Although Ethereum has increased by 5.70% in the past three days, the short-term outlook remains uncertain. A close look at on-chain metrics reveals sell signals that hint at an incoming Ethereum price crash that could fool investors.

Assessing Ethereum Price Crash Chances

Due to Bitcoin’s recent uptick to $62.2K, the crypto market has noted a significant recovery. Ethereum has followed these cues and has bounced nearly 6% to $2,444. Although the demand zone, extending from $2,252 to $2,440, is a key reversal area, the overall outlook remains uncertain.

4 Signals That ETH Investors Should Focus

Here are five signals that suggest the Ethereum price crash is coming soon. Investors need to be alert and pay attention to these signs.

Uncertainty is Not Good for Ethereum

The Uncertain macroeconomic policies coupled with the Fed’s decision to cut interest rates by a 50 basis point hike coupled with geopolitical tension due to the Iran-Israel war are two main catalysts that could impact ETH. These events affect Bitcoin (BTC) and in turn affect Ethereum and the broader crypto market.

No ETH Buy Signal Yet

The 365-day Market Value to Realized Value (MVRV) Ratio is hovering around -14%, but last cycles have seen this indicator slide as low as 70% before Ethereum price formed a bottom. This move suggests that there has not been a capitulation yet and that a further crash could be incoming for ETH price.

Whales Not Interested in Ether Prices Here

The whale transactions worth $100K or more have been on a downtrend since the yearly highs. This development suggests that institutions are not interested in buying ETH at the current price levels. Combining this indicator with the above, hints that it wouldn’t be surprising if Ethereum price crashes from the current level.

Making the outlook even worse is the spike in ETH held on exchanges, which is a bearish sign and hints at a potential crash if things go south.

No New New Capital Inflow for Ethereum

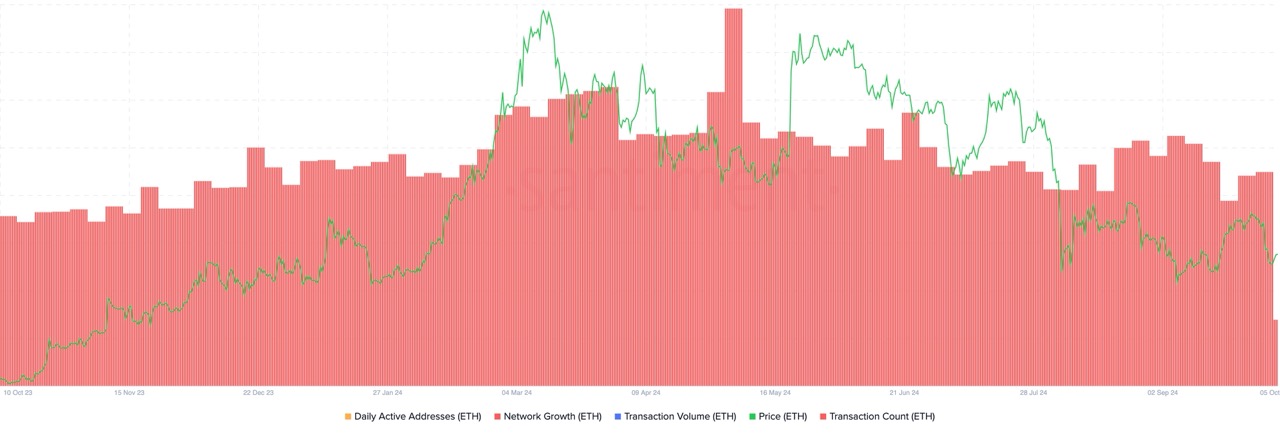

The network growth indicator has been on a downtrend similar to the whale transaction count, indicating that new capital is not flowing into ETH. This metric also suggests that investors do not find the current prices alluring enough to buy.

Despite the short-term rally in Bitcoin and the broader crypto markets, investors should be cautious with bullish Ethereum price prediction. If the Iran-Israel war escalates, it could have major implications on the equities and the crypto markets. Historically, war has always been bearish for the stock market and has caused massive corrections or full blown reversals.

Frequently Asked Questions (FAQs)

Key on-chain metrics include the 365-day MVRV Ratio, whale transactions, ETH held on exchanges, and network growth.

Whale transactions and network growth indicate institutional interest and new capital inflow into Ethereum.

Geopolitical tensions, such as the Iran-Israel war, may negatively impact Ethereum price due to historical correlations with market corrections and reversals.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/ethereum-price-crash-alert-dont-be-fooled-pay-attention-to-these-signals/

✓ Share: