- Base continues to hit new all-time highs in multiple areas, underscoring its dominance.

- Base Network Utility Drives Transactions to historic highs

Base has been gunning to for the top spot as the leading Ethereum [ETH] layer 2 network.

It has been on an impressive growth journey so far this year, and recent observations indicate that it is solidifying its leading position.

Base TVL highlights just how much growth the network has achieved so far. It has been on an overall uptrend in the last 12 months, and it continues to climb.

Base’s TVL soared to a $2.30 billion this week, which is officially the highest total value locked that it has achieved since its launch.

Source: DeFiLlama

The robust TVL performance was also accompanied by healthy stablecoin market cap growth. The latter also soared to a new ATH of $3.72 billion.

The strong TVL growth indicates that a lot of liquidity has been flowing into the layer 2’s ecosystem.

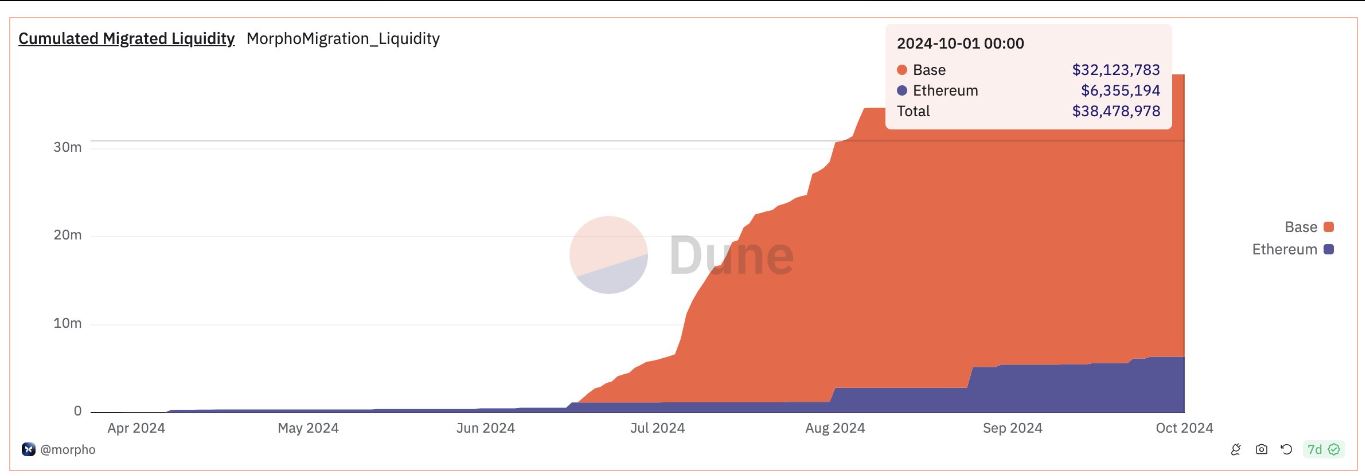

This is in line with recent Dune data, which revealed that liquidity flowing into Base has been outperforming that of the Ethereum mainnet.

According to the data, Base, roughly $32.1 million worth of liquidity was migrated into its ecosystem between June and October. Meanwhile, only $6.35 million migrated into Ethereum during the same period.

Source: Dune

Reports indicate that most of the liquidity flowing into Base during the aforementioned period migrated from CompundV2. Meanwhile, most of the liquidity flowing into Ethereum has been coming from Aave.

Robust transaction activity is fuel

These observations indicate that the layer 2 network has been enjoying robust usage.

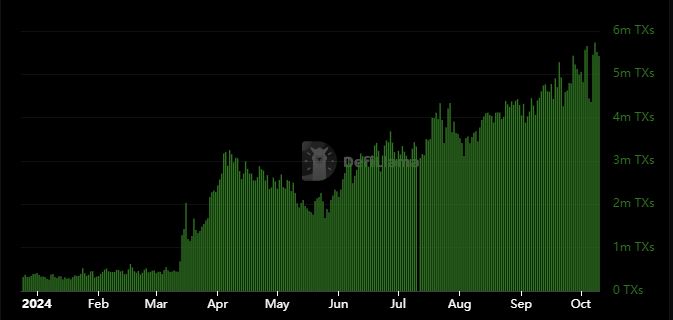

According to DeFiLlama, daily transactions on the Base network have been steadily growing this year. They also reached a new ATH this week.

Transactions peaked at 5.73 million TXs on the 8th of October, which is the highest daily transaction it has achieved so far.

To put things into perspective, the Base network’s daily transactions were lower than 1 million transactions between January and mid-March.

Source: DeFiLlama

These findings underscore Base’s impressive rise to become one of the top Ethereum networks. It ranked second in the list of top Ethereum layer 2 networks in terms of TVL, only outperformed by Arbitrum [ARB].

The latter had a $2.32 billion marketcap at the time of writing, which means it could potentially secure the top spot if it maintains the TVL uptick.

In conclusion, Base is one of the best performing crypto networks so far this year thanks to a combination of factors. Robust address growth underscoring utility, healthy stablecoin presence and an attractive liquidity environment.

Source: https://ambcrypto.com/base-liquidity-inflows-rise-as-tvl-beats-ethereum-mainnet/