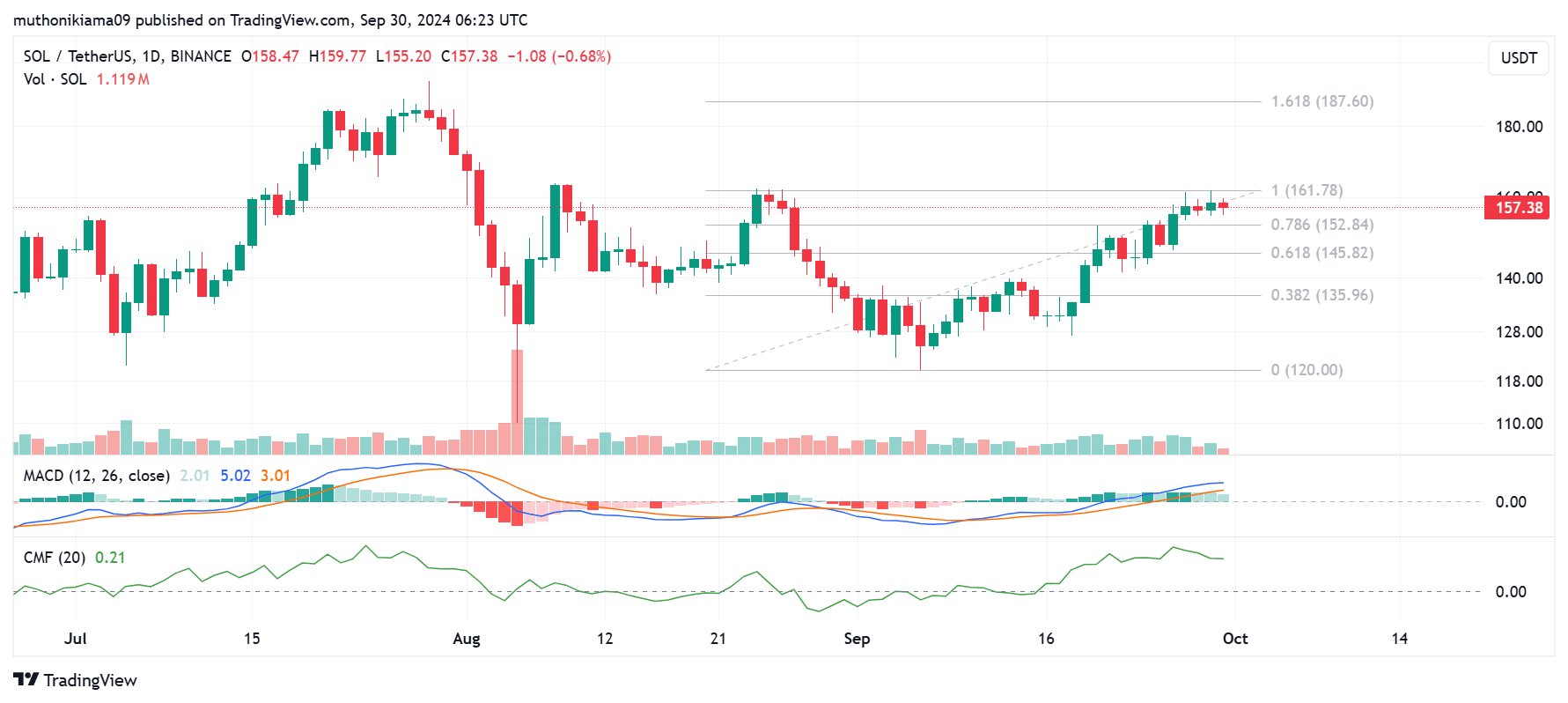

- Solana’s rally weakened after the price failed to break the $161 resistance level.

- However, the rising Open Interest and positive Funding Rates suggested overall bullish sentiment.

Solana [SOL] traded at $157 at press time, an over 7% gain in the last seven days. SOL has made a bold recovery this month alongside the broader cryptocurrency market, with its 30-day gains at 14%.

Data from CoinMarketCap showed that in the last 24 hours, Solana’s trading volumes increased by more than 45%. However, the red volume histogram bars on the one-day chart indicated selling activity.

Moreover, the Moving Average Convergence Divergence (MACD) indicator hinted at a possible bearish divergence as the MACD histogram bars have faded and shrunk while the MACD line flattened.

This showed that the bullish momentum was weakening.

Source: TradingView

The Chaikin Money Flow (CMF) indicator also proved the case of a weakening uptrend, as it was now tipping south.

This showed that sellers have entered the market, with the move coinciding with SOL’s failure to overcome resistance at $161. However, the positive CMF indicator showed that buyers are still active.

If sellers overwhelm buyers and the CMF turns negative, SOL could drop to test support at the 0.786 Fibonacci level ($153). This level previously acted as a strong resistance.

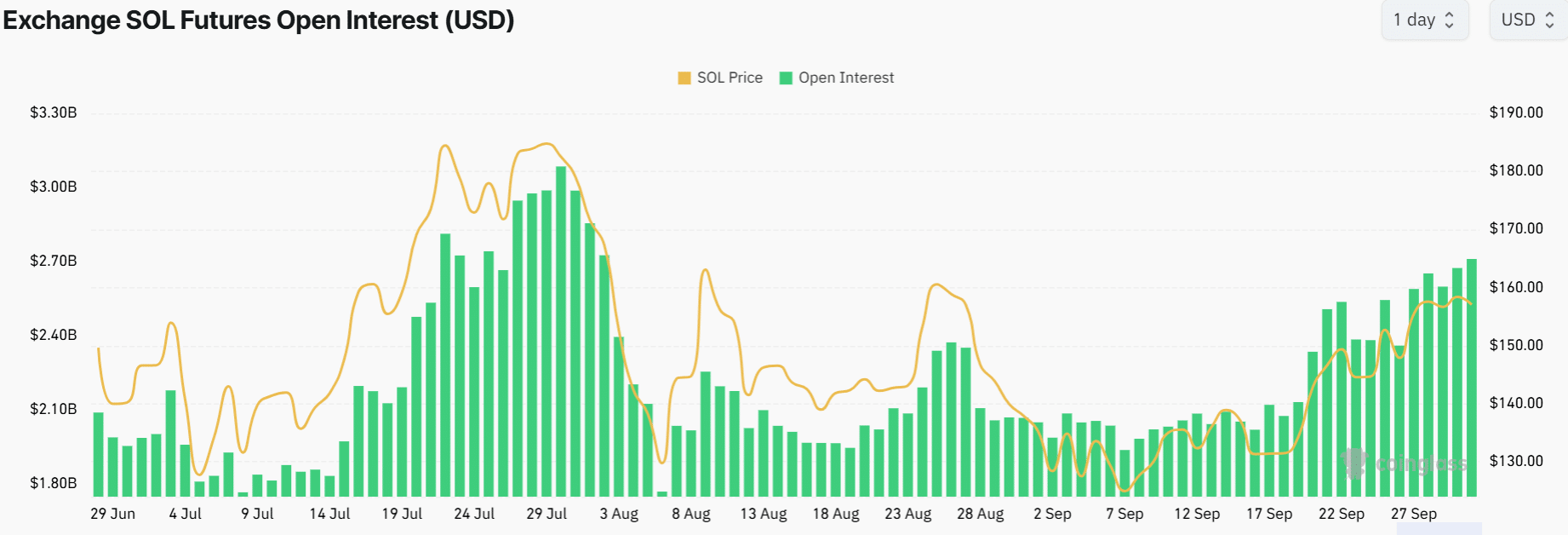

Solana Open Interest approaches high

A look at the Futures market shows that traders are building up their positions on Solana, as Open Interest soared to $2.71M at press time per Coinglass.

Solana’s Open Interest was at its highest level since early August.

Source: Coinglass

A rise in Open Interest shows that market participants are opening margin positions on Solana and maintaining their existing ones.

Furthermore, a look at Funding Rates, which have been predominantly positive for two weeks, shows that these participants have likely opened long positions anticipating further price increases.

This suggests a strong bullish sentiment around Solana.

However, an increase in long positions as the price stagnates or fails to make significant upswings could signal an over-leveraged condition.

This could result in a sharp downtrend if these long traders choose to exit their positions.

dApp volumes soar

The Solana network has seen a rise in activity. Data from DappRadar showed that the seven-day average for decentralized application (dApp) volumes on Solana has increased by 48% to $771 million.

At the same time, dApp transactions have soared by 20% to 97 million, while the Unique Active Wallets (UAWs) have increased by 15% to 19 million.

Source: DappRadar

Read Solana’s [SOL] Price Prediction 2024–2025

While such growth in dApp volumes is often considered bullish due to speculation around rising utility, sentiment around Solana remains negative.

Data from Market Prophit showed that both the crowd and smart money sentiment is bearish on Solana, suggesting that market participants anticipated the price to drop further.

Source: Market Prophit

Source: https://ambcrypto.com/solana-at-161-resistance-will-sol-drop-to-152-or-rise-further/