Solana declines with the rest of the crypto market but looks to leverage a surge in on-chain activity for a rally to late July highs.

Solana (SOL) recently experienced a 9% decline over the past two days after reaching a seven-week peak of $161.80 on Sept. 29. This drop came on the back of a broader crypto market downturn, which saw the altcoin market cap fall from $800 billion to $739 billion.

However, with strong on-chain activity data and positive market sentiment, Solana could be poised for a rally toward its next pivotal resistance level of $186.

Rising On-Chain Activity Amid Correction

Despite the price dip, the Solana ecosystem is witnessing a surge in on-chain activity across various decentralized finance (DeFi) protocols.

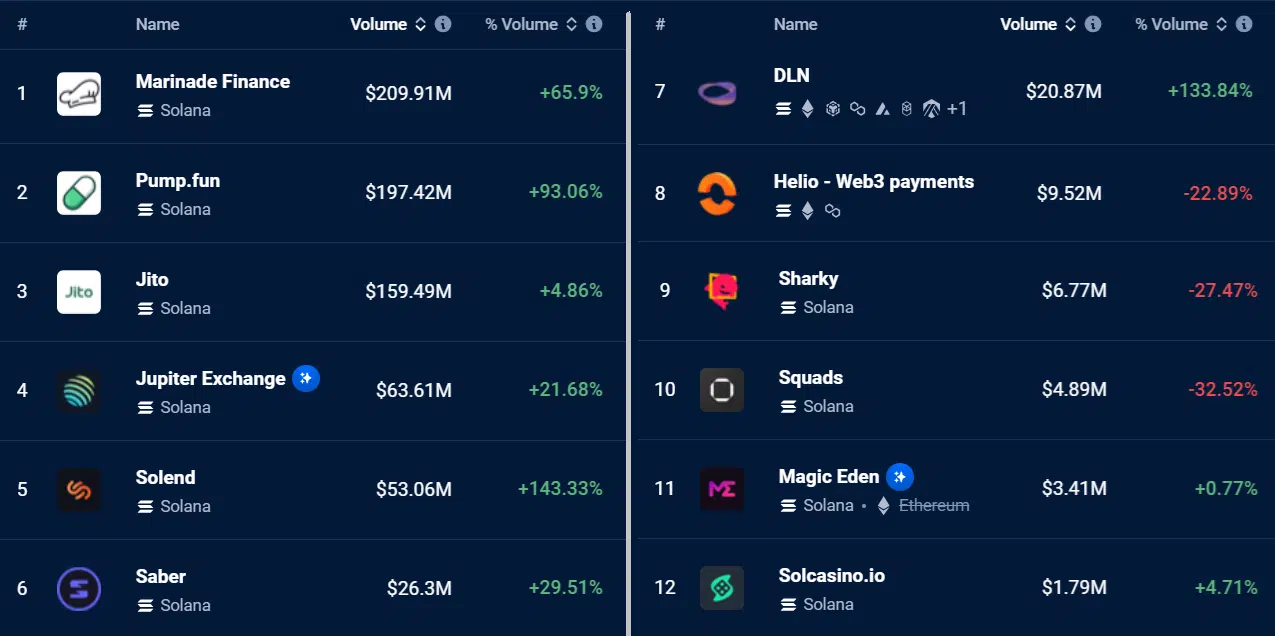

Data from dAppRader shows Solana DeFi staking protocol Marinade Finance recording $209.91 million in volume, up by a substantial 65.9%. Pump.fun is also seeing massive growth with a 93.06% surge in volume, reaching $197.42 million.

Another project seeing steady growth is Jito, with $159.49 million in volume, marking a 4.86% increase. Jupiter Exchange, Solana’s leading decentralized exchange aggregator, witnessed a 21.68% increase in volume to $63.61 million.

On the lending and borrowing side, Solend saw a notable 143.33% increase, bringing its total volume to $53.06 million. Meanwhile, Saber, a stablecoin swapping platform, recorded a 29.51% increase in volume, with total transactions reaching $26.3 million.

However, not all protocols are seeing the same level of success. Helio saw a 22.89% decline in volume to $9.52 million, and Sharky, a lending protocol, experienced a 27.47% drop. Despite these setbacks, overall Solana activity remains strong.

Solana Shows Rebound Potential

Solana’s price movements show a period of consolidation following the recent correction. At the time of writing, SOL is trading around $146.03, with the nearest support level at $144.76, as indicated by the pivot point.

This pivot position indicates that Solana could stabilize in the short term before making another upward move. Further support levels lie at $128.80 (S1) and $118.94 (S2), providing additional safety nets should the price experience further declines.

Meanwhile, the first resistance (R1) is at $160.72, a level it previously failed to hold during the late-September rally. If Solana breaks through this level, it could aim for $170.58 (R2), with a longer-term target at $186.54 (R3), which corresponds to a late July high.

Currently the +DI within the Directional Moving Index is at 19.7, trending downward, while the -DI sits at 18.5, also sloping downward, but at a slower rate. The Average Directional Index (ADX), at 20, shows that the market is in a consolidation phase with no strong trend direction yet.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/10/02/solana-drops-9-but-looks-to-leverage-on-chain-activity-surge-for-rally-to-186/?utm_source=rss&utm_medium=rss&utm_campaign=solana-drops-9-but-looks-to-leverage-on-chain-activity-surge-for-rally-to-186