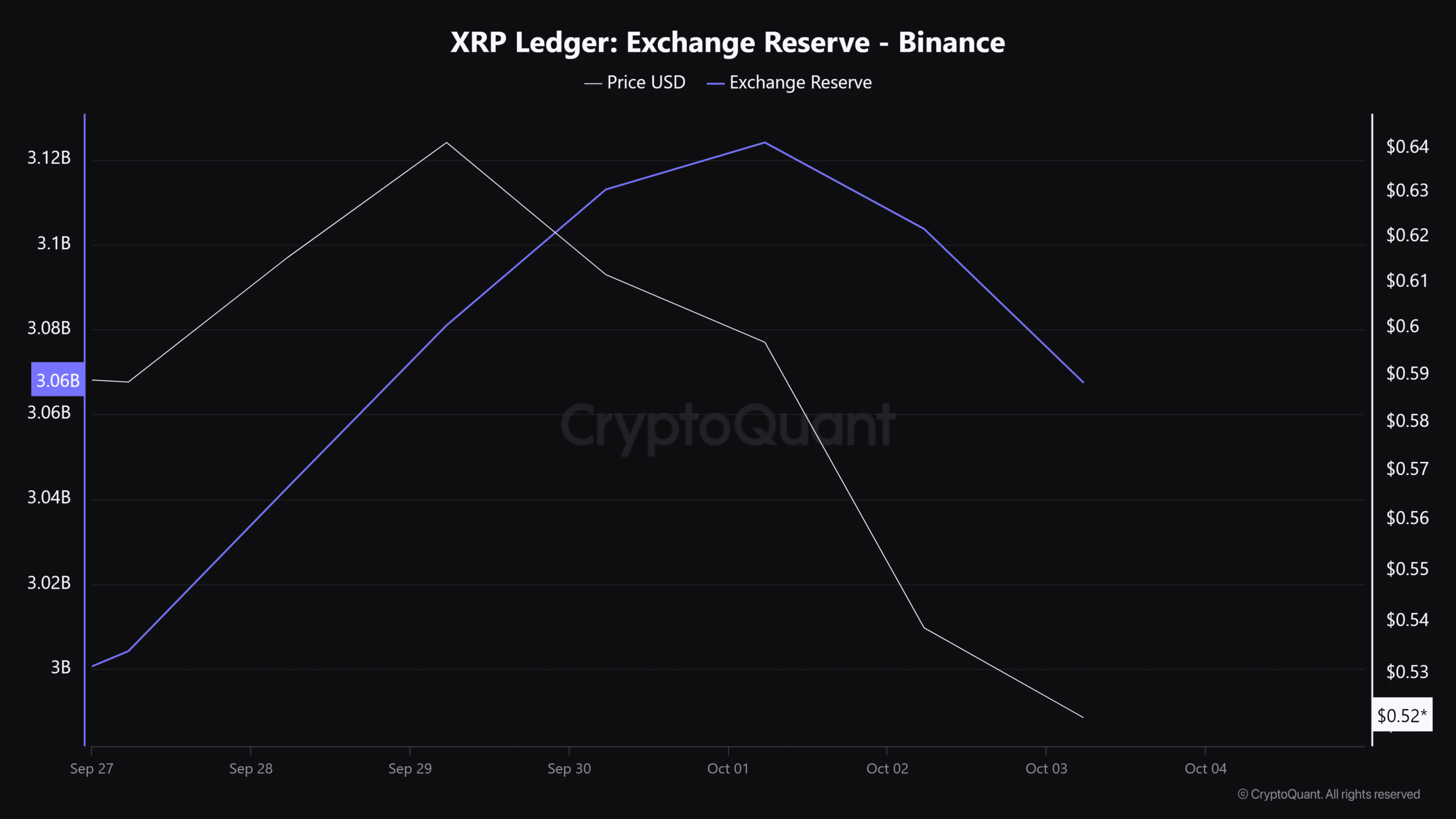

- Binance’s reserve has increased by 135 million XRP worth $72.63 million, over a period of seven days.

- With the current market sentiment and bearish metrics, there is a possibility that XRP price could reach the $0.48 level.

Ripple [XRP] is facing a potential price decline amid traders’ sentiment shifts and whales selling. Meanwhile, other major cryptocurrencies such as Bitcoin [BTC], Ethereum [ETH], and Solana [SOL] have also experienced notable price declines.

XRP exchange reserve soars

Data from CryptoQuant an on-chain analytics firm showed that whales and institutions continue to offload their XRP holdings to the cryptocurrency exchange.

According to the data, Binance’s reserve has increased by 135 million XRP worth $72.63 million, over a period of seven days. This significant rise in exchange reserve is often considered a bearish sign for the XRP holders.

Source: CryptoQuant

Institutions and whales offload their holdings to the exchanges either to stake or sell. In addition to this notable XRP transfer from wallets to exchanges, whales have dumped a massive 49.6 million tokens to Bitso and Bitstamp in the past 24 hours.

Why is XRP falling?

However, the potential reason for this significant XRP offloading is the recent appeal by the United States Securities and Exchange Commission (SEC) in the Ripple lawsuit, along with rising tensions between Iran and Israel.

At press time, XRP was trading near $0.52 and has experienced a price surge of 2.7% in the last 24 hours.

During the same period, its trading volume dropped by 50%, indicating lower participation from traders and investors, potentially due to fear of a further price decline.

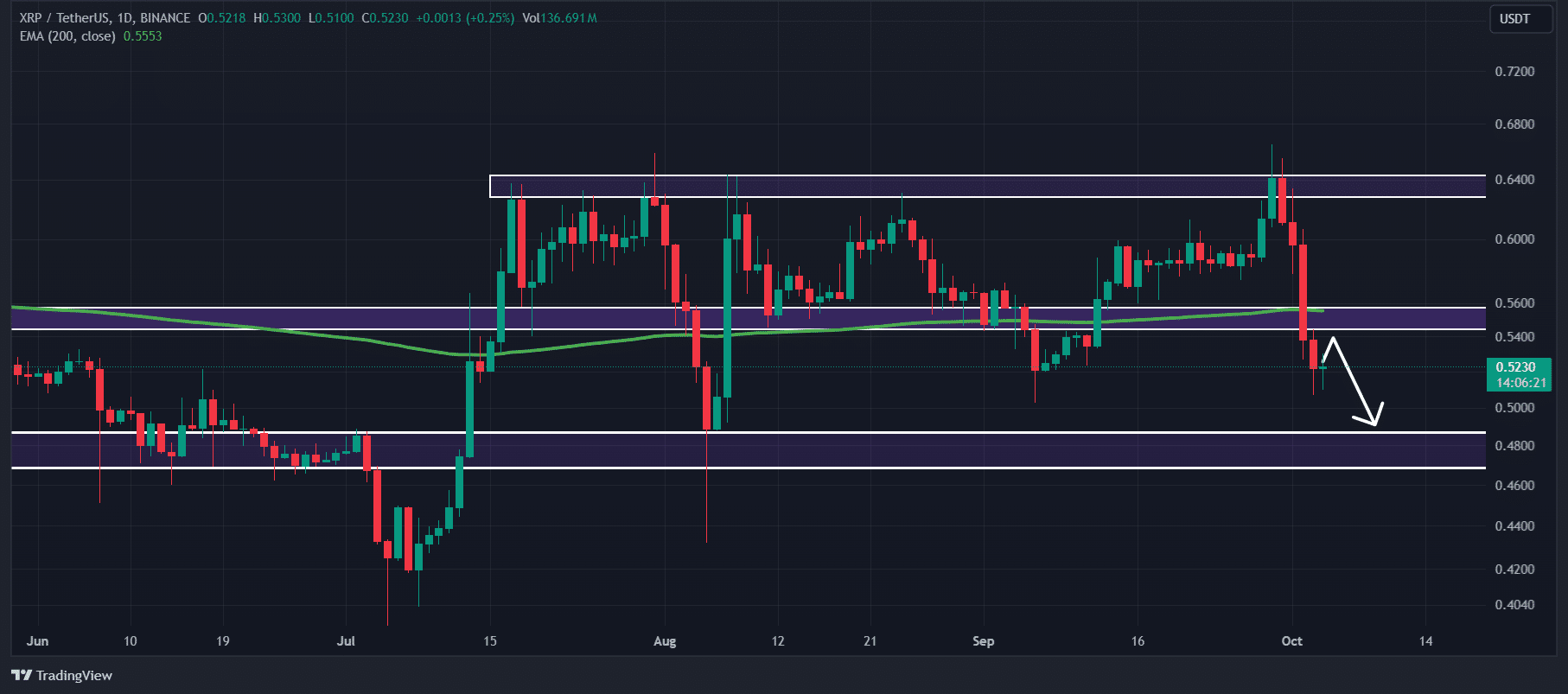

XRP technical analysis and upcoming levels

According to AMBCrypto’s technical analysis, XRP appears bearish as it has broken the crucial support level of $0.553 and is trading below the 200 Exponential Moving Average (EMA) on a daily time frame.

Source: TradingView

Given the recent price momentum, there is a strong possibility that the XRP price could reach the $0.48 level in the coming days.

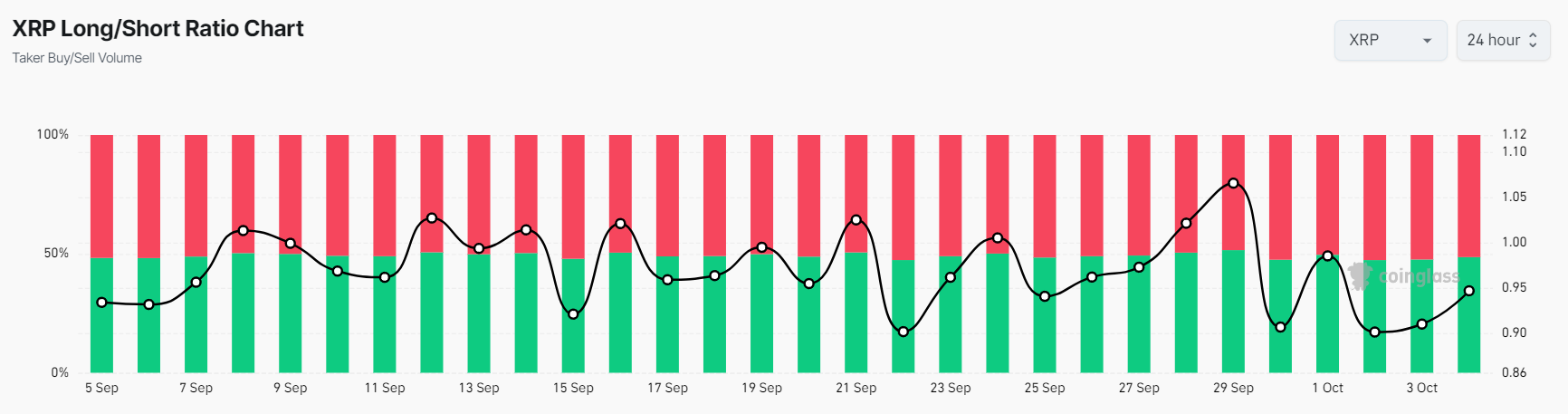

This negative outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, XRP’s long/short ratio currently stands at 0.94, indicating a strong bearish market sentiment among traders.

Source: Coinglass

Read XRP’s Price Prediction 2024–2025

Additionally, its future open interest has declined by 2.3% over the past 24 hours, suggesting that traders are either liquidating their positions or are hesitant to build new ones due to market uncertainty.

Combining these on-chain metrics, technical analysis, and whale activity, it appears that bears are currently dominating the asset, which could lead to a further price decline in the coming days.

Source: https://ambcrypto.com/135m-xrp-moved-to-binance-is-a-drop-to-0-48-next/