- SAND’s Open Interest jumped by 5.6% in the past 24 hours following a bullish breakout.

- The major liquidation levels were at $0.255 and $0.27, with traders over-leveraged at these levels.

The overall cryptocurrency market is experiencing a notable recovery.

Amid this, the virtual gaming platform The Sandbox [SAND] has broken out of a strong bullish pattern and shifted the sentiment from a downtrend to an uptrend.

SAND technical analysis and key levels

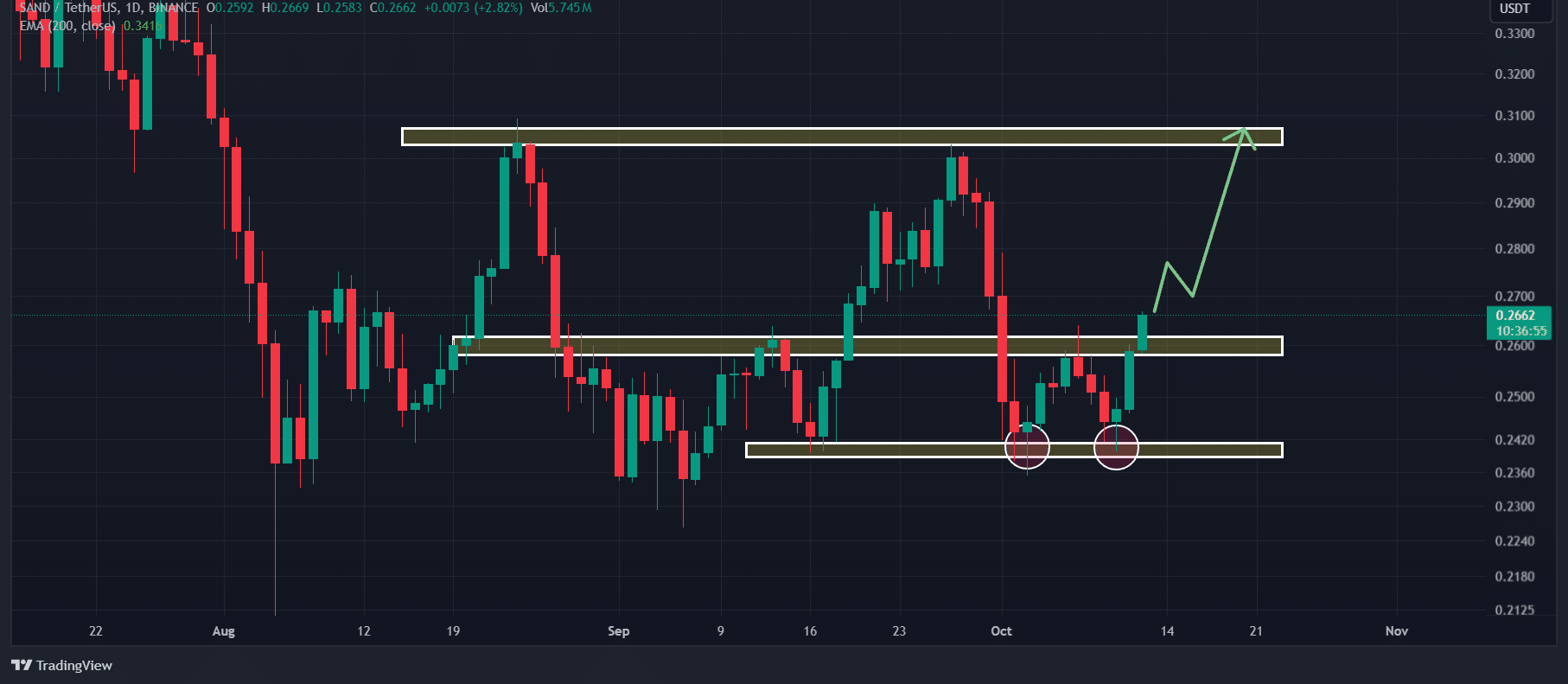

According to AMBCrypto’s technical analysis, SAND appeared bullish at press time as it broke out of a double-bottom price action pattern. The breakout was confirmed by the daily candle closing above the neckline.

Source: TradingView

Based on the recent price performance, if SAND closes a daily candle above $0.264, there is a strong possibility it could soar by 15% to reach the $0.305 level in the coming days.

Additionally, SAND’s Relative Strength Index (RSI) stood at 52.30 at press time, hinting at a potential upside rally ahead.

Despite SAND’s bullish outlooks, the 200 Exponential Moving Average (EMA) indicated a downtrend. When an asset trades below the 200 EMA, traders and investors generally consider it to be in a downtrend, and vice versa.

SAND’s bullish on-chain metrics

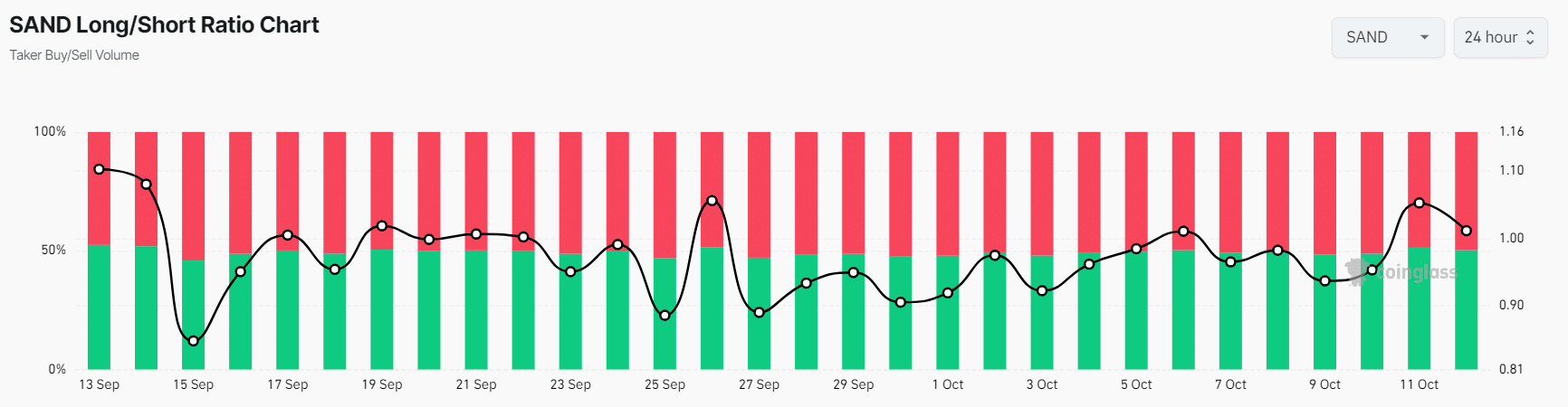

SAND’s bullish outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, SAND’s Long/Short Ratio was 1.03 at press time, indicating bullish market sentiment.

Source: Coinglass

Additionally, its Futures Open Interest jumped by 5.6% in the past 24 hours and 3.91% over the past four hours.

This suggested growing traders’ interest in the SAND token following the breakout of the double-bottom price action pattern.

Major liquidation levels

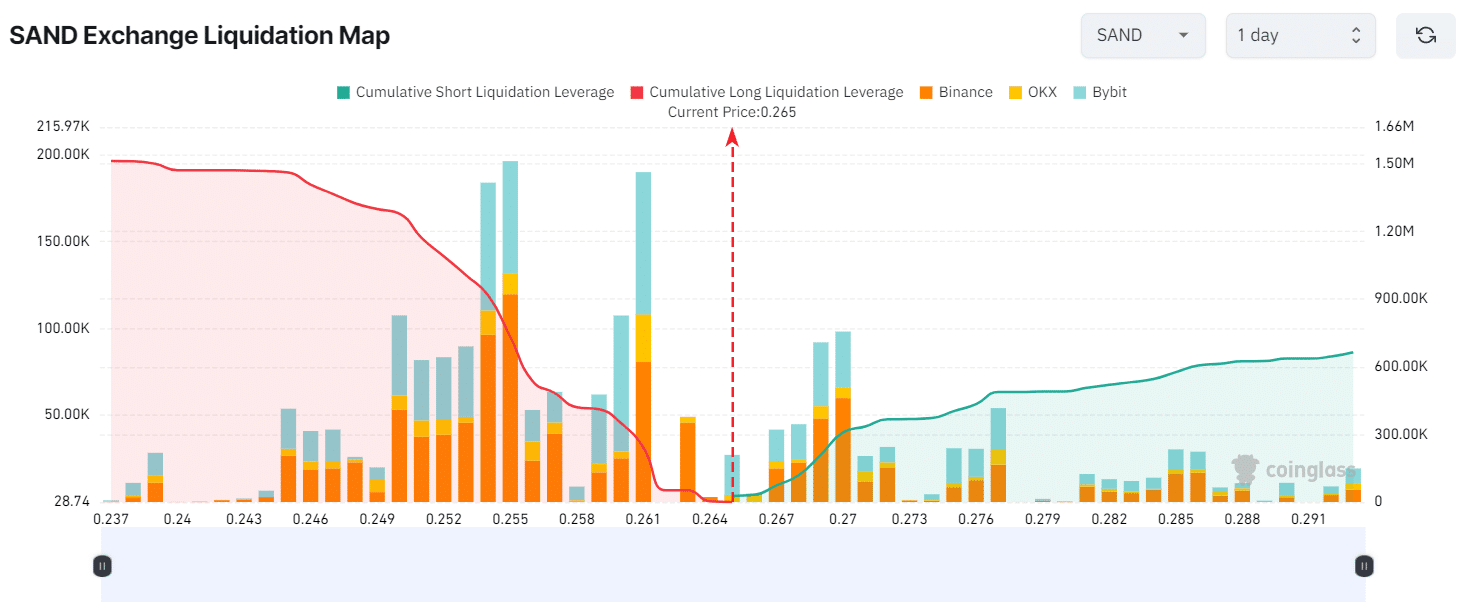

As of now, the major liquidation levels are at $0.255 on the lower side and $0.27 on the upper side, with traders over-leveraged at these levels, according to Coinglass.

Source: Coinglass

If the market sentiment remains unchanged and the price rises to the $0.27 level, nearly $308,620 worth of short positions will be liquidated.

Conversely, if the sentiment shifts and the price falls to the $0.255 level, approximately $732,960 worth of long positions will be liquidated.

This liquidation data shows, that bulls’ long positions are more than double of bears’ short positions.

Combining all these on-chain metrics with technical analysis, it appears that bulls are currently dominating the asset and have the potential to support SAND in the forthcoming upside rally.

Read The Sandbox’s [SAND] Price Prediction 2024–2025

Current price momentum

At press time, SAND is trading near $0.266 and has experienced a price surge of over 5.2% in the past 24 hours.

During the same period, its trading volume declined by 6%, indicating lower participation from traders and investors.

Source: https://ambcrypto.com/will-sand-breakout-rally-15-assessing-key-factors/