With Bitcoin price facing a stiff resistance around $62.2K, the chances of a quick reversal are high. This move would further extend the ongoing seven-month consolidation. Regardless of this sideways price action, the long-term outlook for BTC remains bullish. BlackRock, the world’s largest asset manager, explained in a recent conference why owning Bitcoin (BTC) is crucial as the US dollar’s purchasing power has been on a free fall since 1913.

Bitcoin Price Trades at $62,000 Today

After noting a 2.20% increase on Friday, Bitcoin trades today at $62,000. Weekends generally lack liquidity due to obvious reasons. As a result, crypto markets, including BTC, could experience heightened volatility.

BlackRock: BTC Could be a Hedge Against Weakening US Dollar

BlackRock Explains Why Owning BTC is Important in Brazil’s 2024 Digital Asset Conference as Bitcoin price trades around the $62K. The asset manager explained that the purchasing power of the US dollar has dropped from $1 in December 1913, when the US established the Federal Reserve system to $0.03 as of December 2023.

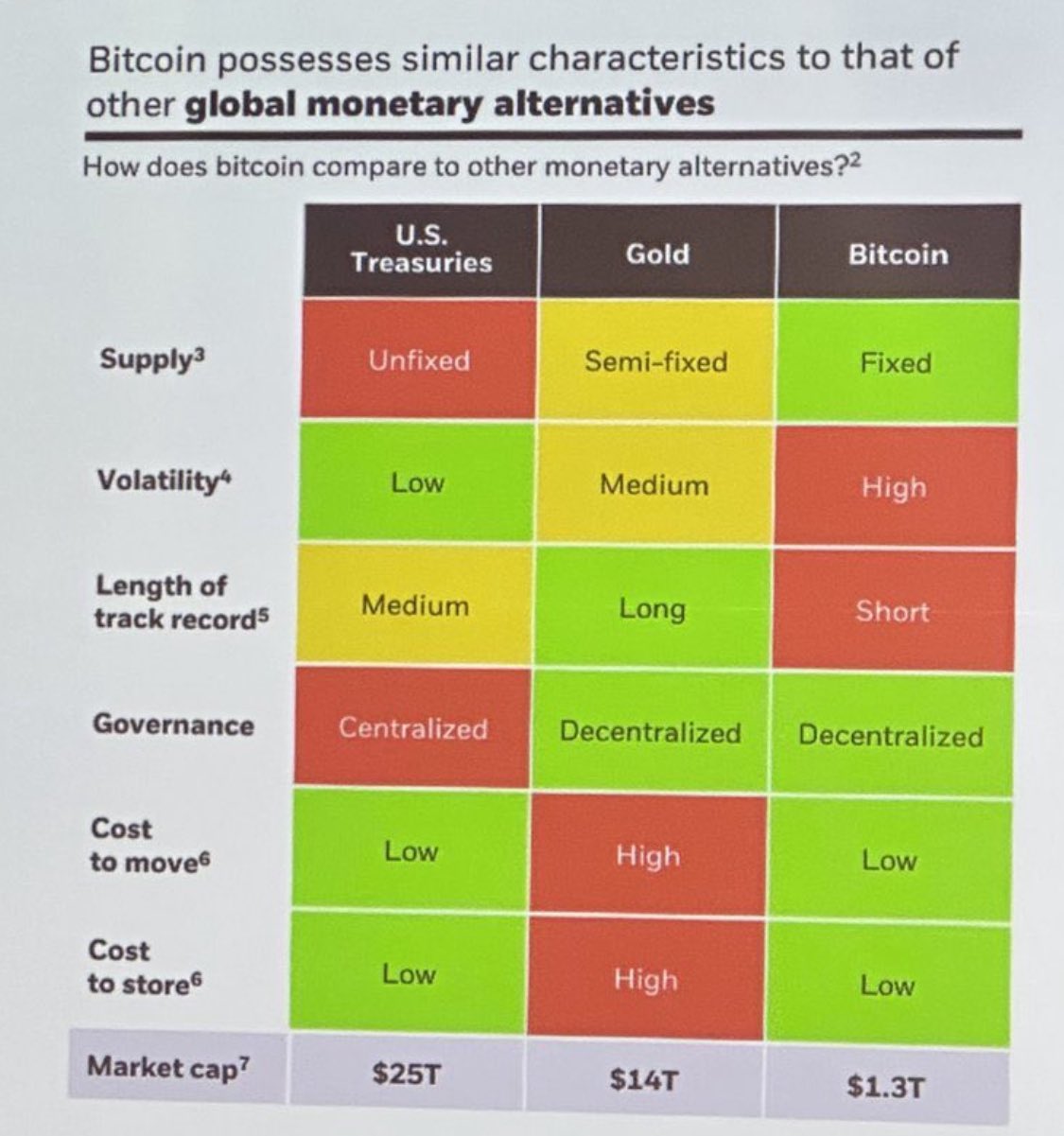

In another slide, BlackRock compared the US Treasuries with Gold and Bitcoin to showcase its properties. While cryptocurrencies are highly volatile, the asset manager highlighted how BTC serves as a global monetary alternative with its fixed supply, decentralized governance, and low transaction and storage cost.

Considering Bitcoin’s market capitalization is just $1.3 trillion, it is still in the early stages, especially comparing it to Gold’s $14 trillion and the US treasury’s $25 trillion. Furthermore, Bitcoin falls under the inflation hedge category, making it a viable alternative against weakening purchasing power of the US dollar.

BTC Price Forecast: More Pain Ahead?

The three-day BTC price chart shows bulls’ clear attempt to shift the trend after creating a higher low and higher high in September after months of lower lows and lower highs. The Bitcoin chart also shows that the key level to overcome would be $65.5K, which has served as key support and resistance levels in the past seven months.

If this resistance level is overcome into a support level, it should trigger a rally to $70K. Considering that the historical Bitcoin price performance has been bullish in the fourth quarter, it wouldn’t be surprising if BTC aims for a new all-time high (ATH).

The daily Bitcoin chart shows bulls’ attempt to revisit the $63.9K to $65K resistance zone. Here, BTC buyers will face a test of strength. Failure to overcome the said hurdle could result in a correction that knocks the asset down into the $60.3K to $61.8K resistance zone. Here, bears will face a challenge. Breaking below the $60.3K hurdle should result in a 4% to 5% correction to the next key support levels at $57.99K to $57.2K.

All in all, the long-term outlook for BTC remains extremely bullish with the recent attempt to set up a higher high and higher low in September. If this trend continues, Bitcoin price prediction hints at new ATH. The daily chart, however, suggests that more downside movement is possible, especially if BTC fails to overcome the $65K resistance level.

Frequently Asked Questions (FAQs)

Overcoming the $65K resistance level could trigger a Bitcoin price rally to $70K, while failure to do so may result in a correction to $60.3K-$61.8K or even $57.9K-$57.2K.

BlackRock views BTC as a hedge due to its fixed supply, decentralized governance, and low transaction costs, which contrast with the declining purchasing power of the US dollar.

BlackRock considers Bitcoin’s market capitalization ($1.3 trillion) relatively small compared to Gold ($14 trillion) and US Treasuries ($25 trillion), indicating potential for growth and adoption.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/bitcoin-price-hits-62k-as-blackrock-bets-on-btc-against-weakening-us-dollar/

✓ Share: