Inflows into crypto investment products continue for the third week, as funds attract $1.2 billion, the highest figure since July.

A weekly report from CoinShares shows that digital assets saw an inflow of $1.2 billion last week amid increased investor traction. This marked the third consecutive week that crypto investment products saw an inflow and the highest since the third week of July.

Per the report, the surging inflows were congruent with the favorable macroeconomics in the United States. For context, the Federal Reserve System (Fed) recently reduced interest rate by 50 basis points (bps), as inflation woes prevailed. This action spread dovish sentiments among investors, driving exposure to digital assets like Bitcoin.

Furthermore, the inflows were also associated with the approval of options contracts for certain US Bitcoin spot ETFs. For context, the US Securities and Exchange Commission (SEC) approved the options trading on the BlackRock iShares Bitcoin Trust (IBIT) on September 20.

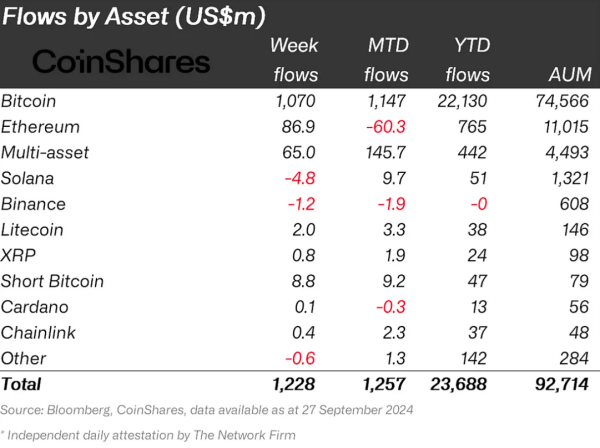

The inflows between September 23 and 29 saw the assets under management (AUM) of crypto products increase 6.2% to $92.7 billion. However, trading volume on these investment vehicles declined 3.1% week-to-week.

Bitcoin, Ethereum Shines

Expectedly, Bitcoin led the inflows into the investment products last week, attracting $1.07 billion from investors. Notably, flows into the investment vehicles for the premier asset saw a 73% uptick from last week’s $284 million, signaling renewed traction for the products.

Meanwhile, Ethereum ETPs saw a break in negative trends last week, with the products recording their first net inflow in five weeks. The funds recorded an inflow of $87 million, reducing their deficit month-to-date to $60 million.

Notably, investment products for other altcoins saw mixed reactions. Investors dumped $4.8 million and $1.2 million from Solana and Binance Coin (BNB) funds, while that of Litecoin and XRP saw inflows of $2 million and $800,000, respectively.

It also bears mentioning that BlackRock led inflows last week among issuers, raking in $594 million through its Bitcoin and Ethereum ETFs. Fidelity and Ark 21 Shares’ ETFs saw a net inflow of $206 million and $269 million, while Grayscale sold $117 million worth of its holdings.

US Dominate Inflows

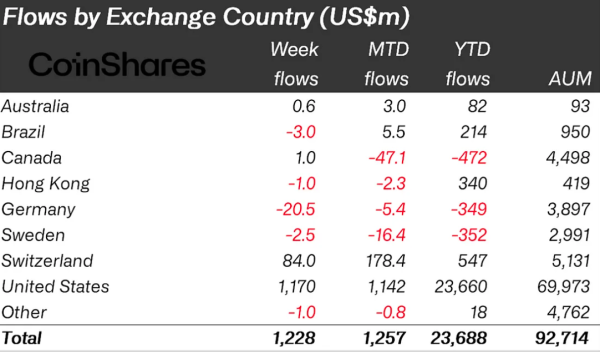

With Bitcoin holdings among US ETFs surging last week, the country led regional inflows into crypto ETPs. Coinshares’ weekly report shows that US-based ETPs saw an inflow of $1.2 billion the past week.

Other notable inflows came from Switzerland and Canada. Switzerland recorded its highest inflows since mid-2022, with an $84 million positive flow, while $1 million flowed into ETPs in Canada.

Meanwhile, Germany, Brazil, and Sweden recorded a combined outflow of $26 million, with Germany alone accounting for 79%.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/09/30/crypto-investment-products-record-1-2b-inflow-as-streak-extends-to-three-weeks/?utm_source=rss&utm_medium=rss&utm_campaign=crypto-investment-products-record-1-2b-inflow-as-streak-extends-to-three-weeks