- Toncoin has shown renewed vigor after regaining its position above the ascending triangle support.

- Over 6.02 million active addresses are engaged in trading TON, intensifying the supply squeeze.

Despite historical challenges in achieving substantial gains due to its market dynamics, Toncoin [TON] has demonstrated positive momentum recently, with price increments of 8.35% monthly and 3.62% weekly.

The daily fluctuations, on the other hand, remained stable.

Regardless of its stable activity on the daily chart, the TON’s market development positions it for an ascent.

Liquidity setup for an upcoming upswing

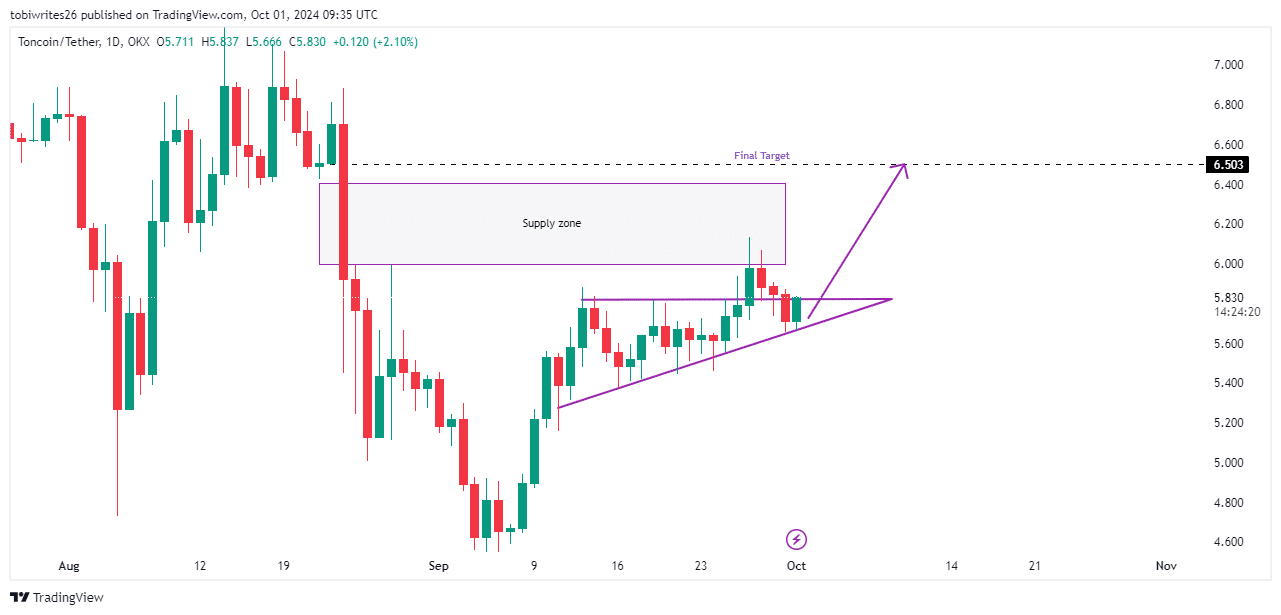

TON was trading within an ascending triangle at press time, a formation commonly seen before significant rallies.

On the 27th of September, TON briefly breached this pattern, but after hitting a supply zone, it was forced back into its established trading pattern.

Recently, TON tapped into the support zone of the ascending triangle and has now begun its upward trajectory.

This rally could gain definitive momentum once TON achieves a candle close above the upper resistance line of the pattern, at 5.818, potentially pushing its price as high as $6.503.

Source: Trading View

Should TON fail to break above this resistance, it is likely to continue trading within the pattern, falling back to the base support level as it gathers the necessary liquidity to surpass this threshold.

AMBCrypto has found that a reduction of market participants, coupled with an impending supply squeeze, could fuel a forthcoming rally for TON.

TON trading activities intensify

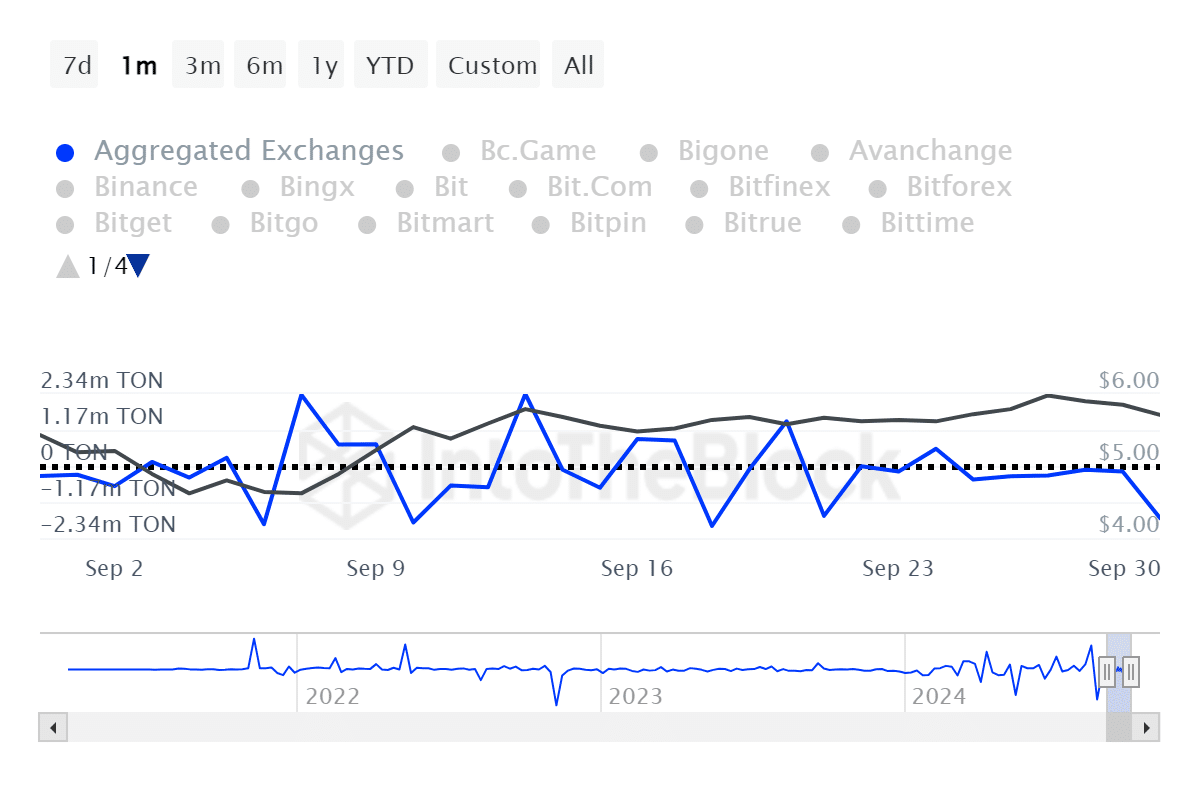

According to data from IntoTheBlock, the number of active addresses—also referred to as market participants—has seen a notable decrease following a surge in TON’s value.

As of the latest update, there are currently 6.02 million active addresses, indicating low trading activity within TON’s market. This is typically indicative of market sentiment, which can be bullish or bearish.

However, AMBCrypto has confirmed that the current trend is bullish, which is captured by the negative exchange flow.

The Exchange Netflow, which tracks the quantity of TON available across various cryptocurrency exchanges, has decreased by 1.5 million.

This decline suggests that a large amount of TON is being transferred out of exchanges, likely into private wallets for long-term holding.

Source: IntoTheBlock

Such movements typically lead to a supply squeeze, as the reduction in available TON on exchanges could heighten demand for the cryptocurrency, potentially driving up its price.

Final confirmation pending for TON bullish outlook

Despite several market activities and developments suggesting a bullish future for TON, a definitive market confirmation is still pending.

Open Interest data, which measures trader interest in the market, indicates a slight bearish sentiment among some participants.

Read Toncoin’s [TON] Price Prediction 2024–2025

This is evidenced by a modest decrease in Open Interest by 0.41%, positioning it at $257.15 million.

A shift in this metric back to positive territory would serve as additional confirmation that TON is poised for an upward trend in upcoming trading sessions.

Source: https://ambcrypto.com/why-toncoin-can-reach-6-503-in-the-coming-days/