued since the launch of spot ETFs in January 2024, with a score of just 2 last week.

Read Bitcoin’s [BTC] Price Prediction 2024 – 2025

Similarly, searches for “Bitcoin” have dropped significantly from March, with a score of 33 last week. This stark contrast highlighted the shift in market dynamics.

Source: https://ambcrypto.com/bitcoin-etfs-steal-golds-thunder-analyst-explains-investor-shift/