- TIA is projected to continue its downward trajectory in the coming days, potentially reaching $4.55.

- This bearish trend is underscored by a death cross formation on the MACD, indicating a strong possibility of further declines.

According to CoinMarketCap, the overall crypto market’s capitalization fell by 2.63%, largely due to losses in altcoin.

Celestia [TIA], in particular, emerged as one of the top losers, recording a significant drop of 6.53%. As market sentiment grows increasingly negative, further analysis by AMBCrypto suggests TIA’s price may drop even more sharply.

Significant sell pressure is likely to drive TIA’s price downward

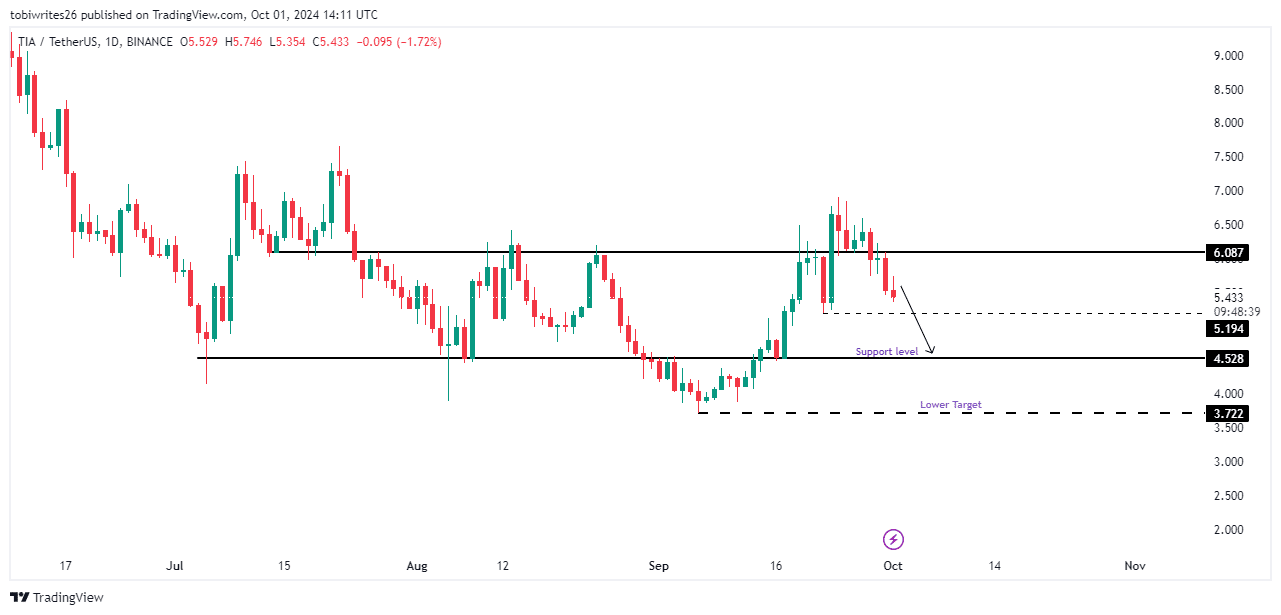

Since entering a consolidation channel in early July, TIA has oscillated within this range, reacting notably to the channel’s range. Currently, it has reacted from the resistance line, where it is facing significant selling pressure.

This resistance has become a focal point for market participants aiming to drive the price lower, as witnessed by TIA’s ongoing daily decline of 6.53%.

Source: Trading View

Should this selling pressure persist, TIA is expected to drop to the support level at $4.528, where it might stabilize temporarily. However, with continued bearish momentum, TIA could potentially reach its September low of $3.722 or even fall further.

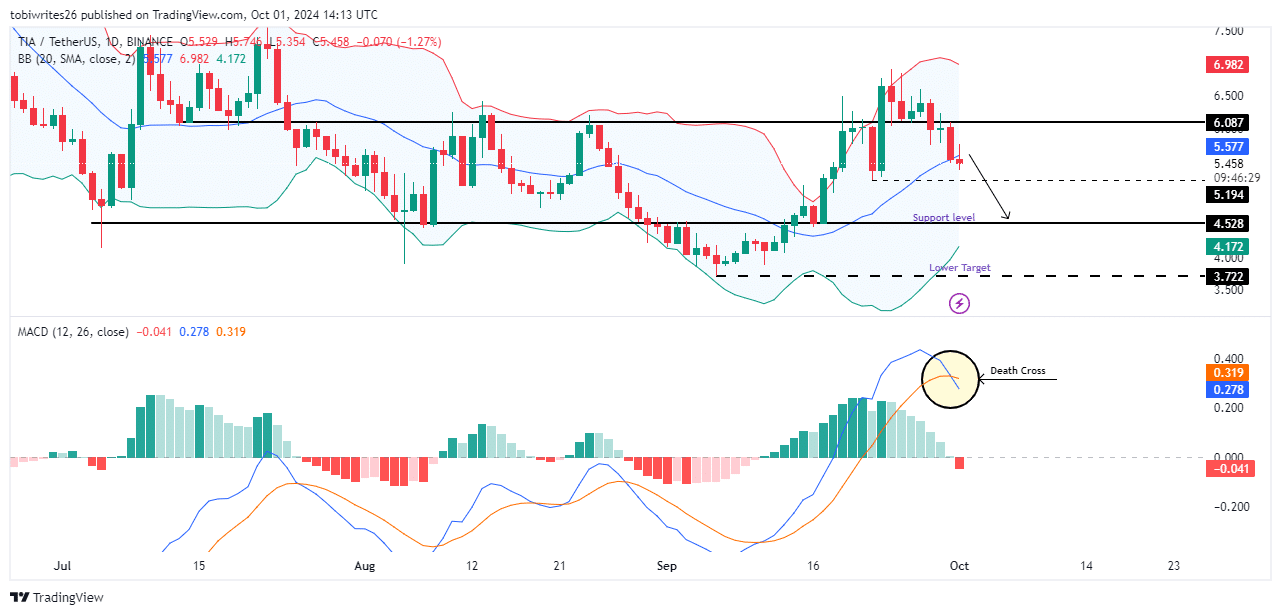

Death cross indicates further decline for TIA

TIA has developed a bearish pattern in the market, marked by its blue MACD line crossing below the orange signal line, signaling that bearish forces are gaining control.

Typically, such a pattern leads to a continued decline in both momentum and price. The likely next target is the support region at $4.55.

Source: Trading View

Additionally, the Bollinger Bands suggest this downward trend will persist. TIA has moved away from the upper band, which often indicates an overbought condition, and is now trending toward the lower zone, which could further drive down its price.

Market trends oppose bullish traders on TIA

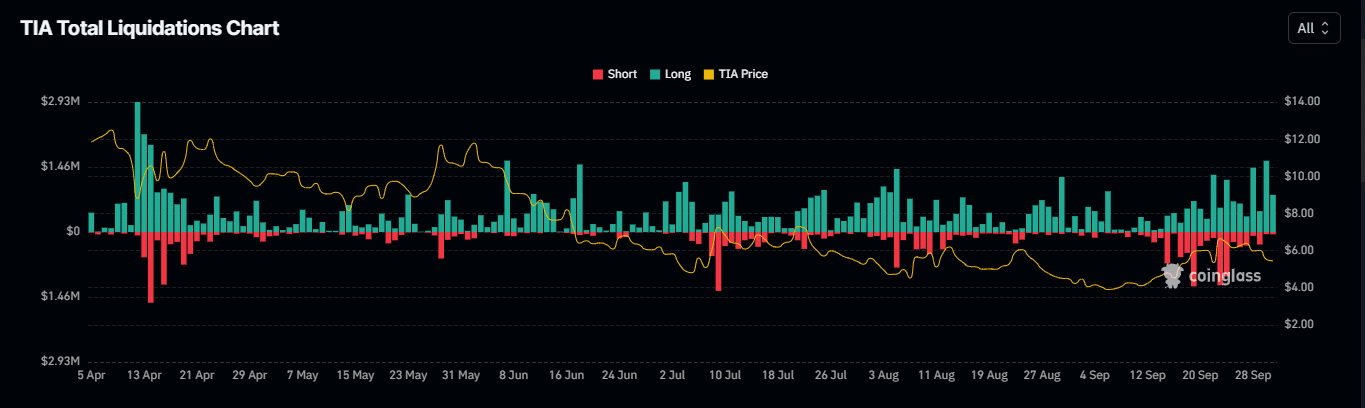

According to Coinglass, TIA has experienced a notable disparity between long and short liquidations over the last 24 hours.

At press time, a total of $1.24 million in TIA positions has been forcefully liquidated, with long positions accounting for $1.17 million of this total and short traders making up the remaining $75.84 thousand.

Source: Coinglass

Is your portfolio green? Check out the Celestia Profit Calculator

This significant difference in liquidations between long and short traders indicates a heavily bearish market sentiment, with more traders anticipating further price declines.

If the prevailing bearish sentiment persists, it’s likely that TIA’s downtrend will continue until substantial buying pressure emerges to stabilize the price.

Source: https://ambcrypto.com/why-tia-may-drop-to-4-55-as-bearish-death-cross-appears/