Regulators have begun a very aggressive and intense regulatory supervision of cryptocurrencies, with an overwhelming consensus on the need for industry control. The crypto industry is viewed as a dangerous and problematic area that needs to be protected by the nanny state. Despite the aforementioned narrative, traditional industries-personified by banks-have taken much heftier punishment for mal-instincts and for transgressions.

Traditional Industry Fines vs. Crypto

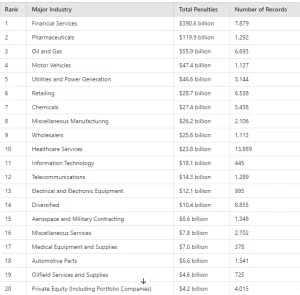

The table below presents the top 20 industries by total fines imposed since 2000, highlighting just how significant penalties in traditional sectors have been compared to the relatively minor infractions in the crypto space.

The data tells an undeniable story: regulatory breaches in traditional industries are extensive and costly, yet these sectors continue to operate without the same level of stigma that cryptocurrencies face. The billions of dollars in fines highlight the widespread issues in sectors that have historically been trusted, from banking to pharmaceuticals.

Why Is Crypto Taking the Heat?

Despite the numbers indicating far worse misconduct in other sectors, the crypto industry continues to be scapegoated. Here are some key reasons why:

- Fear of the Unknown: Cryptocurrencies represent a shift away from centralized control, challenging established norms. Their decentralized nature presents unique challenges to traditional regulatory frameworks, creating fear and resistance among regulators who are more comfortable with the traditional financial system.

- Perceived Risks and Volatility: Crypto assets are often perceived as more volatile and risky, with associations to illegal activities like money laundering and fraud. However, in terms of fines and regulatory action, cryptocurrencies have not yet approached the level of traditional industries such as banking or pharmaceuticals.

- Threat to Established Institutions: The disruptive potential of cryptocurrencies has also led to regulatory pushback. By offering a decentralized alternative to the traditional financial system, crypto is viewed as a threat to established institutions that benefit from the status quo. This resistance is reflected in the disproportionate scrutiny faced by the crypto industry.

The narrative that crypto is problematic needs to be reevaluated. Since 2000, financial services have been fined $390 billion and have not gotten the kind of regulatory crackdowns received by crypto, comprehensive regulations and education for policymakers, as well as enabling frameworks, are essential. Balanced oversight could foster the blockchain innovation necessary in ensuring equity across different sectors in the process of fostering financial inclusion while fighting politically-motivated scapegoating of the crypto industry.

Ironically, while they have been fined for various infractions ranging from fraud to market manipulation, these institutions continue unabated beyond monetary penalties. For many of these banks, fines are counted among the costs of doing business, with no substantial alteration to their operations or accountability frameworks.

Source: https://www.cryptonewsz.com/banks-fined-390b-vs-crypto-regulation/