- Ethereum, at press time, was trading at a key level on the daily timeframe

- Institutions and whales resumed activity as optimism returned to the market

Ethereum (ETH), the market’s second-largest cryptocurrency, is trading at critical levels again. These levels are especially significant for long-term investors. At the time of writing, ETH was hovering around the $2,700 range – An important resistance level on the daily timeframe.

The previous month’s price levels are now acting as key support and resistance zones. ETH is respecting the previous month’s low as support, while the midpoint between the previous month’s high and low is acting as resistance.

Market sentiment remains optimistic, suggesting a potential break above the $2,700 resistance. This could push ETH to target the $3,200-level. However, market dynamics remain unpredictable, and any abrupt change could alter this outlook.

Source: Hyblock Capital, TradingView

Increased whale and institution activity

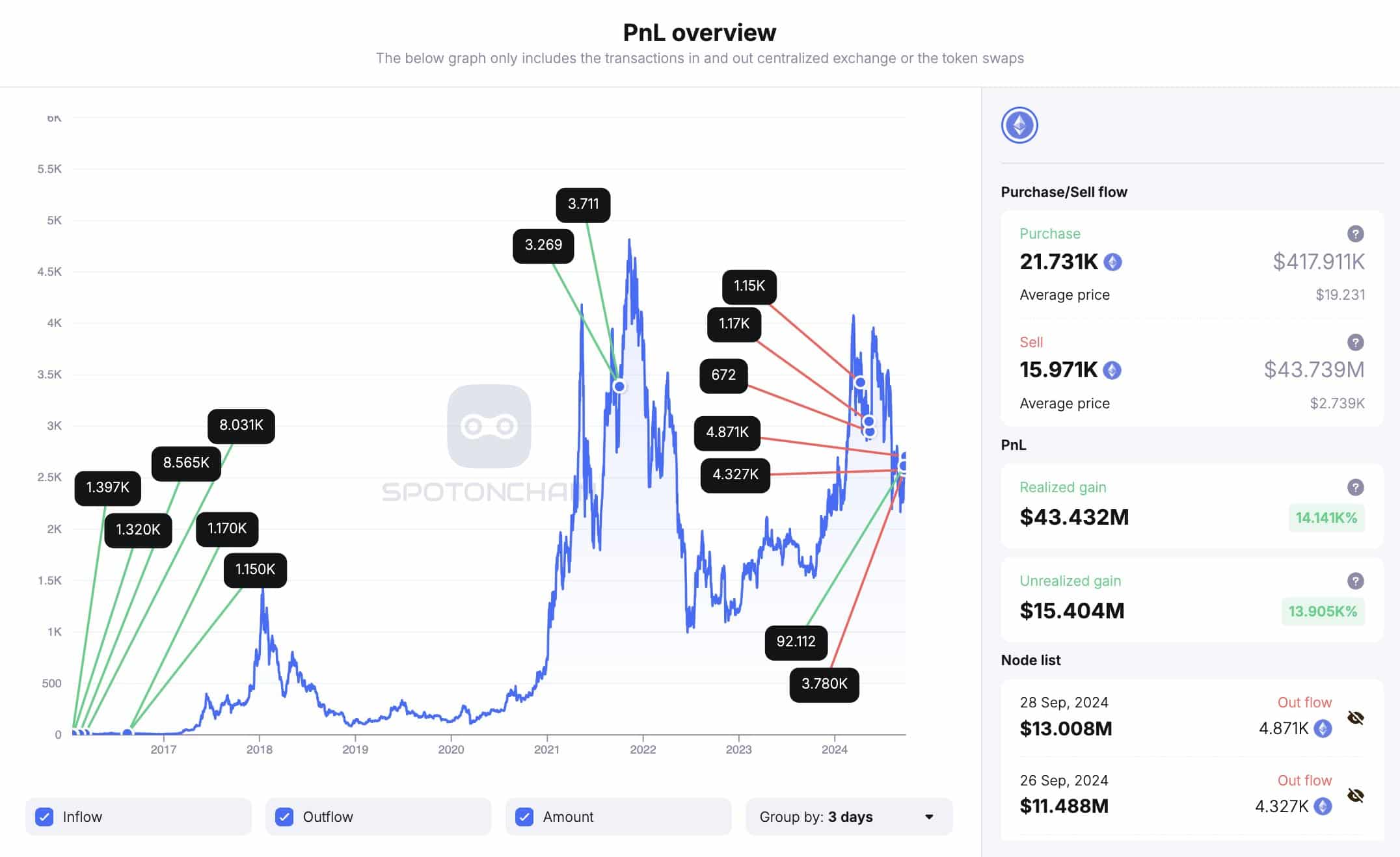

Greater institutional and whale activity further supported the case for a higher ETH price. Recently, an Ethereum whale who has been silent for four months, cashed in 12,979 ETH, making a profit of $34.3 million.

This whale initially bought ETH at just $7.07 per token. This whale has since sold a total of 15,879 ETH, netting $43.5 million in profit.

With this whale still holding 5,760 ETH worth approximately $15.5 million, it means that larger investors are betting on ETH hitting the $3200 target. This renewed whale activity is a strong indicator of ETH’s bullish potential, further supporting $3200 target.

Source: SpotOnChain

Meanwhile, institutional actions are also influencing the market.

Two major institutions have been offloading ETH recently. Cumberland, a trading firm, deposited 11,800 ETH, valued at $31.88 million, into Coinbase. On the contrary, ParaFi Capital withdrew 5,134 ETH from Lido and transferred it to Coinbase Prime.

Despite this selling activity, the hike in whale participation is a sign that many are still optimistic about Ethereum’s future price movement.

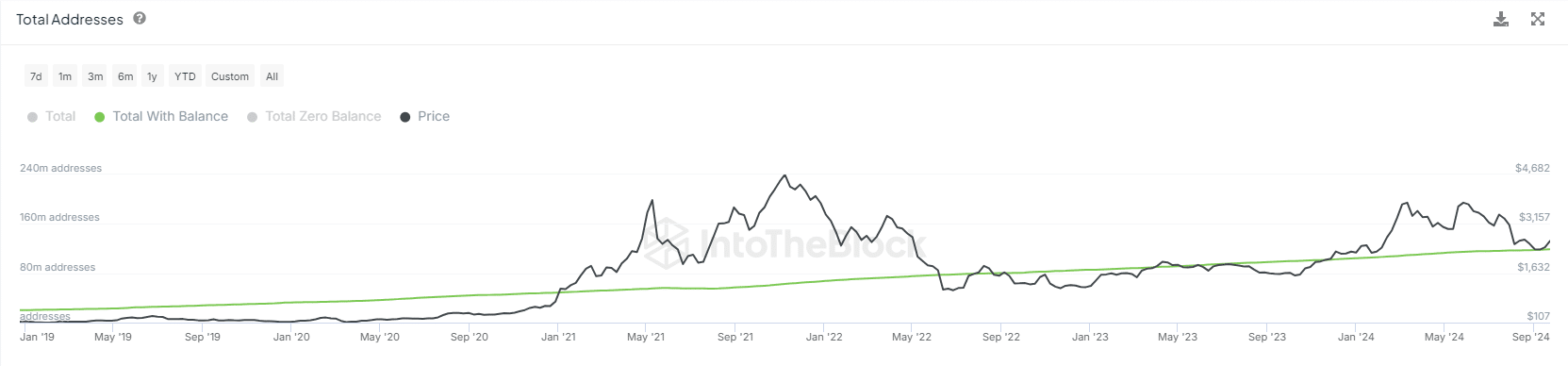

Hike in ETH total addresses with balance

Another positive signal for ETH is the uptick in the total number of addresses holding a balance. The growing number of wallet addresses is a strong indicator that more investors are entering the Ethereum ecosystem.

This trend is often viewed as a bullish signal, one suggesting that Ethereum’s adoption is increasing due to its utility in decentralized finance (DeFi) and scalability solutions.

Source: IntoTheBlock

The uptick in wallet addresses can be interpreted as another bullish signal alluding to ETH’s $3,200 price target in the final quarter of the year. This period is historically known for bullish crypto market activity.

Fear and Greed Index now at neutral

The market’s optimism is also reflected in the Fear and Greed Index, which moved to a neutral reading of 50 at press time. This is a positive shift after a long period of extreme fear, particularly following the 5 August market crash.

As the market begins to recover, more traders are likely to be attracted to ETH, making it an ideal time to accumulate more ETH ahead of the anticipated bullish move.

Historically, entering the market when it’s flashing neutral sentiment offers better opportunities than waiting for extreme greed. This often signals market tops.

Source: IntoTheCryptoverse

Right now, Ethereum is positioned to move higher, driven by whale activity, increased adoption, and improving market sentiment.

If ETH can break through the $2,700 resistance, the next target of $3,200 could be within reach.

Source: https://ambcrypto.com/ethereums-breakout-odds-is-3200-a-viable-price-target/