- Bitcoin price surge to the $72K level would liquidate $20 billion in short positions.

- Exchange net flow has surged by over 10%, and long position bulls remain dominant.

Bitcoin [BTC] short sellers are witnessing the pressure as the market edges closer to a massive liquidation event. According to a renowned analyst, a 10.6% price increase would be needed to liquidate $20 billion worth of shorts at $72,600.

This could force a raft of buybacks and an even higher price as market participants scramble to cover losses.

With such high stakes, the $72,600 level has been a significant battleground for such huge stakes of both bulls and bears.

In case Bitcoin manages to pierce through this level, it could spark a chain reaction that could shift the market dynamics.

Source: X

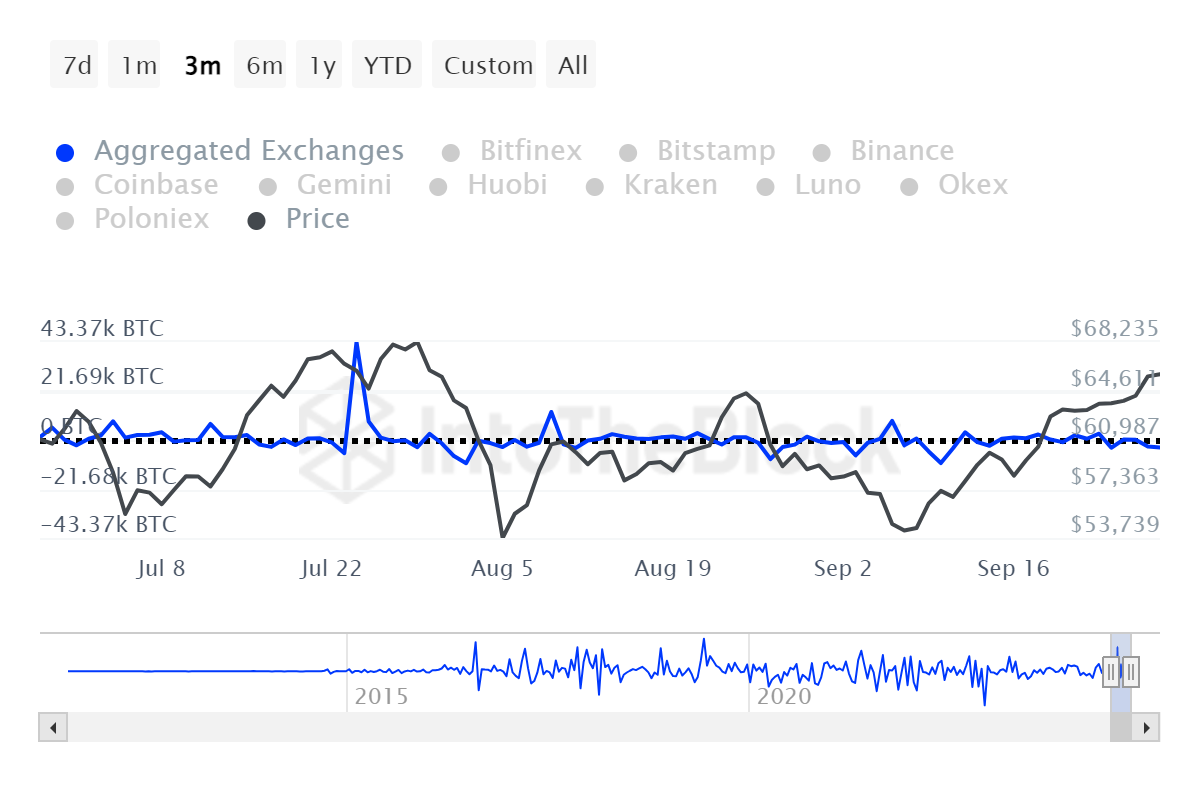

Bitcoin exchange net flow spikes by over 10%

Adding fuel to the fire, Bitcoin exchange net flow has surged by over 13%, according to the IntoTheBlock data. This metric gives an indication of how much money is flowing into and out of the exchange.

Generally, such a sharp surge in the metric may indicate that investors are already bracing themselves for a huge move

More Bitcoin might be heading into exchanges, gearing up for buying anticipation of a price rally.

This net flow surge indicates the optimism among market participants in a breakout above resistance, until it tests for the $72,600 mark.

Source: IntoTheBlock

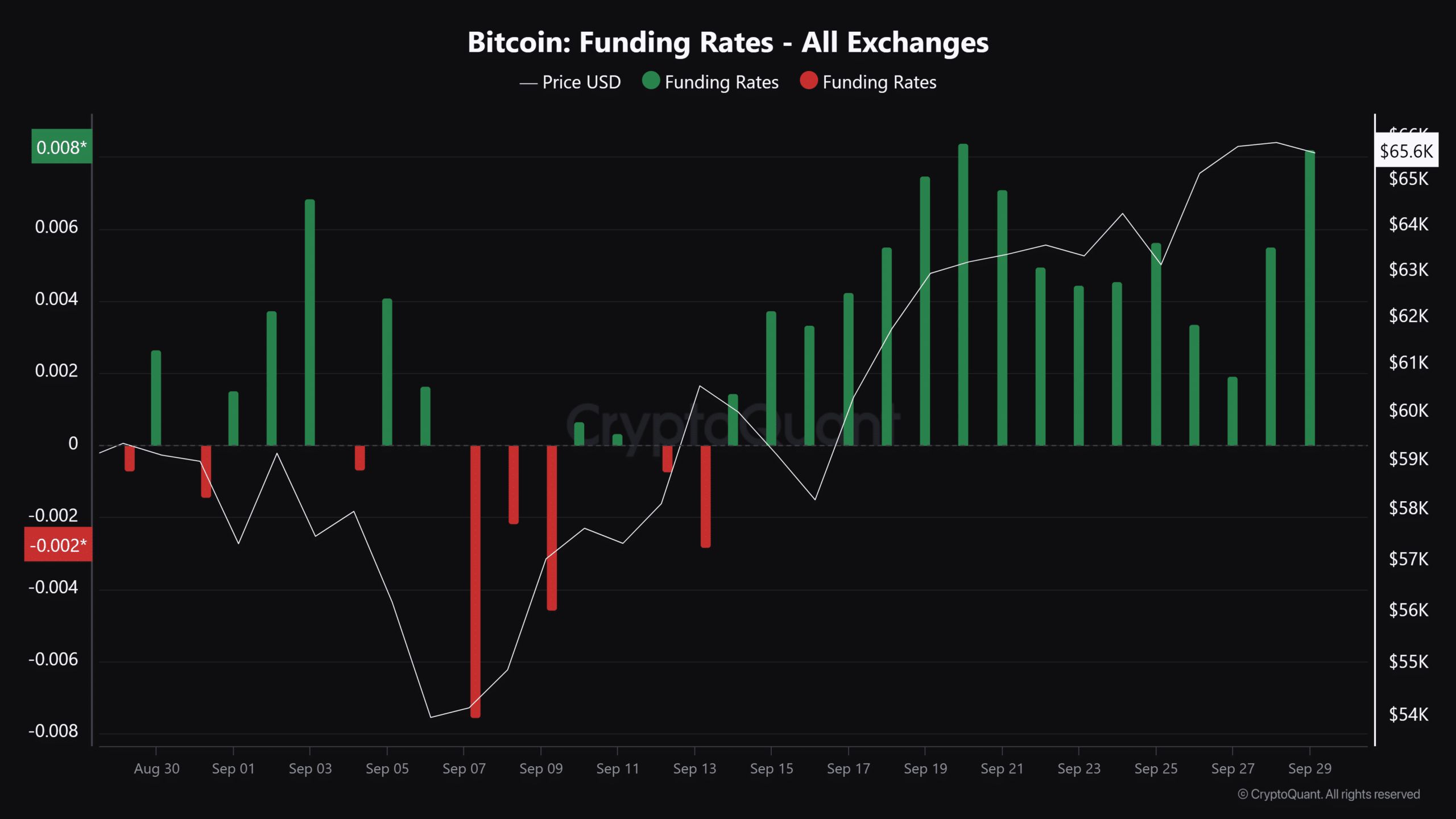

Long positions takers in control

According to CryptoQuant data, long position investors currently dominate the market.

In fact, they are willing to pay funding fees to short traders. This trend suggests that the Bitcoin bulls are in control, hence further supporting the notion of an imminent upward price movement.

Historically, when long position takers are paying a premium to short traders, it is usually an indication they believe the price is about to rise.

This funding rate further reinforces the bullish outlook, as long as investors are setting the groundwork for a high price increase if the value of Bitcoin goes against them.

Source: Cryptoquant

Is your portfolio green? Check out the BTC Profit Calculator

Bitcoin is at a key price movement that may liquidate billions in short positions. With the Bitcoin net flow up by over 10% and dominant long-position bulls, there are signs that the market might be planning for a breakout.

If Bitcoin hits the $72,600 mark, it will fire up a huge liquidation event, which can force short sellers into closing, as price could move even higher.

Source: https://ambcrypto.com/over-20b-at-risk-if-bitcoin-hits-72k-massive-short-squeeze-looms/