- At press time, Worldcoin navigated through a critical demand zone, signaling potential for further gains.

- Market sentiment continued to strengthen this bullish outlook, adding multiple factors that support the stability of the demand zone.

Despite a modest retracement of 2.38% in the last 24 hours, Worldcoin [WLD] has showcased strong performance over the past month, accumulating a total gain of 27.86% during this period.

It is noteworthy that such an upward movement over an extended period, followed by a minor price correction, typically indicates a market consolidation or retracement phase.

This pattern suggests that WLD is gearing up to resume its upward trajectory.

Retracement into demand zone

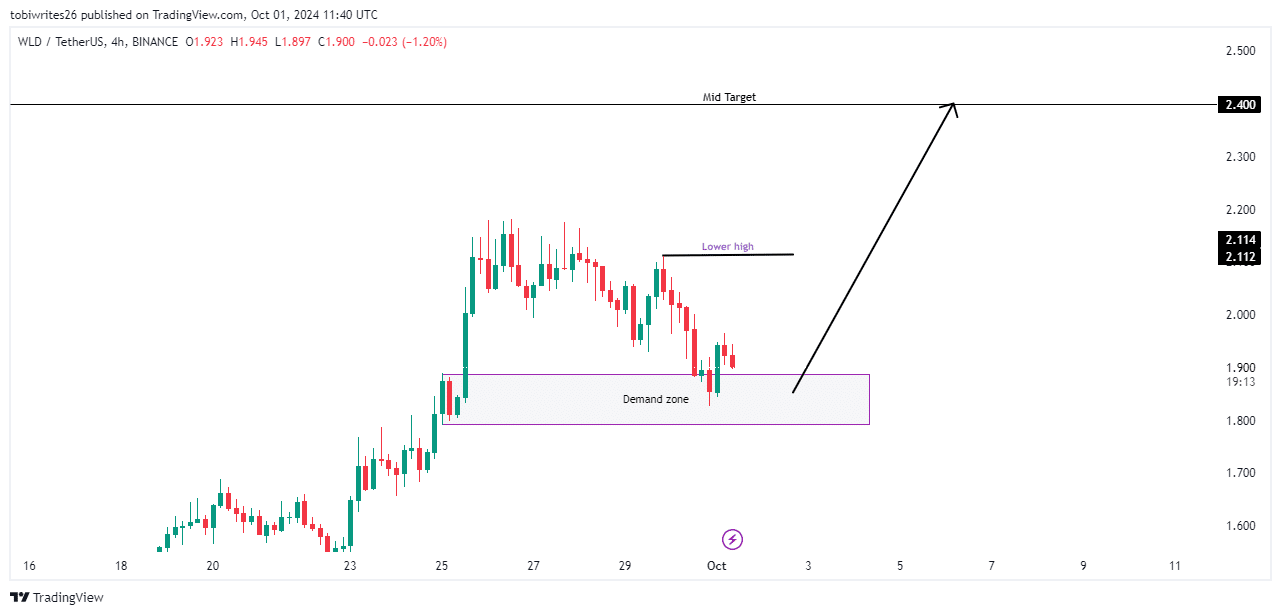

WLD’s recent downward movement, or retracement, has positioned it back into a key demand zone.

This zone is typically characterized by a concentration of buy orders, indicating that market participants are inclined to purchase at these levels.

Confirmation of this demand zone’s bullish impact will be evident once WLD’s price surpasses the current lower high on the 4-hour chart at 2.112.

Achieving this would set WLD on a path to reach a mid-level target of $2.4, potentially extending its upward trend to $3.0.

Source: TradingView

Conversely, trading below this demand zone would jeopardize WLD’s position, potentially leading to a decline toward 1.511, with additional selling pressure possibly driving it to its lowest point in 2024.

WLD is unlikely to fall

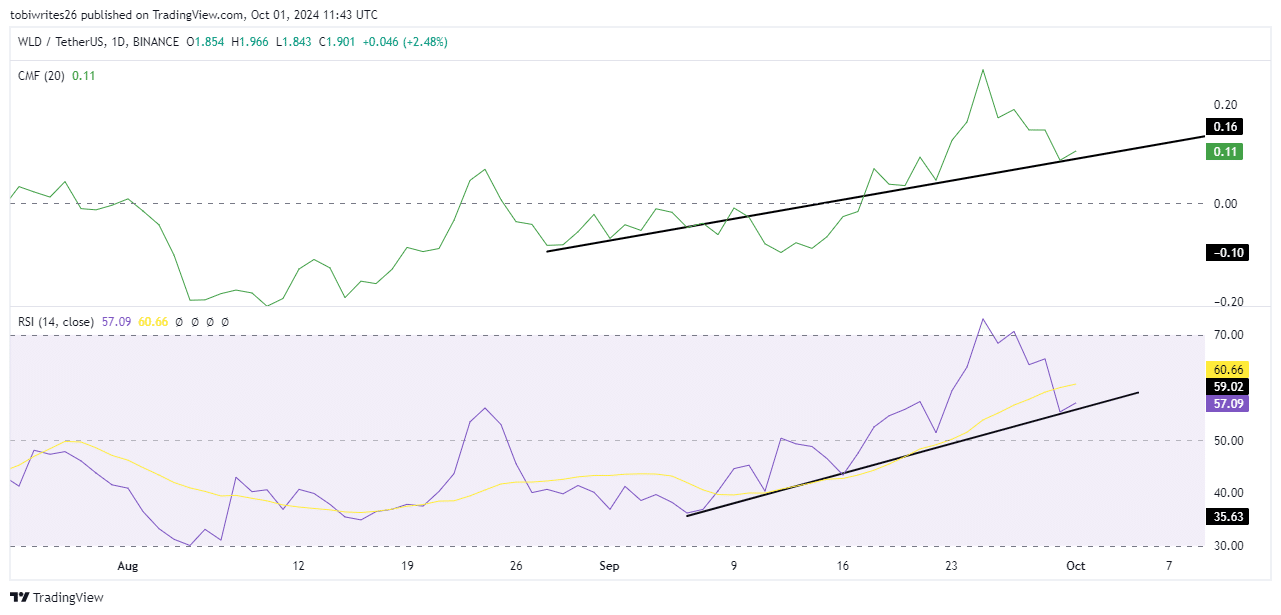

According to AMBCrypto’s analysis using the Chaikin Money Flow (CMF) and the Relative Strength Index (RSI), WLD exhibits bullish signals that may lead to further price increases as the market session progresses.

The Chaikin Money Flow has reversed its course, now trending upward after reaching a historical support trend line. This shift indicates bullish market sentiment, with traders increasingly funneling liquidity into WLD tokens.

Source: TradingView

Similarly, the Relative Strength Index, which assesses market strength and potential direction, mirrors this pattern. The RSI has returned to a support line and pivoted upwards, reinforcing the bullish outlook.

Given these positive indicators and WLD’s position as a major demand zone, there is a strong likelihood that its price will continue to ascend.

THIS can cause a potential surge

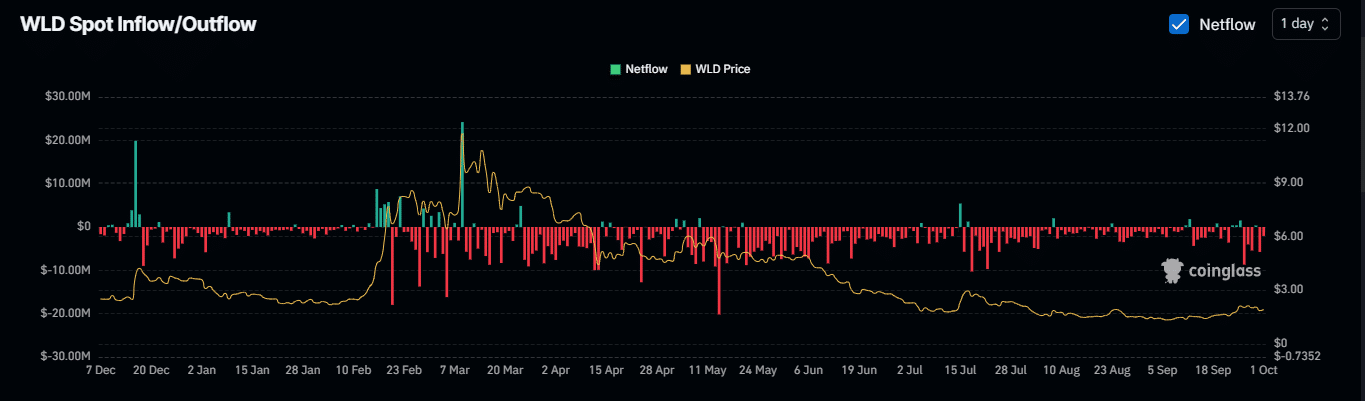

According to Coinglass, the Exchange NetFlow for WLD has been negative over the last 24 hours and even more pronounced over a 7-day period.

This trend indicates growing confidence among WLD holders, suggesting a bullish outlook as they opt to keep their holdings outside of exchanges.

Read Worldcoin’s [WLD] Price Prediction 2024–2025

In detail, $1.97 million was withdrawn from exchanges in the last day alone, with a total of $7.71 million pulled from the market over the past week.

Source: Coinglass

These significant outflows contribute to the increasing anticipation of a WLD rally. If this trend of withdrawals continues, it is likely that WLD will experience further price increases.

Source: https://ambcrypto.com/worldcoin-why-wld-will-cross-3-sooner-than-you-expect/